Financial professionals now require a greater degree of automation and tools that support deeper insights while leveraging professional judgment and freeing up time to spend elsewhere. Today’s businesses are complex and require a more dynamic solution that’s able to assess risk depending on any number of factors, such as business locations, cost centers, or regions, each of which may factor differently into an overall risk assessment.

Businesses are susceptible to different types of risk. On the sales side, issues could arise involving revenue or revenue recognition. On the purchasing side, there could be problems with expense limit violations or inappropriate vendor accounting. That’s not to say that these examples are commonplace, only that different types of risk exist due to the nature of the activities in an area, and treating all equally would also be risky.

As businesses become more complex and automated systems more sophisticated, the volume of financial data being generated is growing quickly, making the job of understanding risk in different areas of a business nearly impossible. The challenge for financial professionals, then, is to arrive at that holistic view of risk across a set of financial records that are much too large to tackle. So is this where AI saves the day? Not exactly. Solutions like MindBridge can certainly aid in surfacing risk. However, we still need a human-centric interpretation of the data and an auditor’s expertise in accounting processes to make accurate and informed business decisions.

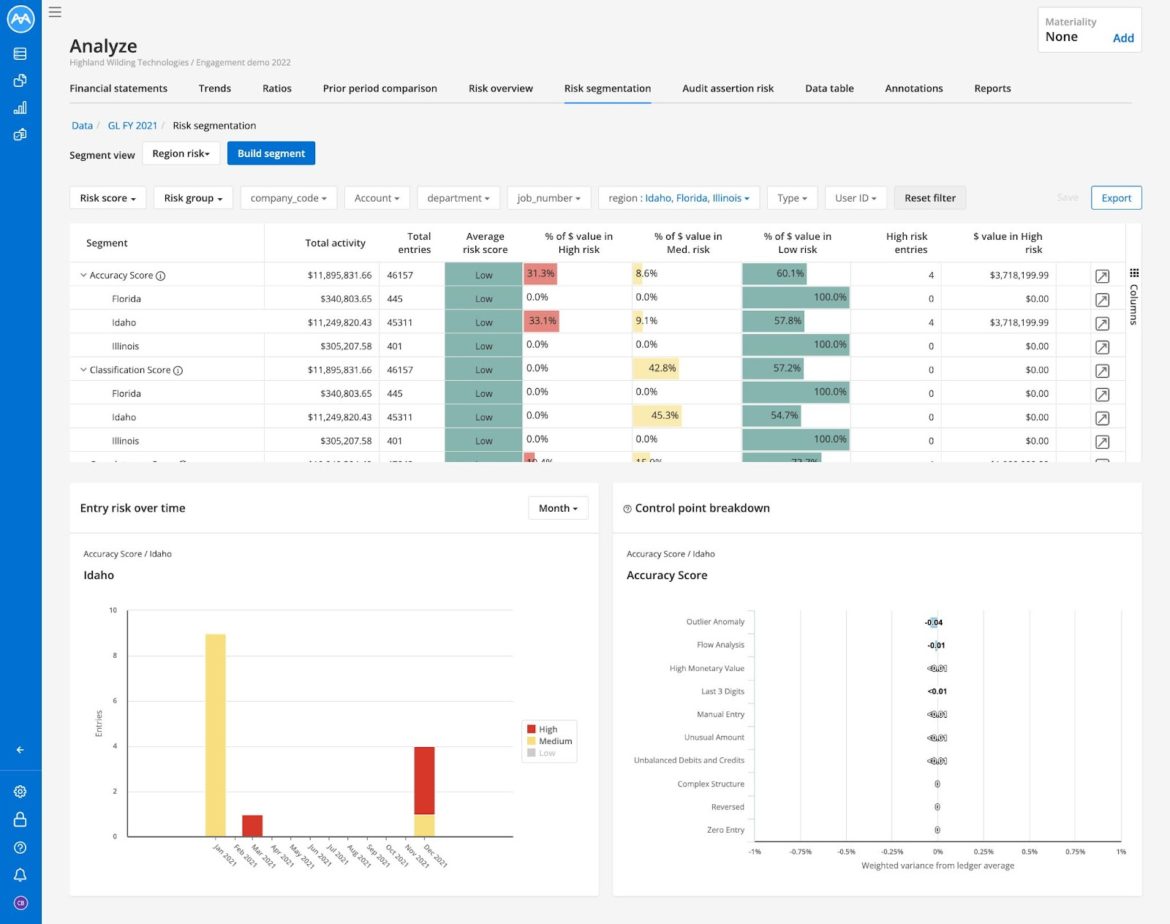

MindBridge solves this problem with the Risk Segmentation dashboard, a game-changing feature that combines 2 powerful capabilities to allow financial professionals to create custom risk assessments.

It all starts with a MindBridge custom risk score: a user-defined selection of MindBridge control points that work together to build a risk assessment from different perspectives. Custom risk scores can be targeted and tuned to specific business areas, so the auditor can tailor risk assessment accordingly. Customized risk scores offer a degree of detail not found outside of MindBridge.

The Risk Segmentation dashboard presents the results of custom risk scores and provides users the ability to extend the display with custom views referred to as “segments.” Segments are easy to configure and capture a specific view of information. Users are free to arrange display details by account hierarchy or with additional pivots included in data files. Watch a short overview demo.

By combining customized rules and account selections in a new risk score with the ability to rearrange analysis results and insights by segment, financial professionals now have a fast, powerful method to effectively target and uncover various types of risk in different parts of the business. With unlimited quick and easy ways to discover and assess risk with MindBridge, financial professionals are saving time while driving increased confidence in their assessment of financial statements.

Learn about the latest release from MindBridge.

Chris Corman, Senior Vice President of Product Development, is a 25-year veteran of the Ottawa technology sector with a proven track record as a technical leader and entrepreneur, having founded and led private and public software startups, one of which was acquired by Microsoft. Chris holds an Honours Mathematics Degree in combined Computer Science and Electrical Engineering from the University of Waterloo.