Setting the standard for efficiency with AI-driven anomaly detection:

In today’s dynamic business environment, organizations are constantly evolving, making traditional methods of anomaly detection outdated and inefficient. Leveraging AI solutions like MindBridge allows finance and audit professionals to stay ahead of the curve by adapting and calibrating to the changing practices and processes within their organization. This AI-driven approach ensures a targeted and efficient method of identifying anomalies to pinpoint issues. By promptly detecting anomalies, whether they arise from errors, fraud, or unforeseen circumstances, businesses can maintain trust amongst stakeholders.

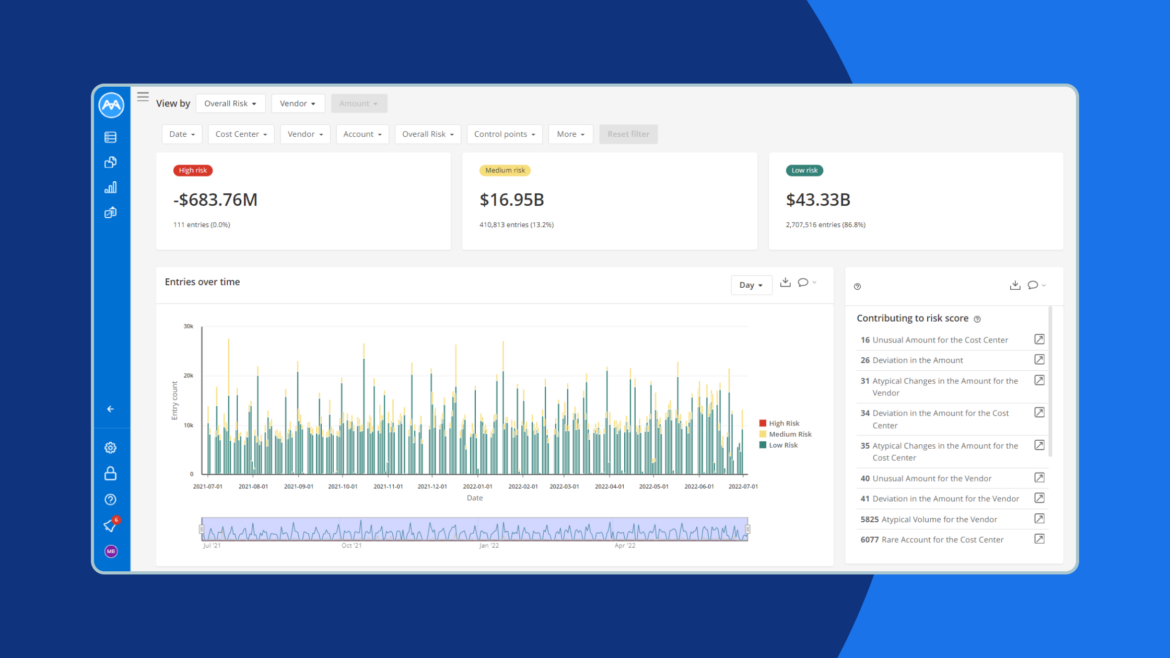

Transforming data to intelligence in minutes across transactional data sets:

The setup process is expedited through MindBridge preconfigured analysis, which covers diverse financial and operational data sets, including General Ledger, Customers, Vendors, Employees, and more. This ready-to-use configuration seamlessly integrates automated tests such as business rules, statistical models, and machine learning algorithms to analyze data, minimizing manual setup time. Once data is ingested and mapped, MindBridge triggers automated analytical procedures, accelerating actionable insights. See it in action.

Addressing the human error factor:

Despite technological advancements, human errors remain prevalent in financial processes, with one-third of accountants reporting making errors weekly, according to a recent Gartner report1. Leveraging AI-driven anomaly detection solutions like MindBridge helps organizations promptly identify and mitigate these errors, minimizing corrective costs. By reducing reliance on user hypotheses and alleviating potential biases, MindBridge offers a clear and more objective view of the data, minimizing the likelihood of errors slipping through the cracks. Addressing these issues in a timely manner increases trust amongst stakeholders and facilitates better decision-making and operational efficiency in your organization.

Rapid proficiency and implementation:

MindBridge offers proficiency in hours rather than months, enabling organizations to quickly adapt and leverage the power of AI for efficient anomaly detection. Thanks to the streamlined implementation process facilitated by the intuitive, easy-to-use design of MindBridge products, organizations can easily start analyzing data, identifying anomalies, and mitigating risks. This ensures the establishment of trust, transparency, and efficiency within their organization right from the outset.

Continued enhancements in the April release:

In our most recent release, MindBridge enables more depth of analysis and configurability for our users through new control points and API enhancements.

- Two new control points that analyze entries departing from expected account trends and unusually high volumes.

- The ability to build specific rules-based control points across the platform that meet organizational policies and oversight objectives.

- API enhancements now allow for users to efficiently connect more analysis types and streamline continuance of analysis in future periods with roll-forward capabilities.

MindBridge prioritizes feedback from its customer base and financial professionals to continuously enhance its product offerings with advances in data insights and transaction risk detection. For more information on the current release, please visit our What’s New webpage.

1Reduce Accounting Errors by Building Finance Technology Acceptance. Published 8 January 2024 – ID G00801871 – Jacob Joseph-David