MindBridge Announces Strategic Partnership with

The future of financial decision intelligence is MindBridge AI™

Drive transformational outcomes to increase growth, minimize costs, and optimize performance.

Trusted by global leaders

Accelerate revenue while boosting earnings

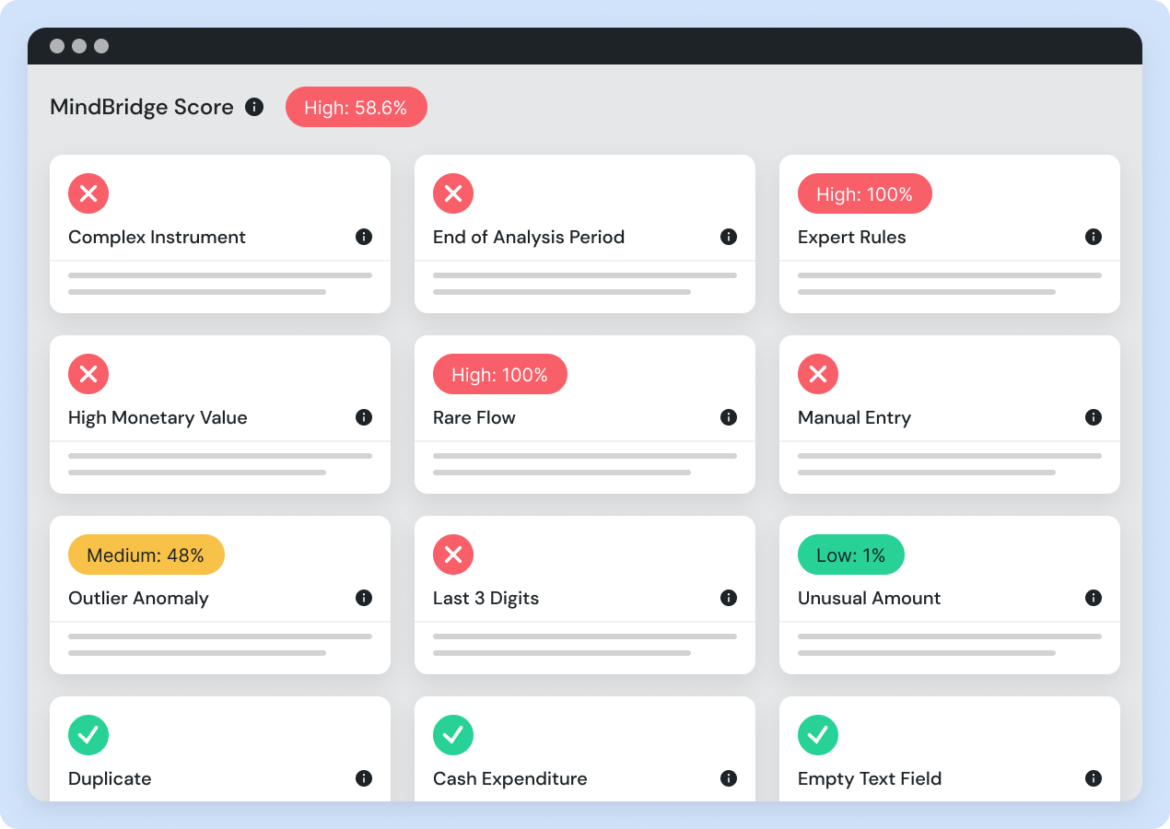

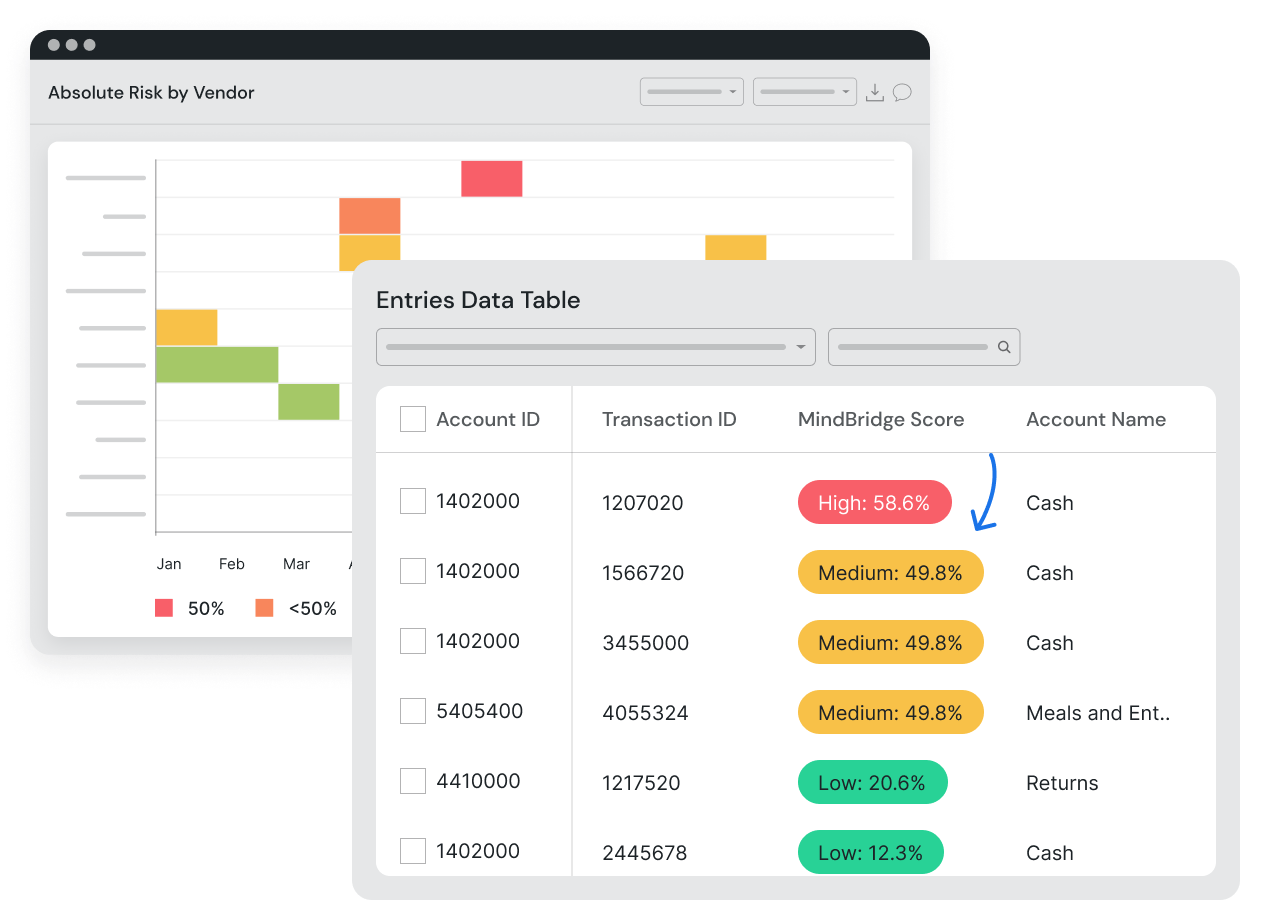

Automate known error detection

Establish repeatable and scalable processes to eliminate manual labor intensive work. Spend more time on value added activities

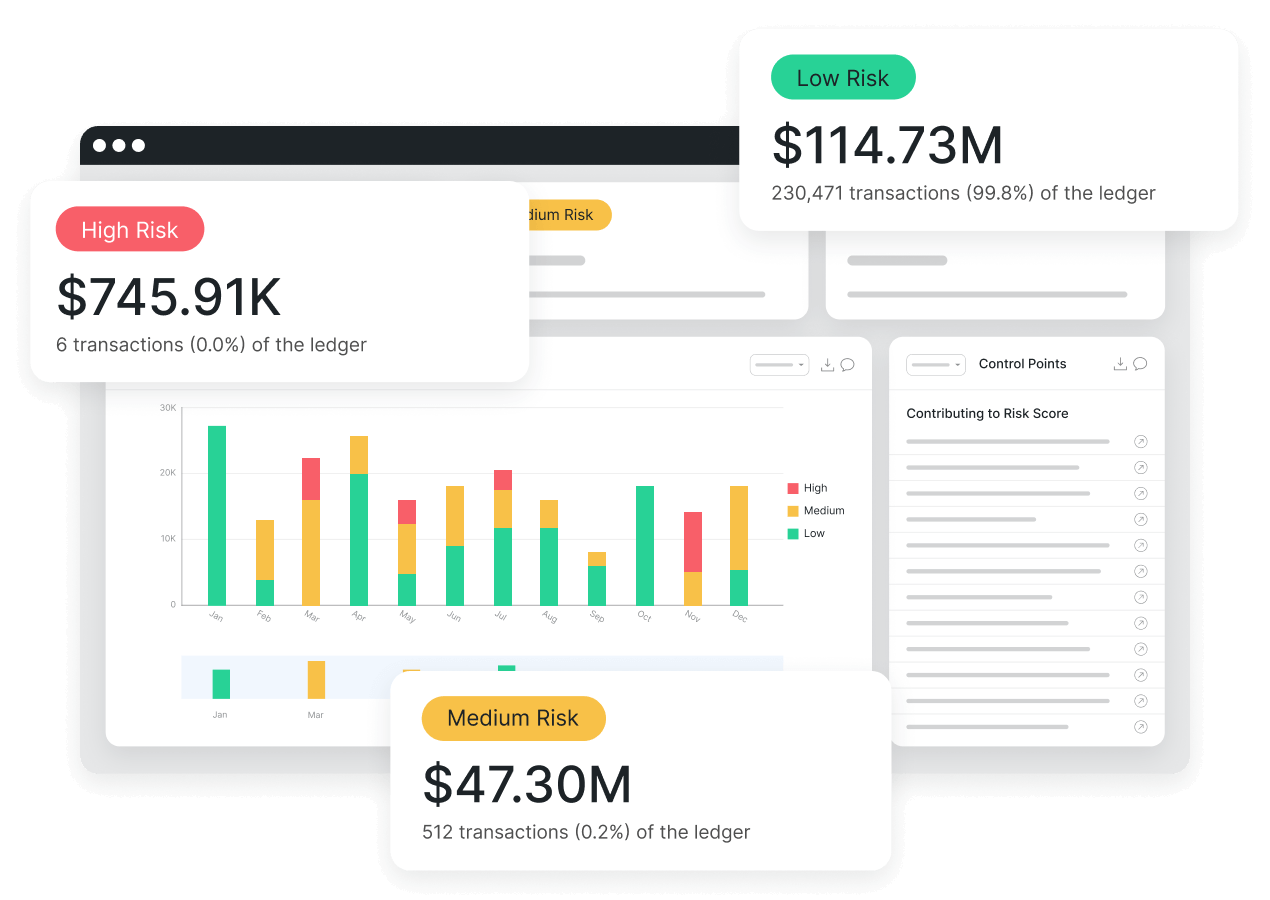

Implement continuous monitoring

Analyze 100% of financial transactions all of the time for expanded risk coverage and opportunity identification. Move from reactive to proactive risk management.

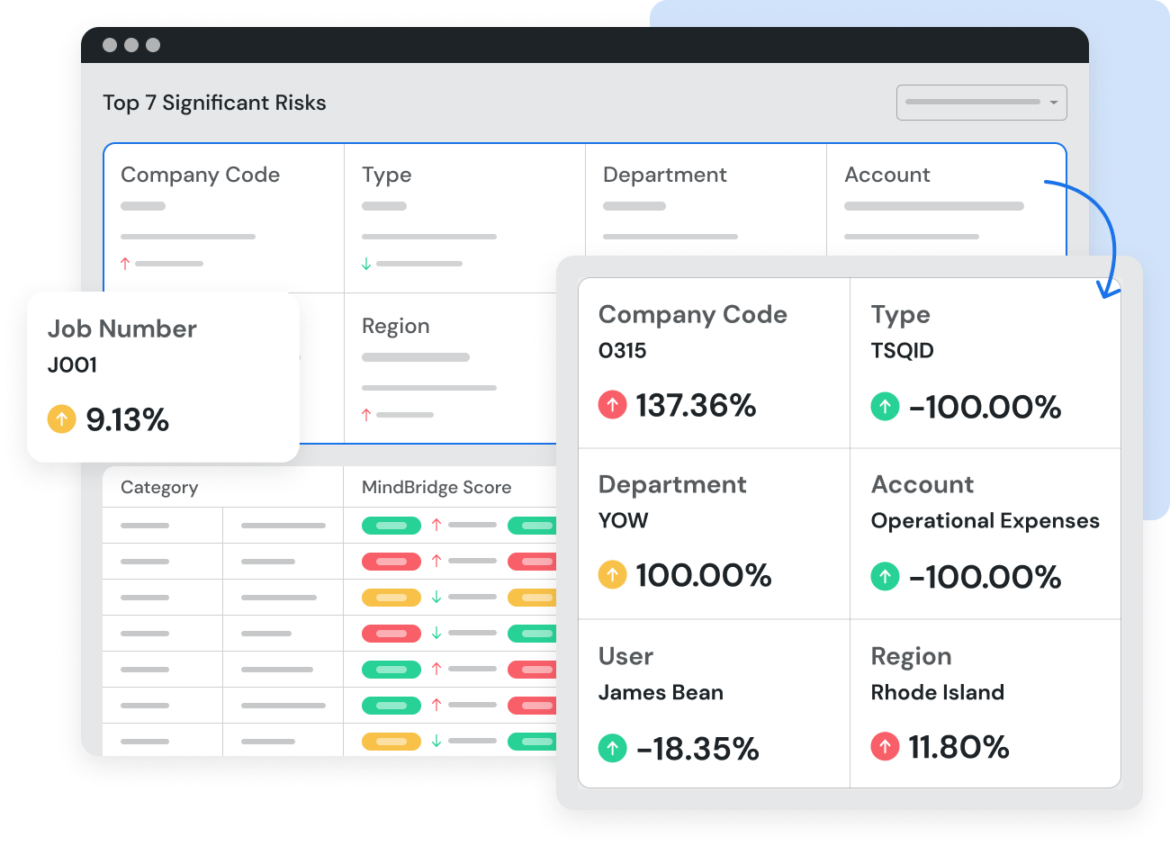

Surface the unknown unknowns

Risks and opportunities are buried deep within the vast amounts of data, often across an array of disparate systems. Sleep better at night by gaining a centralized and connected view of your enterprise’s entire financial data sets.

Don't get left behind

Sticking with outdated financial analysis processes exposes your company to fraud, financial loss, and compliance issues. MindBridge empowers your business with adaptable AI-driven use cases, so you stay ahead of the game.

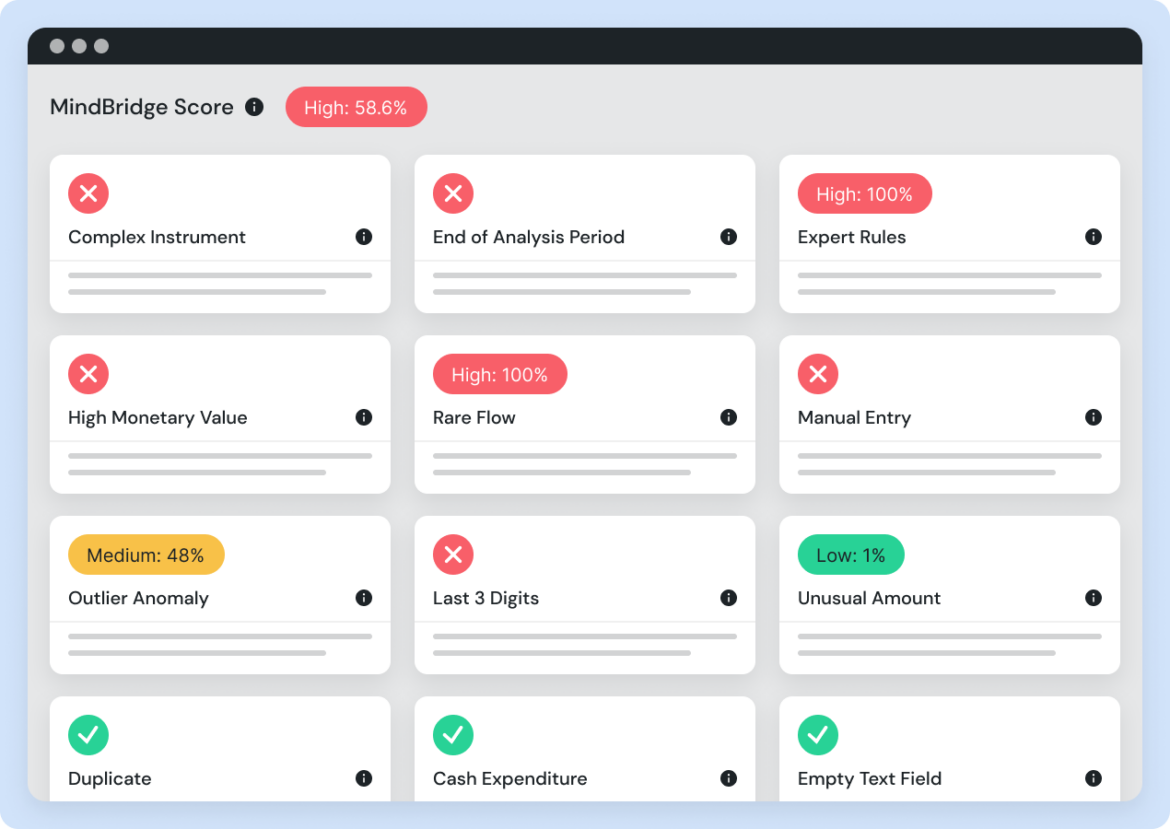

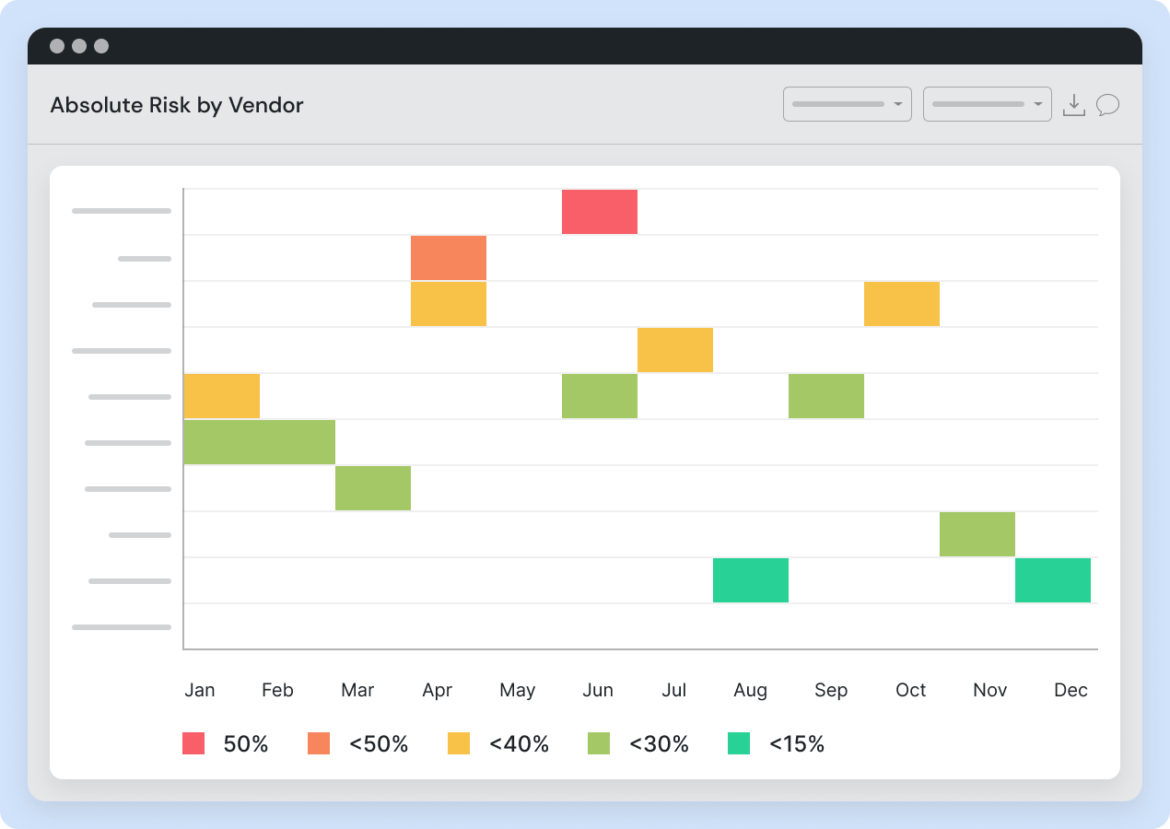

With adaptable AI, risk has nowhere to hide

Before MindBridge

After MindBridge

AI Central Insights Factory

AI-powered use cases give companies a connected view of the enterprise, scanning the entire organization for risks and improvement opportunities.

Unified Data Strategy

Processes exceed systems. Seamlessly integrate and connect directly into your existing technology ecosystem, without interruption.

Ensemble AI and Unsupervised Machine Learning

The MindBridge AI™ platform eliminates the need to codify data and provides unbiased insights for better financial decision intelligence.

Deployed to over 27,000 accounting, finance, and audit professionals globally

MindBridge automates and pinpoints what to look for, turning this random process into something targeted and efficient.”

Jessica Helms

Partner, Cherry Bekaert

I needed something that could scale and tell me what I didn’t already know.”

Ryan Mitchell

Manager of Finance Digital Delivery

Why would we reinvent a system when MindBridge provides so much that’s ready right out of the box?”

Shakeel Nasierkhan

Director, Internal Audit

Instead of doing a little bit of everything

at one of our divisions or subdivisions, we

can locate the areas of highest risk and

focus our time on them.”

Chris Swanson

Manager of Internal Audit Data Solutions at Polaris.

With the amount of data we process, we enable our staff to be data literate, to handle the data in a way that drives insights and independence. This was an innovative approach that was implemented to address scale.”

Jeremy Beltgens

Sr. Manager Assurance Innovation at MNP

By combining KPMG’s in-depth industry expertise with MindBridge’s advanced technologies, we continue to digitally transform the audit, providing increased quality and value to clients and enhancing public trust.”

Sebastian Stöckle

KPMG Global Head of Audit Innovation

Resources

Accreditations and Awards