MindBridge Q4 2022 Release

AI-enabled financial oversight: MindBridge delivers another major update to its leading financial risk analytics platform

This release gives clients greater control over how they identify and categorize unusual monetary flows, ultimately leading to more effective and efficient risk assessments.

Enabling next-gen financial risk discovery and anomaly detection

Enhanced Financial Scoring

New Monetary Flow Analysis

New API Updates

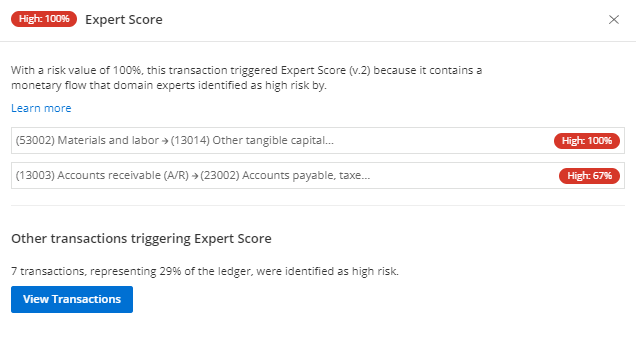

Enhanced financial expert scoring

MindBridge has further enhanced the clarity and explainability of its proprietary financial Expert Score control point, enabling faster, more targeted responses to identified entries and transactions. This will help organizations quickly isolate the riskiest monetary flows within their business, supporting the broader goal of managing elaborate financial processes.

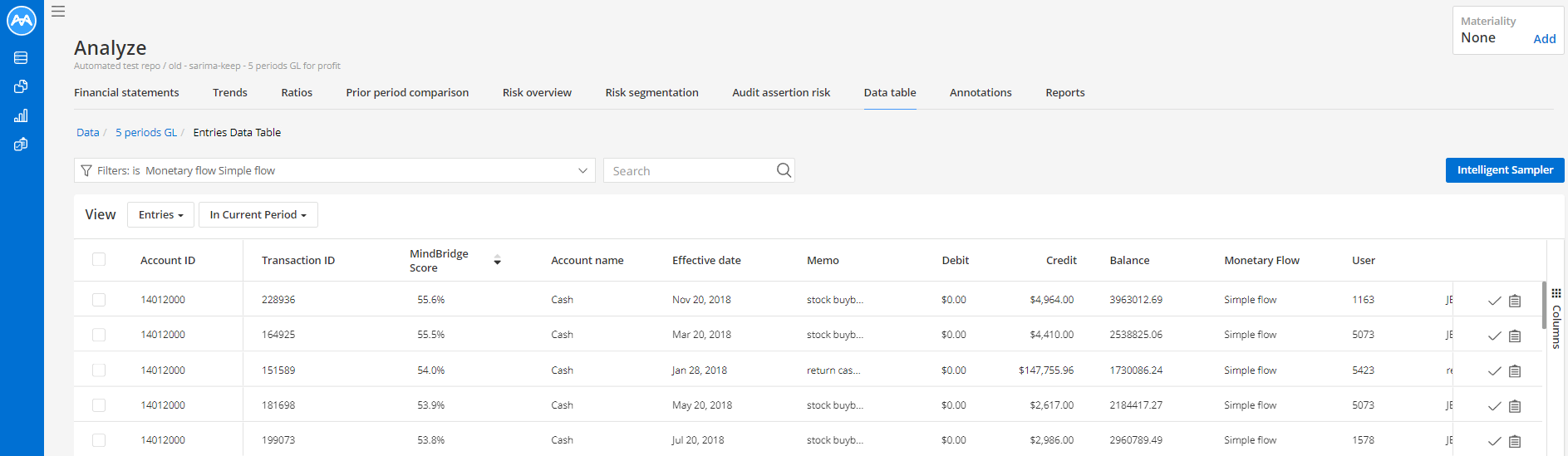

Risk responses for monetary flows

MindBridge has also deepened a long-standing capability to analyze all of an organization’s inter-account financial flows. MindBridge users may now distinguish between different types of flows, ensuring teams have greater visibility into complex transactions. Combined with the enhanced Expert Score, these two capabilities enable users to better interpret and take action on results.

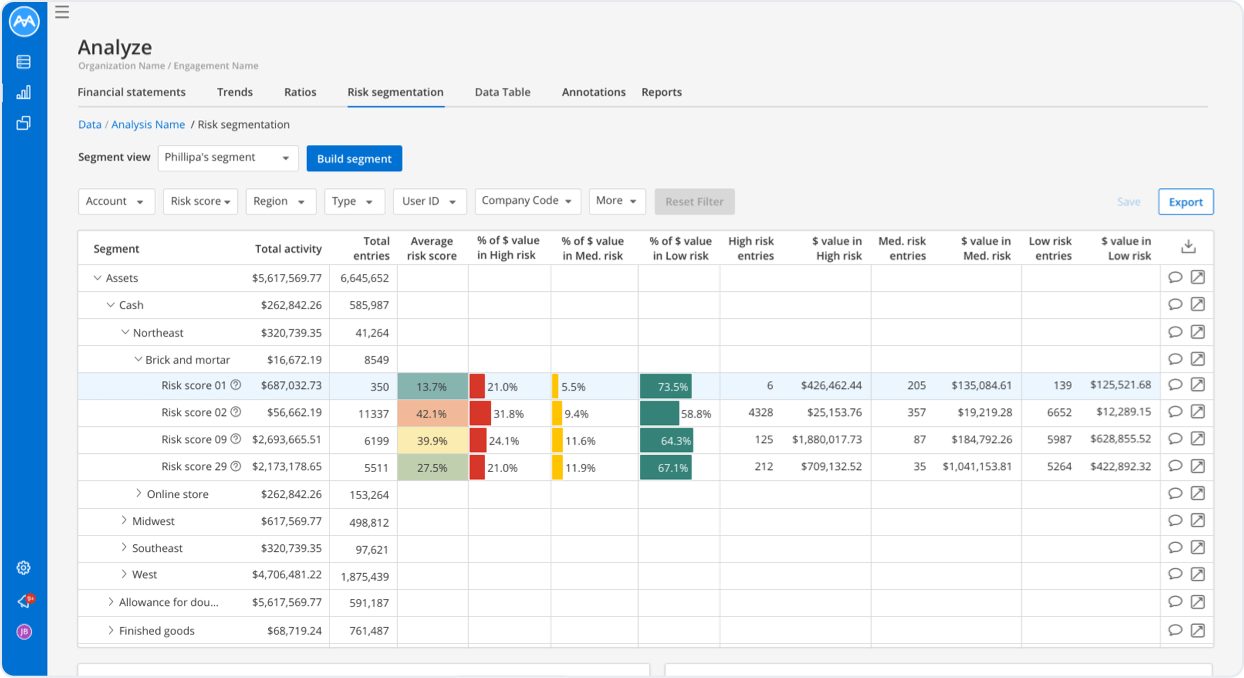

Visualizations for tailored risk scores

MindBridge has seen a strong positive market reaction to the release earlier this year of its risk segmentation dashboard which allows customers to visualize risk scores tailored to their organization. This game changing capability allows organizations to uncover and analyze risks in specific business processes and identify weaknesses in existing controls.

Plus more

MindBridge continues its investment into the API with improved collateral. This includes advanced technical documentation, including improved descriptions, appendices, and step-by-step tutorials. This allows users to accelerate time to value and makes it easier to move data into MindBridge and results out of MindBridge into your executive dashboard tools of choice.

In addition, MindBridge is excited to announce a new capability to allow users the flexibility to rename account nodes at the engagement level. This is a dynamic feature that supports the entire engagement and can be performed without rerunning the analytics pipeline.

MindBridge has expanded its financial risk identification capabilities to provide you with leading AI technology for stronger financial oversight.

All MindBridge capabilities are available for customers today. To hear more about how MindBridge can help reset your internal control framework watch the on-demand webinar here.

What else do we have for you?

MindBridge is constantly evolving with state-of-the-art technology to expand its unique financial risk detection capabilities and to help support the professional judgment of our customers.

Visit our Knowledge Base to learn more about this and other releases.

Contact info@mindbridge.ai to talk to us today.