AI adoption in finance is no longer a matter of if; it’s a matter of when and how fast.

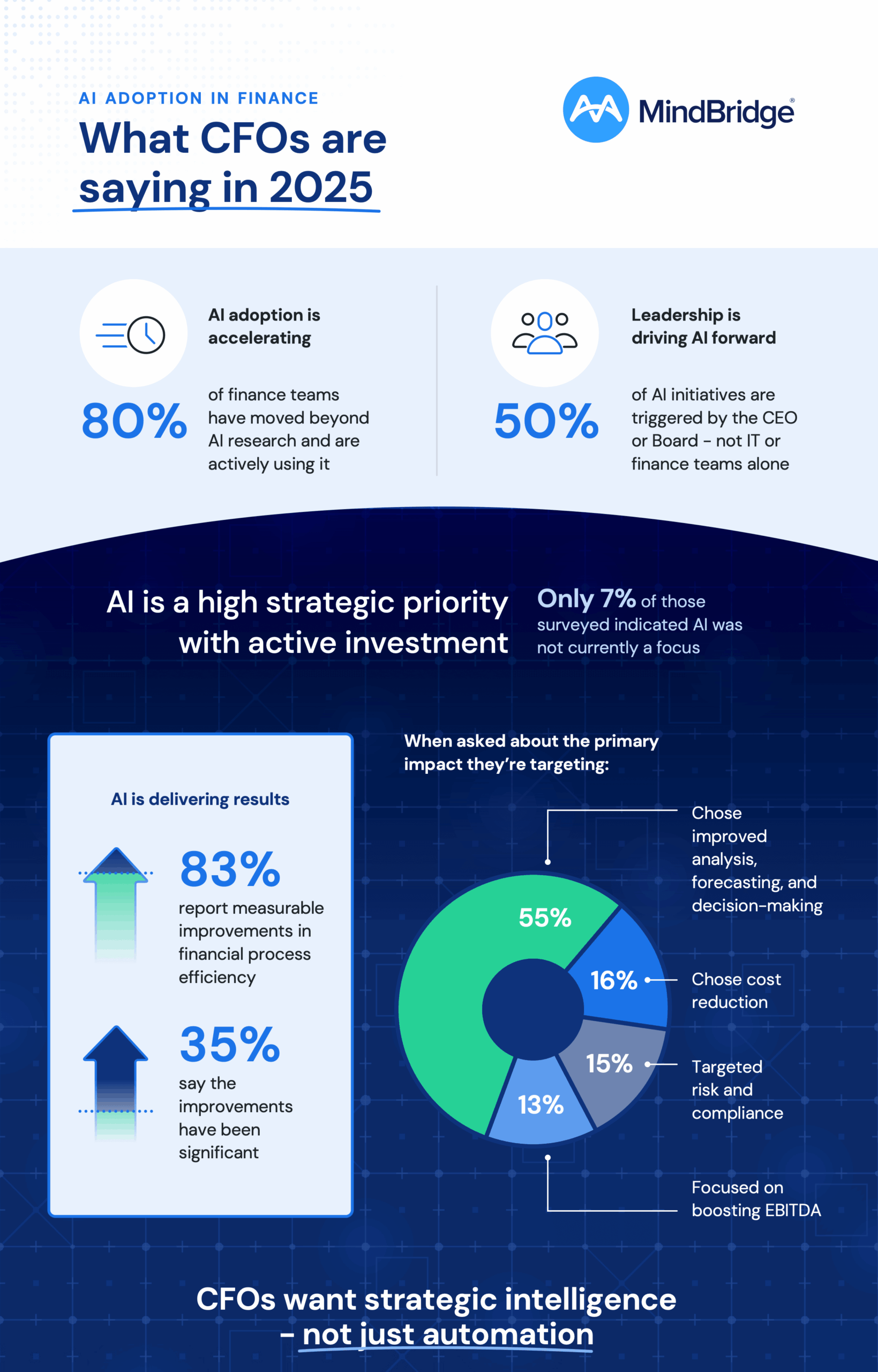

According to our latest MindBridge CFO AI Adoption Survey, a full 80% of finance teams have already moved beyond research and are actively using AI to improve operations, identify risk, and drive better decision-making. This shift isn’t just about technology; it’s a signal that AI has become a strategic necessity in the finance function. CFOs are no longer on the sidelines watching; they’re leading the charge.

Preview the findings: The infographic below highlights key data points from the 2025 MindBridge CFO AI Adoption Survey. Click to view the full version (PDF) for complete insights.

CFOs Say: AI Is No Longer Optional

The survey shows that 52% of finance leaders believe AI will be “very critical” or “absolutely essential” to maintaining a competitive edge by 2030. It’s not surprising. As Gartner estimates, poor decision-making causes 3–8% in EBITDA leakage annually—a stat that 91% of finance leaders polled agree with, and 60% plan to tackle with AI.

In fact, the ROI is already here:

- 83% report measurable improvements in efficiency

- 77% report at least 5% in cost savings

- 10% say savings exceed 30%

What’s Driving the Shift?

The rapid adoption of AI in finance isn’t happening in a vacuum—it’s being fueled by a fundamental reframing of the CFO’s role in the enterprise. No longer just stewards of the balance sheet, today’s finance leaders are expected to drive agility, surface insights at speed, and deliver strategic value in real time. AI is emerging as the infrastructure that enables this transformation.

What’s especially striking in the survey data is that AI adoption is no longer confined to tech-forward outliers or isolated innovation pilots. Instead, it’s becoming a core component of enterprise strategy, driven directly from the top.

Here’s what stood out in the data:

- AI implementation is a strategic priority: 49% say AI is a top strategic focus with active investment, signaling that finance leaders are backing their intent with capital and commitment.

- The adoption of AI is an executive mandate: 50% of AI initiatives are being launched by the CEO or board, not IT or finance teams acting independently, underscoring that this is now a boardroom-level conversation.

- Top goals are not what you would expect: 55% cite enhanced forecasting and decision-making as the primary benefit they’re targeting, far outweighing cost reduction. AI is being positioned not just as a tool for doing things faster—but for thinking better.

The Bottom Line

AI isn’t a future ambition; it’s a present reality. The finance leaders embracing AI today are shaping the performance edge of tomorrow. Those who delay? They’re risking not just efficiency, but long-term relevance.

“Finance leaders are sounding the alarm: AI is no longer optional,” said Stephen DeWitt, CEO of MindBridge. “The organizations investing today will lead the future of finance. Those that delay are risking efficiency, performance, and diminished value.”

Ready to up your game?

Whether you’re just starting or looking to scale your AI capabilities, MindBridge is here to help you with your financial transformation.

Download the full 2025 CFO AI Adoption Survey or book a demo to see what’s possible.