Audit services are traditionally viewed as compliance requirements by regulators or a way to instill confidence with a company’s investors. As a result, the focus of the CFO might shift to minimizing costs and efforts in order to comply with the required audits.

During the limited interactions with the audit committee or the company’s CFO, how can auditors demonstrate their value as a trusted advisor that goes beyond traditional assurance to delivering valuable insights? How do auditors build strong working relationships with respective clients for future audit engagements?

Enhanced Audit Findings Reports or Presentations

Leveraging MindBridge Ai Auditor, the audit team can enhance their Audit Findings Report or Audit Committee Presentations to include visualizations, reports, and trends analysis to better communicate the work performed by the audit team. Reports can be tailored to include areas that are beyond formal requirements to areas that would be of most interest to the audit committee or that the CFO would be most concerned about. This helps create an open and data-driven dialogue with clients regarding their business and financial risk areas with related observations and findings.

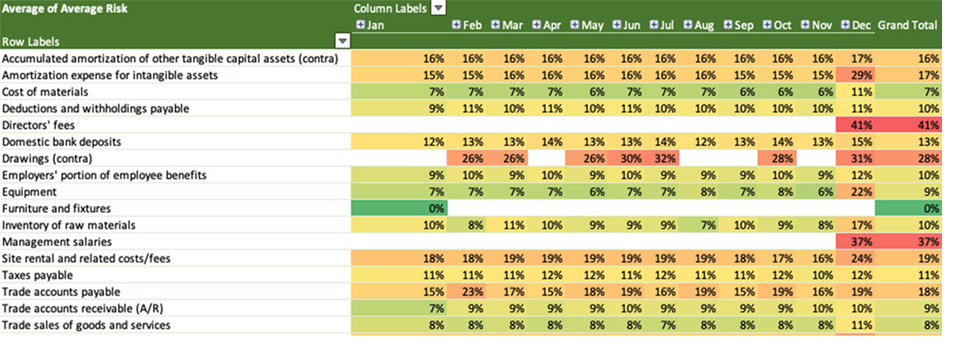

As Ai Auditor uses business rules, statistical models, and machine learning to risk score each transaction, it allows the audit team to present the breakdown of high risk, medium risk, and low-risk transactions to clients, by percentage and dollar value. The risk can further be presented by specific accounts that could indicate a higher risk or a time period of higher risks. Stratifying this risk by time, Ai Auditor further breaks down risk by month, weeks, and days to identify unusual periods of activity. The risk graphs can be exported and used in any audit presentations to show clients where high-risk transactions are by account, time period, or any of their interests.

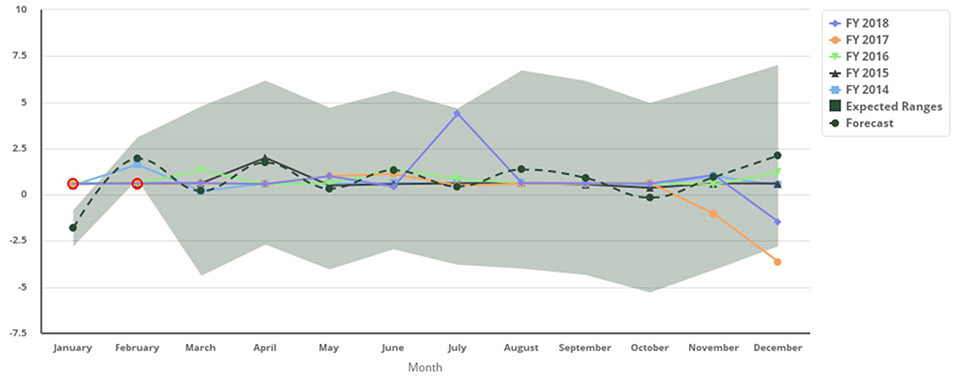

The Trends and Ratios functions help analyze key performance indicators and trends within the client’s business. MindBridge uses a proprietary implementation of an algorithm called SARIMA, developing an expected range based on the historical data of the company and comparing it to actual results to identify any outliers. This information is plotted onto a graph within the “Trending’s” tab that can be downloaded and incorporated in audit presentations. Key ratios such as Liquidity (Current Ratios, Quick Ratios, etc.), Profitability (Return on Assets, GPM, etc.) and Leverage (Asset turnover, Debt to Equity, etc.) can be computed and plotted onto graphics within the tool and then saved to be used as a part of the audit presentation. With multi-year data comparisons, audit teams can show their clients which key ratios are changing year over year or month over month. They can also identify any key ratio deviations and potential causes associated.

Better client discussions

Traditional Audit Closing meetings usually involve a presentation from the audit partner and team on the Audit Strategy, Audit Status, key audit findings, and any areas of interest. Given the limited time that the audit team has in front of the CFO or audit committee, technology such as Ai Auditor can be leveraged to articulate value beyond audit requirements to those of business insights and financial risk observations.

Using the Financial Analysis Template provided by MindBridge, Trends and Ratios can be used to explain key findings and trends related to the account of interest and. For example, Gross Profit Margin can be computed using Ai Auditor’s Trends functionality, incorporating SARIMA and leveraging multi-year data to develop an expected range of Gross Profit Margin within the data set. With multi-year data points showing on the same graph, auditors can identify and show any ratio outliers to clients.

These types of data-driven insights help client conversations to be more targeted. For example: “the gross profit margin for July 2018 is outside the expected range per our AI analysis. We identified the issues to be related to increased material costs during the first quarter of the year impacting the gross profit margin.”

Ai Auditor’s ability to risk assess 100% of the company’s GL data allows the audit team to show their clients the risk breakdown of their transaction data. By illustrating audit work performed to investigate these high-risk or medium-risk transactions, the conversation with the client can be enhanced to: “The audit team identified $100M in high transactions, which represents 27% of the ledger. The high-risk transactions were identified as related party transactions that occurred near year-end. Upon further investigation by the audit team, all related party transactions were reviewed, and no issues were identified.”

In addition, the Ai Auditor risk assessment can also be adjusted to show risk by account. Under the Reporting function, a report can be downloaded and imported into any audit presentation. The risk by account chart breaks down each grouping found within the ledger and risk associated with that grouping. From there, the audit team can show clients key areas of risk as it relates to a specific account.

Similarly, the risk can also be filtered by the users who are entering the accounting transaction. The client might be interested in a specific user, with most of their posted transactions identified as high risk. A high risk by the user could indicate a potential control risk: “We analyzed controls based on the user’s function and identified control issues for the following users: User 123, User XYZ, and User ABC. These users were sharing passwords and recording transactions outside of the scope of their duties. Further, we identified User 456 may lack the appropriate training based on the transactions being entered.”

Other opportunities

Ai Auditor helps auditors to provide their client with more confidence over the organization’s financial information. Auditors can become trusted advisors for their clients by leveraging technology to identify risky transactions, areas of potential control risks, and any downward trends.

Being a trusted advisor creates an open dialogue with clients and can lead to other opportunities for the audit firm, such as risk advisory, accounting policy advisory, tax, forensics and more, all while keeping Auditor Independence in mind. With the power of machine learning and AI analysis, Ai Auditor can provide clients new perspectives of their businesses unlike anything they have ever seen before.