Copyright © 2025 MindBridge. All rights reserved.

MindBridge Q1 2023 Release

Your most critical risks, now clearer than ever

Take advantage of MindBridge’s latest release of leading financial risk analytics.

Play Video

New Visualizations to Transform Your Financial Oversight

Surface unknown and far-reaching financial risk insights before they become a crisis

- Reclaim time by focusing on risk drivers

- Enrich your analytical evidence

- Collaborate on key insights to update and refine your control activities

MindBridge is proud to offer a growing collection of templates that enable risk detection of operational and sub-ledger data, including vendor and payroll analytics.

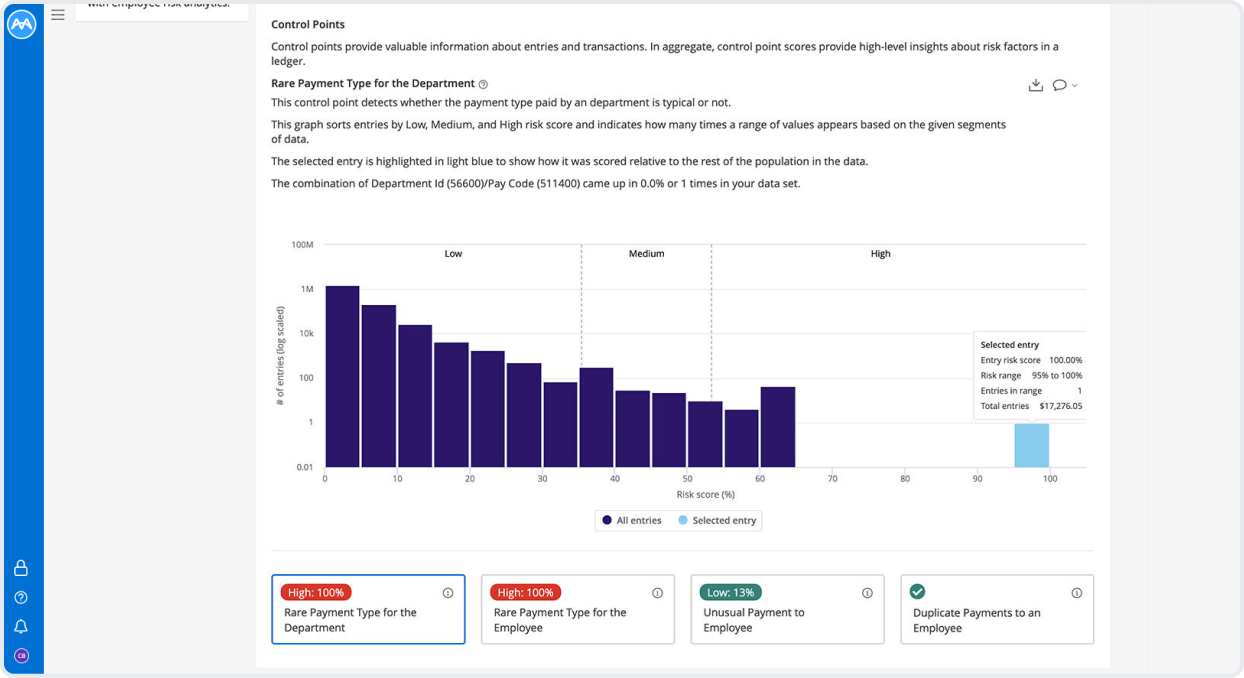

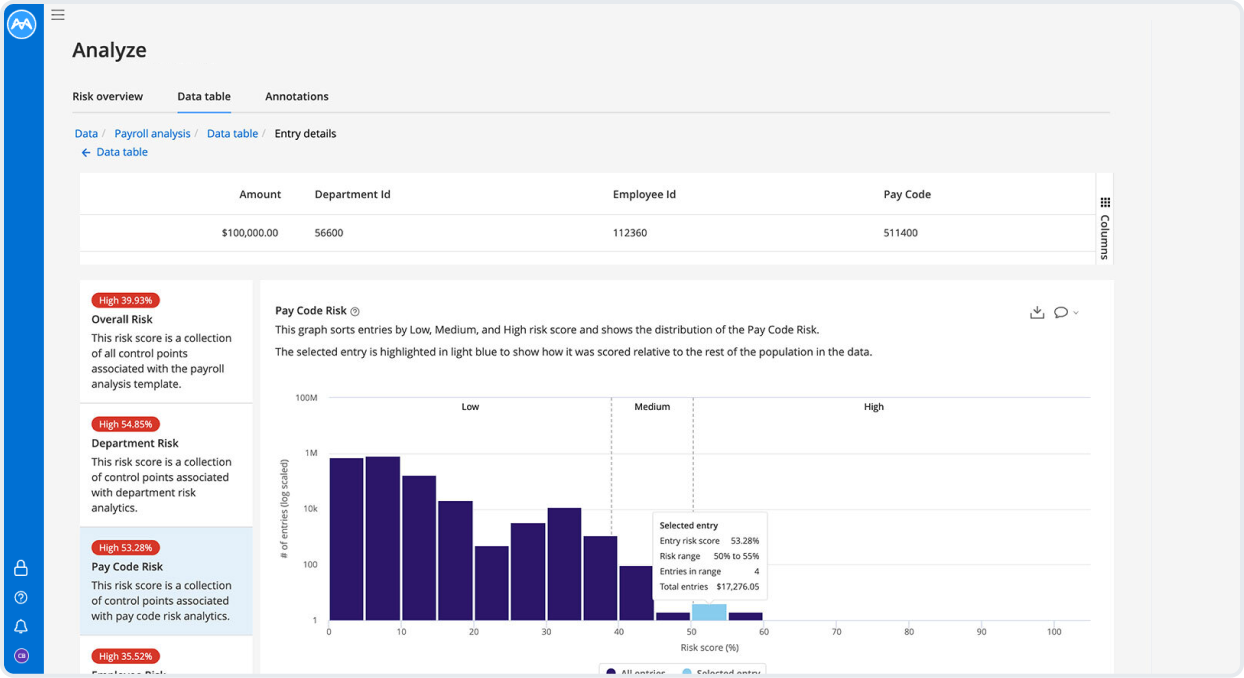

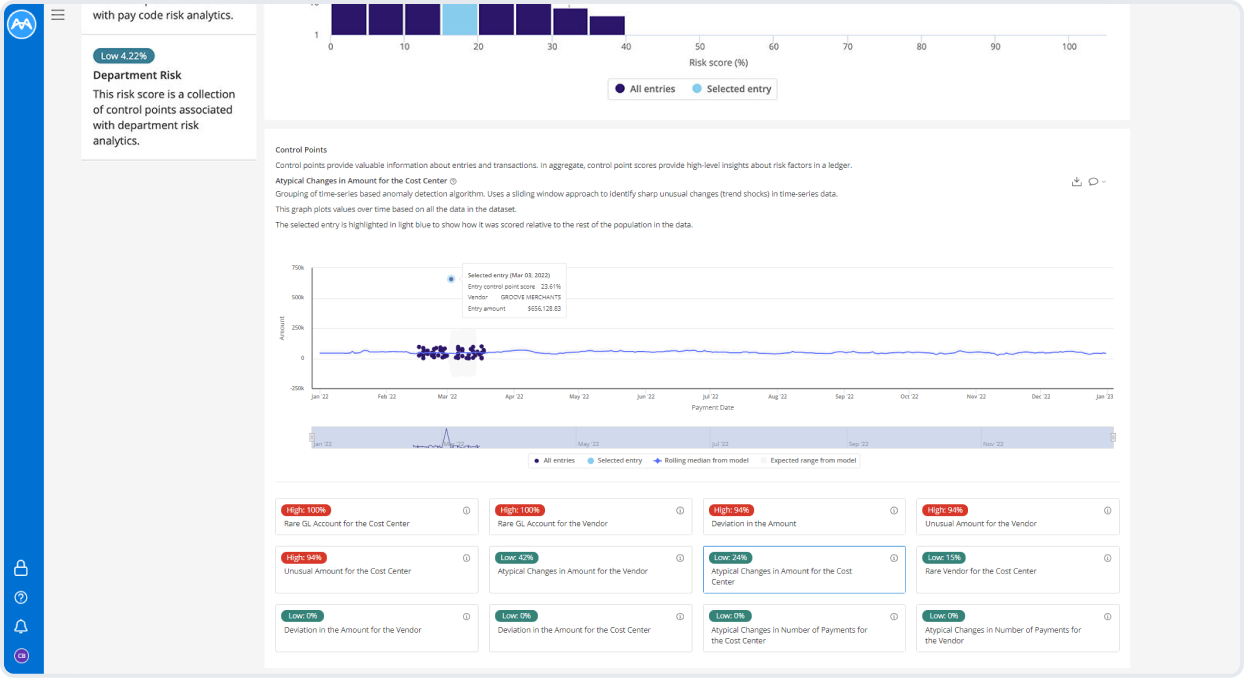

MindBridge has further enhanced the clarity and explainability of its risk scores, enabling faster, more targeted responses to highlighted entries. Now you’ll be able to easily identify and explain the characteristics behind each risk score, allowing you to quickly take action on your insights.

Visualize the distribution of risk within your automated detective controls

MindBridge has further enhanced the clarity and explainability of its proprietary financial Expert Score control point, enabling faster, more targeted responses to identified entries and transactions. This will help organizations quickly isolate the riskiest monetary flows within their business, supporting the broader goal of managing elaborate financial processes.

Identify which characteristics of an entry are responsible for driving risk

MindBridge has also deepened a long-standing capability to analyze all of an organization’s inter-account financial flows. MindBridge users may now distinguish between different types of flows, ensuring teams have greater visibility into complex transactions. Combined with the enhanced Expert Score, these two capabilities enable users to better interpret and take action on results.

Improve evidence collection for key insights that shape risk responses

MindBridge has seen a strong positive market reaction to the release earlier this year of its risk segmentation dashboard which allows customers to visualize risk scores tailored to their organization. This game changing capability allows organizations to uncover and analyze risks in specific business processes and identify weaknesses in existing controls.

Strengthen your financial oversight

Improve operational efficiency with MindBridge’s expanded AI suite of risk identification capabilities.

All of these MindBridge capabilities are available today. Read the release notes here.

Wondering if MindBridge is the right solution for you, we can quickly show you. Let’s talk.