Integrated and flexible, that’s how we often describe software. But what does that really mean? Working with financial data has always been the mainstay of spreadsheets and rule-based systems. Are those tools integrated and flexible? Not really; desktop software can only handle so much data, and single-purpose products leave users jumping from app to app to complete a task. It’s time intensive, and it’s error-prone.

Fast forward to MindBridge and the world of machine learning, big data architectures, and flexible systems designed to work with a variety of formats. In this world, we’re learning and constructing models from the data itself, not simply applying rules. Integration for MindBridge has always been a march to more automated systems that connect with other services to support holistic solutions without intervention, and that’s where integration and flexibility truly shine.

Enhanced integration supports the exchange of information in an automated fashion and opens the door for far more efficient use of technologies that each play a role in an overall process. Integration combined with greater flexibility allows firms with established processes and standards to drive efficiency with a tighter coupling to internal methodologies.

With its latest mid-year release, MindBridge opens its leading risk scoring cloud platform with industry-standard Application Programming Interfaces (APIs) that supports the automation of risk assessment. With widespread adoption of AI within our customer base, our clients recognize the need to integrate via APIs into their technology landscape. The MindBridge API offers inbound data ingestion capabilities along with MindBridge risk-scored exportable assets. Additionally, the MindBridge API allows customers to build powerful collaborations with various services, including data analytic engines, financial accounting packages, or downstream notification services, to name a few.

A pioneer in the use of multiple algorithms to detect and assess risk in financial data, termed Ensemble AI, MindBridge again raises the bar with user-definable risk group ensembles. User ensembles allow clients to build firm-specific risk models that map more closely to internal processes and methodologies —a more integrated and flexible approach to risk assessment.

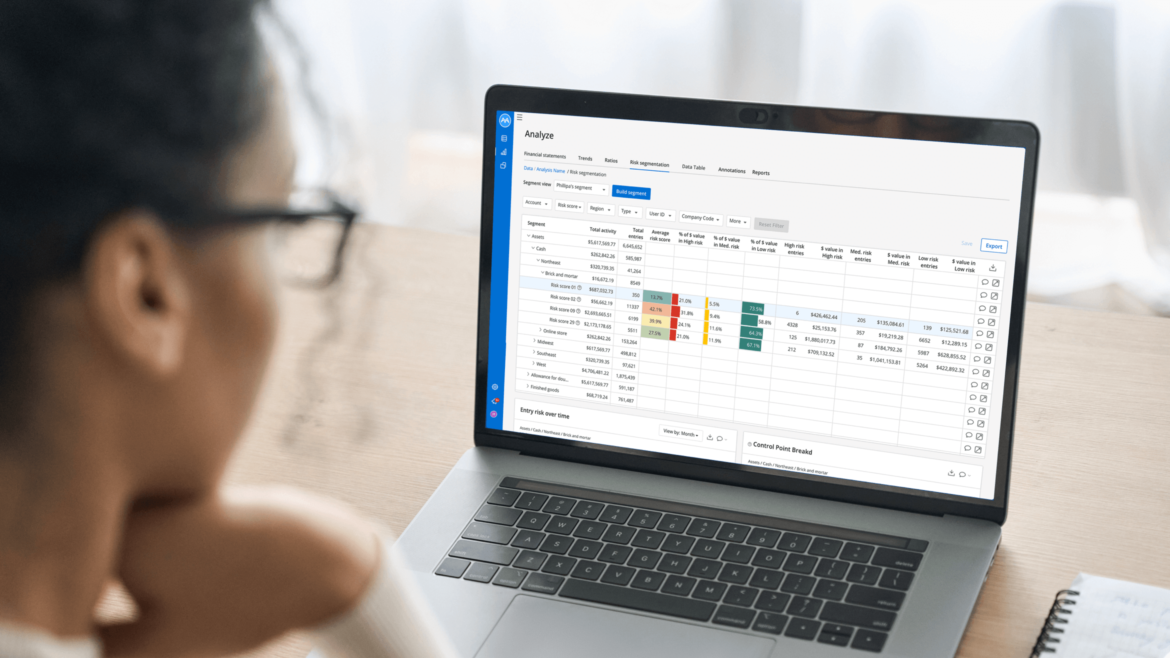

Complimenting user ensembles, MindBridge has released the new Risk Segmentation dashboard that provides key insights in a highly flexible format. Users are free to manipulate risk scores and uncover meaningful insights through any number of user-defined segments allowing far more granularity and filtering capabilities with a variety of financial data.

And while we’re speaking of flexibility, MindBridge continues to extend support of its platform with the addition of 30 new enterprise resource planning (ERP) guides focused on importing your data into MindBridge. The MindBridge interface is also now available in several new languages, Canadian French, Parisian French, German, and Castilian Spanish. Language support covers the entire MindBridge platform as well as supporting materials for non-English speaking users and opens the door for accelerated platform adoption.

We are continuously advancing our capabilities to help align leading financial risk analytics with human intelligence for deeper insights. Register for our upcoming webinar for more information about how an open API can empower your data to move at your organization’s speed.

The MindBridge API will help your organization supercharge next-gen innovation by automating tasks and capabilities within MindBridge.

This webinar will cover:

- Highlights of our Summer Product release, our Open API

- A deep dive into how the API can be implemented

- Sample use cases that highlight API integrations