The accuracy of financial data is not just an operational need but a strategic imperative. Clean financial data is crucial for reliable financial analysis, accurate reporting, and sound decision-making. Finance teams need to be the trusted source of truth. This allows the business to maintain consistent compliance, manage risks, and optimize performance in business operations and financial reporting.

The high cost of financial errors: understanding the impact on businesses

According to a recent survey by Gartner, Inc., 18% of accountants make financial errors at least daily, with more than half (59%) making several errors per month. Such mistakes, while seemingly small at the individual level, can accumulate significant risks and distortions in financial reporting.

In many organizations, approval and review processes act as crucial checks and balances, ensuring that transactions meet established guidelines and standards before moving forward. However, simply having these processes in place is not enough; the depth and thoroughness of these reviews are critical to their effectiveness. The business needs to know they can rely on finance teams to have the most accurate data. It is important to consider whether these processes are rigorously examining all aspects of a transaction, beyond just the dollar values and dates, to catch potential errors and inefficiencies.

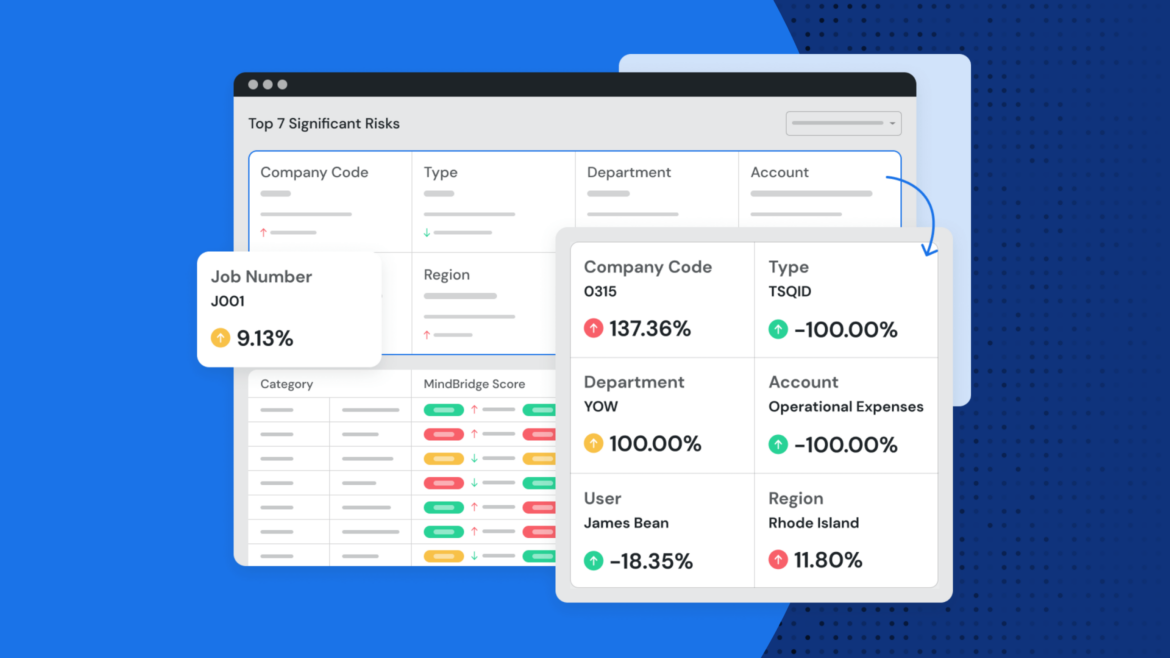

How MindBridge AI enhances accuracy in financial reporting with advanced analytics

By leveraging a combination of statistical, machine learning, and artificial intelligence methodologies, MindBridge can detect sophisticated patterns and anomalies that can safeguard against human error and possible fraudulent activities. This not only streamlines the detection process but also helps mitigate issues sooner reducing audit findings, and the cost of correction.

Detecting multi-million dollar errors with MindBridge AI

MindBridge has continued to address pivotal accounting errors in our latest release building on our already exceptional level of depth in analysis with unusual digit combinations and unusual digit transposition. Here are simple examples of what MindBridge can capture:

- A transaction was recorded as $1,234,567 instead of $1,324,567. A $100K error.

- A transaction was recorded as $11,234,567 instead of $1,234,567. A $10M error.

These errors, potentially leading to million-dollar misstatements, highlight the critical need for accuracy in financial data. The implications of these errors are not just internal but affect financial reporting, external stakeholder trust, and compliance.

Empowering financial leaders: the future of financial governance with AI

For finance and audit professionals, the adoption of sophisticated tools and next-generation anomaly detection techniques is not just about staying compliant but about leading the charge in transforming financial governance. By prioritizing clean financial data, leveraging the right tools, and staying ahead of technological advancements, financial leaders can protect their organizations against significant risks and position them for sustained success in a competitive business environment.

To learn more about how MindBridge AI’s innovative tools enhance financial anomaly detection, visit our What’s New page.