CFOs continue to be one of the most important resources to their business. In the last 20 years or so, they have spent countless hours working through regulatory and reporting changes, implementing new systems, and partnering with other leaders in the business on analytics. Through all this, they also have to come up with new ideas to find funding and preserve revenue streams, and maintain the fiscal discipline that CEOs and boards have come to expect.

How can CFOs and their teams balance these needs against higher fiscal scrutiny, cost cutting, and changing work environments?

The answer is to bring longer-term thinking up front, to measure, plan, and execute on our new environment now and get comfortable with the new normal.

CFOs here and now

Many companies are shedding resources and re-aligning their operations to protect their core business, while also hoping to make themselves indispensable to clients. Some are successful while others are struggling to adapt and find themselves trying new ways to look at cash flow, going concern ratios, and most importantly, customer engagement and retention.

This is only natural as the global economic slowdowns and supply chain uncertainties mean that CEOs and boards are tasking CFOs to review all expenses. These short-term projects start with salaries and travel expenses and follow with software subscriptions and other suppliers. While these are good actions to take, they don’t necessarily prepare the organization for the new normal, when people are returning to work, supplies start shipping again, and customer expectations have shifted.

CFOs must build a longer-term strategy into their short-term goals.

Another key consideration is the rise in fraud. According to the latest ACFE Report to Nations 2020, we know that up to 5% of top line revenue is lost to fraud around the world. There’s an expectation that COVID-19-related business and personal stressors will eclipse that figure quickly if we’re not careful.

To evolve beyond the short-term and reactive decision making now, organizations must buckle down and work through their long-haul strategies. From a CFO perspective, this could be:

- Assessing the level of granularity on reviews and reports

- Identifying areas of the business to trim or reduce

- Determining any new risks for the organization to consider

- Understanding how quarterly reporting, audit, and governance cycles will change

Preparing for post-crisis business operations

As former CFO, Shaye Thyer, posted on LinkedIn: “I would have given my left leg to have access to some of the amazing tech we have now.”

It’s not easy for business leaders and their teams to shift to the new normal and that’s where strategies, people, and tools must come together.

How does this differ from leadership advice in the past?

Rather than focus on reactive measures that use traditional processes and historical data, leaders must plan and strategize updates to their finance organization that take advantage of today’s unique opportunities to outpace the competition. This also means understanding the changed expectations of employees working in a different environment to keep them satisfied, motivated, and productive.

This could mean taking stock of internal remote working situations, and that of clients, to build them into new strategies. Augmented working environments open up a wealth of opportunities for collaboration, communication, and value creation. As this Forbes article states, returning the 2.7 billion people affected by lockdowns and stay-at-home measures could mean that, “While some employees will return onsite, others may continue to work remotely or engage in a hybrid model. In addition to arming workers with the skills and access needed to meet work requirements, re-engaging the workforce will involve assigning meaningful work.”

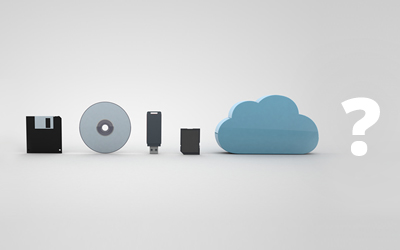

A big piece of this puzzle will be tools that adapt to these shifts in working models and leverage those changes to open up new opportunities. Moving to a digital-first strategy is key, as it will help teams collaborate better and remove as many manual steps as possible. This should cover everything from payables and receivables processes, such as getting all contracts signed digitally, to working on the assumption that travel will be limited.

Some offices are moving away from physical locations to hybrid models or even full remote working. Whatever each firm decides to do, there’s no question that professions are changing:

“Three elements of our practice have changed forever: the unprecedented move to a virtual practice, the client experience and our relationships with traditional office real estate.”

– Gary Shamis for Accounting Today

The bottom line for CFOs

To prepare for the new normal, I recommend these steps:

- Perform a full review of your tech stack and tools to see what needs to change for a post-COVID business model. This includes seeing where AI can fit to empower your teams and bring value.

- Start thinking digitally and how to support vendors, customers, and other stakeholders that are making their moves now.

- Prepare for a new way of working together on financial reporting from a distance, and evolving audits to be completely “touch free”

- Identify risks, especially potential fraud opportunities, and shore up the team with tools that augment their data assessment capabilities and provide deeper insights than traditional descriptive analytics technology

Since my start in this space over 20 years ago, we’ve had a number of times where we’ve relied on the CFO more than any other C-suite executive. This time around, we need to augment the Office of the CFO with state of the art technology, new normal of workplaces (virtual or not), and trust the professionals to take us into new strategies. We need to continue to be lean, execute extremely fast, and ensure that our strategy includes insight-driven tech (such as AI) and become digital in all that we do.

To see why finance teams trust MindBridge, watch this 4-minute video now