Anomaly detection is the ability to identify rare items or observations that don’t conform to normal or common patterns found in data. These outliers are important within financial data because they can indicate potential risks, control failures, or business opportunities. Moreover, they usually represent critical areas that need further examination or scrutiny.

Consumers and businesses lose millions of dollars annually due to hackers’ never-ending cyber onslaughts. However, investing in and retrieving stolen funds costs financial organizations billions more. As attacks become more sophisticated, money-handling organizations must incorporate strong fraud-prevention techniques into their plans to safeguard their clients and themselves from excessive expenses.

Anomaly detection is a powerful technique for detecting fraudulent transactions and behaviors, thanks to financial institutions’ ever-increasing amounts of data.

MindBridge and Anomaly Detection

This is not futuristic. MindBridge is a global leader in financial risk discovery and anomaly detection that helps financial professionals access better ways of working by identifying, surfacing, and analyzing anomalies across broad financial datasets.

MindBridge detects and determines anomalies by analyzing critical accounting and broader financial data by grouping debits and credits that have relationships within ledgers. This is a very distinctive approach unique to MindBridge. The platform goes beyond just reviewing static accounts and numbers and uses machine learning to look at occurring relationships and patterns. MindBridge is targeted toward accounting use cases that differ from most analytic and anomaly detection tools for general business intelligence.

To expand on this example, MindBridge has a view into monetary flows that consider the entire expense, including, for example, paying that expense with cash. This is the relationship of what’s happening behind the transaction by analyzing debits and credits. MindBridge breaks down monetary flows, which drives our rare flow, the outlier anomaly, and expert score. This granularity leads to an easier interpretation of the results and anomalies or outliers that can be investigated. We efficiently identify transactions that would not otherwise be identified and surface the meaning of those transactions to the organization for easier interpretation.

Make no mistake, these practices are here to stay. Although artificial intelligence and machine learning are always evolving, their adoption in financial accounting has only begun. Audit and assurance firms and enterprise finance departments see growing value in quickly analyzing and understanding financial risk in large volumes of business data without having to build systems in-house or rely on advanced data science teams.

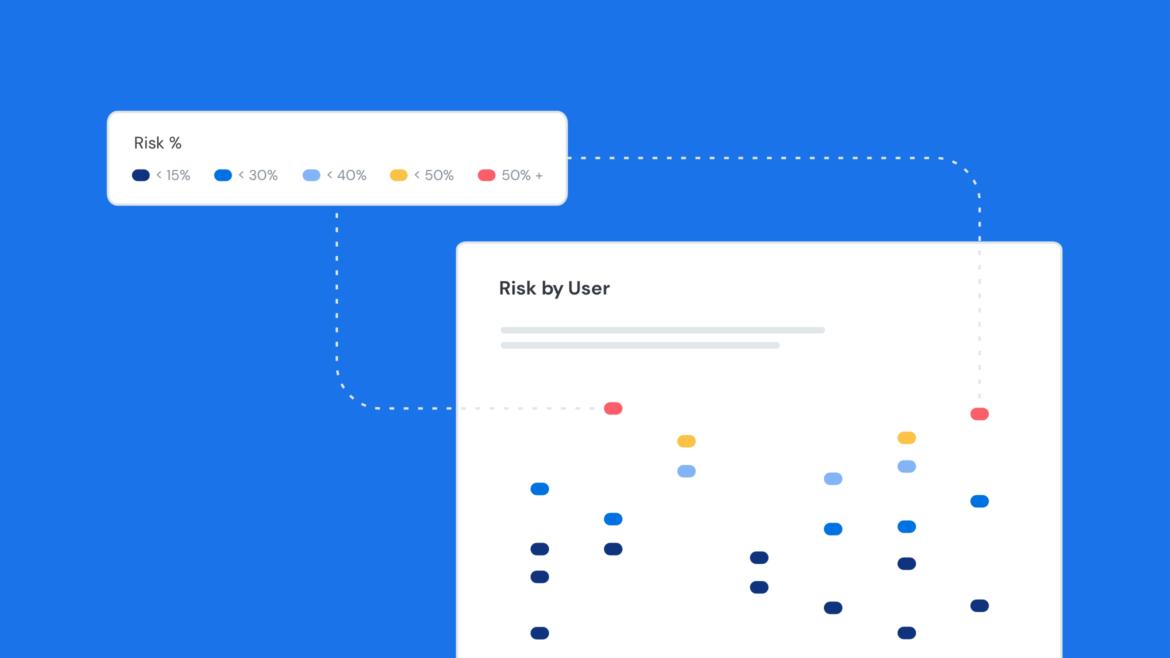

MindBridge’s ability to create risk scores based on patented control points makes our cloud software stand out to firms. Our pointed approach is more direct and efficient. Because we can test 100% of transactions instead of a small manual sample size, we provide a high-value offering. This also means we give auditors and financial experts time to concentrate on more meaningful requirements. Increased oversight makes it easier to correct issues based on focused insights through data anomaly detection.

How AI Can Be a Valuable Tool — If Used Correctly

Real-time anomaly detection in financial transactions allows businesses to react quickly to deviations from the norm, potentially saving millions of dollars that would otherwise be lost to fraud. Payments and finance firms can improve the efficiency of their anti-fraud initiatives by reducing the time between detecting problems and resolving them.

The fear of the “uprising of machines” is a naive approach to AI. Certainly, machines getting smarter, more efficient, and more effective for all types of businesses and tasks is not a new trend. But for a focused MindBridge conversation, it’s important to address the need for financial professionals to gain insights across large data volumes or multiple subsidiaries — without going on-site or tapping into the finite details of business-critical data as opposed to random sample manual tests.

These insights allow you to learn and know where to focus your time based on the detection of risks within your data or certain ledgers. In turn, you can make informed decisions to support your professional judgment. The algorithms are designed to look for patterns and work together to identify the most granular levels of risk. Then, the human user must decide to investigate potential issues or fraud further.

Applying what is learned from the machine with the human-centric aspect of trained, skilled knowledge and experience aligned with regulated standards, laws, and ethics helps you arrive at an opinion that best serves clients or the business.

Anomaly Detection and Machine Learning

Machine learning anti-fraud systems are cutting-edge methods for reducing uncertainty because they automate the difficult anomaly detection process. ML algorithms can detect very subtle and often concealed events and correlations in user behavior that might indicate fraud.

Anomaly detection with machine learning can handle massive data sets by comparing several variables in real-time to evaluate the risk of fraudulent transactions or actions.

Over time, technology has advanced in simultaneously tracking and processing:

- Transaction size

- Location

- Time

- Device

- Purchase data

- A variety of other characteristics

ML in anomaly detection also assists in analyzing far more financial data than human rules-based methods. Smart algorithms that track customer behavior help decrease the number of verification procedures that slow down the buying process and eliminate false positives, resulting in far better user experiences.

Using AI and ML to Streamline Business Processes

A 2015 McKinsey & Company report stated that 45% of work activities could be automated with AI. These findings are still relevant today. Markets are dynamic and move at faster rates than most people realize. Businesses must build automated, agile, and fast-paced operations to keep up with changes. Firms are embracing more flexible, results-driven approaches to attain dynamism and implementing AI to help with the shifts.

AI is frequently regarded as the future of technology and, in some cases, the ultimate driver of future innovation. Automobiles, voice assistants, facial recognition technologies, augmented reality, and much more already incorporate AI. However, business operations gain AI and ML benefits through more streamlined procedures. Artificial intelligence has revolutionized commercial processes by automating routine operations, enhancing user interfaces, and analyzing large volumes of data.

Machine learning is commonly employed in businesses because it recognizes diverse patterns in data and establishes links between data and possible data analysis conclusions. As machine learning algorithms advance, deep learning in AI occurs. AI can then examine a wide range of variables in the data. By simply comprehending the voice and context of the request, AI-enabled natural language interfaces make interacting with applications simple and speed up multiple steps within processes.

More specifically, research indicates that adopting AI in the financial services industry has the potential to lower operating expenses by 22% by 2030. Financial institutions are rapidly using AI to take advantage of the large amounts of available data sets and increase the affordability of computing capabilities. Both are essential components of ML models. Financial services providers use these models to spot signals and capture underlying data correlations in ways humans simply cannot.

But the applications of AI in finance are not limited to machine learning models for decision-making. They extend throughout the entire spectrum of financial market activity.

MindBridge saves auditors and finance departments time by testing all their transactions and applying risk scores based on test control points. Business teams then understand where to allocate time and resources, and human-centric AI can be achieved.

How Anomaly Detection Fits Into Your Audit Process

Technology and the rising use of automation, analytics, and AI drive the audit process’ evolution, building on innovations that computers brought to the assurance profession (e.g., transferring ticking and calculating from physical ledger papers to electronic working papers).

Huge volumes of data can be evaluated to uncover anomalies and identify insights, patterns, and linkages that are not easily obvious to humans using today’s processing power, machine learning, and AI-enabled audit tools. To interpret the output, one must determine if the information represents a true anomaly and, more importantly, determine if the true anomaly involves human insight and expertise.

When this process considers auditors, the auditor spends less time collecting, comparing, preparing, and summarizing data and more time analyzing and evaluating the information and data outcomes. This could provide more information about the entity, which makes the auditing process more informed from the beginning.

It’s critical to recognize automation, analytics, and artificial intelligence for what they are: facilitators similar to computers. They won’t take the place of auditors but rather change the auditing process and the auditors’ jobs.

Analyzing the general ledger will show indicators of the risk of material misstatement that might exist (e.g., standard rules-based tests, statistical analysis, or ML algorithms to aid in data anomaly detection). The results of these analyses might be quantified to provide further insight and explain what specific risks exist within the financial statements. A summary dashboard will allow you to view the full spectrum of tests and areas of identified risks.

Additionally, you might filter the view on various criteria identified within the data ingestion phase. You can focus specifically on analytics available for accounts included in your scoping decisions.

Enterprise organizations are looking to make huge advancements in data analytics technologies. Though certain industries, such as banking, healthcare, and manufacturing, have been progressive with their investments, departments within these organizations have not. C-suite executives and management teams want to modernize, bringing data elements into finance departments’ overall auditing approaches. This can include implementing a stand-alone risk group — all within tight budgets and staffing allocations.

Transforming Finance With Anomaly Detection

Fraud detection is extremely important for payment and financial organizations. Leading financial institutions worldwide now use real-time anomaly detection in auditing to prevent losses before they happen. Businesses can buy comprehensive anomaly detection systems or create them from the ground up to stay ahead of fraudsters.

To maintain real-time responsiveness, an organization needs a sophisticated anomaly detection system that uses ML to monitor and correlate several complicated indicators with varying degrees of fluctuation while sifting through millions of data points every second. Many finance department employees and internal audit teams have modest backgrounds in analytical skill sets, from the process and data mining to spreadsheet analytics. They might also lack the resources for finding data-driven risk insights, monitoring, mining, etc.

Implementing MindBridge into your department or organization means eliminating the need for human labor and expertise. Your organization can begin moving toward the convergence of finance and technology. MindBridge can save you money, time, labor, and valuable resources and put your company on track to faster, more accurate, and more efficient anomaly detection.

To take advantage of all that MindBridge has to offer and start seeing results within your organization, visit our What’s New page today.