Well, it’s finally here. According to an article from Forbes Magazine, we have reached the age of automation. From AI and machine learning to financial automation and robotics, we’re officially an automatic civilization. Please, be kind to our new robot co-workers.

Okay seriously, this is important stuff, even if we did all see it coming. Especially when it comes to the ever-expanding world of finance.

In every industry, every business, and every firm, finances and how they are managed are vital to the growth and development of a company. Whether you’re a business owner, CFO, or part of the finance department, the role of automation in the future of finance is vital to your role, growth, and the evolution of your organization.

Financial automation doesn’t just mean automating payroll, although it doesn’t hurt to do that as well. Automating financial processes incorporates much more, including risk assessment, audit, and compliance among many other aspects.

An article from DigitalistMag outlines the capabilities of today’s financial automation services, describing the ability to “gain new insights from existing data to optimize credit decisions and improve financial risk management, automating business processes that previously required manual human intervention, and improving the customer experience.”

Financial management has evolved rapidly since the advent of computational technology. As this technology evolved, financial experts and professionals soon recognized that process standardization and centralization are absolutely necessary to increase the efficiency and effectiveness of modern organizations. As efficiency grew into a central tenant of management processes, financial automation became the next logical step for businesses and organizations.

In 2016, McKinsey estimated that 60% of all occupations have approximately 30% or more capabilities that can be automated with existing technology. Moreover, there has been a significant change in the understanding of what can be automated and what should be automated, which has become increasingly evident due to the unprecedented effect the COVID-19 pandemic has had on work.

For businesses looking to hire and outsource their financial processes or professionals who want to simplify and streamline internal processes, it may be time to look at automating them instead. For many, this has already begun, as “CFOs around the world heavily invest in financial automation software as a next step in the evolution to enable enterprise transformation.”

In this way, financial automation could lead to a complex or fundamental shift in how an organization’s core business is conducted.

Taking the first step toward financial automation can seem daunting. However, with more businesses adopting automation into their day-to-day financial practices, it’s clear to see the power this technology holds.

So, what exactly is financial automation?

What is financial automation?

For us mere mortals, financial automation can be as simple as automatically depositing your paycheck, paying bills, or saving a portion of your income per month. The concept is similar for businesses and corporations, but at a much larger scale, and with a lot more moving parts.

Financial automation is the process of utilizing technology options to complete tasks with minimal human intervention. These tasks would normally be accomplished by employees, which, in theory, frees up time for them to perform more complex tasks.

According to another automation study from the McKinsey Global Institute’s automation research, current in-use technologies can fully automate 42 percent of finance activities and mostly automate a further 19 percent.

While many still consider financial automation and intelligent software to be on the horizon, organizations have already started to utilize cutting-edge tools and technologies such as advanced analytics, process automation, robo-advisors, and self-learning programs. A lot more is still yet to come as technologies evolve, become more widely available, and are put to innovative uses.

Levels of automation

The initial forms of automation were (and still are) macros and scripts: simple rules-based automation that repeated simple work with highly structured data – things like general accounting operations, revenue management, and cash disbursement have an over 75% fully automatable ability with already existing technologies.

Robotic process automation (RPA)

RPA is the basis (above macros and scripts) to understand the capabilities of automation. An example of an RPA would be simple software that can perform repetitive tasks quickly with minimal effort, like some of the rote tasks mentioned earlier.

According to the 2017 McKinsey research (also mentioned earlier), about a third of the opportunity in finance can be captured using basic task-automation technologies such as these.

Artificial intelligence (AI) and intelligent automation (IA)

On the other end of the spectrum is artificial intelligence. Artificial intelligence is theoretically achieved when software is able to make intelligent decisions while still complying with controls using algorithms or machine learning.

Machine learning algorithms demonstrate the ability for computers to take in a constant stream of data, analyze that data for patterns and recommend solutions to problems humans can’t even see, proving vastly positive results in improving a company’s financial proficiency.

Once a dream for financial professionals and business owners, this form of financial automation software is becoming a reality, shaking up the way that tasks are performed, and even introducing other aspects such as forecasting into the mix.

Improvements with financial process automation

The umbrella of finance – from payroll to predictive forecasts can involve menial and repetitive tasks which leave limited time and resources to focus on value-adding activities to grow your organization. When financial process automation is added, it serves as a pivotal support to free up needed resources and time.

As these technologies can cover more ground and more deeply analyze company financials, many organizations are finding that AI and automation technologies are actively improving their bottom line. According to a survey from the Association of Certified Fraud Examiners via the Harvard Business Review, “organizations lose 5% of their revenue every year due to fraud. The typical fraud case causes a loss of $8,300 per month and lasts a full 14 months before detection. And lack of internal controls contributed to nearly one-third of all fraud cases.”

Risk discovery is just one aspect of financial automation, but a growing one.

As AI, RPA and IA continue to use machine learning to do more and perform more intricate tasks, offering insight into finances, we are seeing how this can be incorporated into an organization’s long-term organizational strategy. MindBridge, for example, has developed AI technology for risk discovery, a complex financial task that incorporates not only transactional analysis, but offers broader insights into financial health and integrity.

Want to learn more about how auditors are using AI?

By automating certain financial processes, “finance professionals can not only provide real-time insights into the current status of the business but, with advanced predictive algorithms, they can look into the future and proactively steer the business.”

Financial automation and its capabilities are excelling at a fast rate. With the help of AI, RPA, and IA, standard automation practices can be enriched beyond simple pre-programmed controls and scripts. From McKinsey & Company once again, AI algorithms can learn from historical datasets and the interactions of the financial professional with the system, thereby improving the matching rates tremendously. In this context, matching rates refer to the ability at which an AI system is able to tag users to certain data sets based on their profile of demonstrated usage. Furthermore, the AI technology allows automatic extraction of unstructured information from documents, such as emails.

Of course, return on investment is always a concern. It can take a lot of time and effort to implement new technologies, and savvy business leaders need to know that the tools and processes they put their money behind will work.

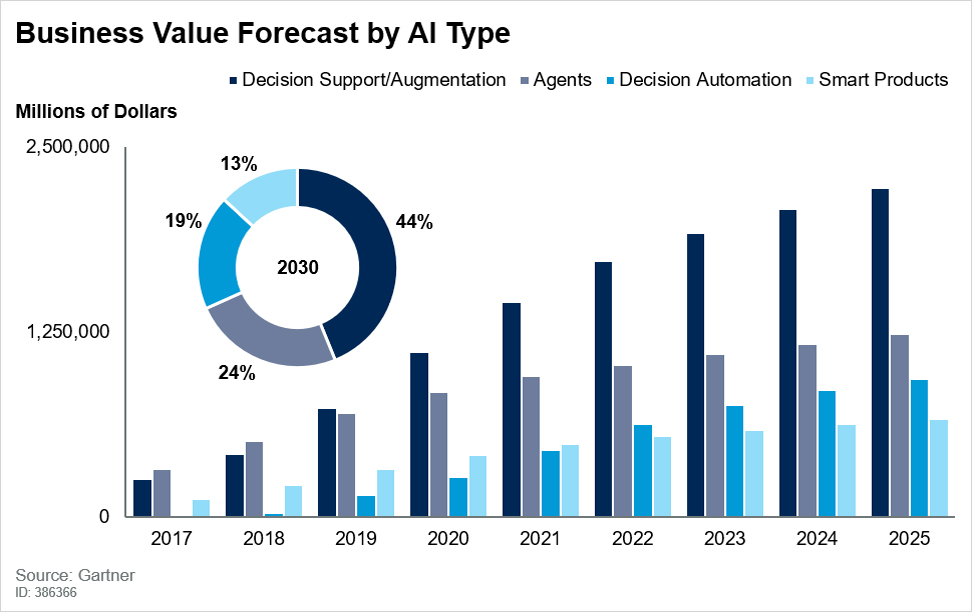

According to Gartner, “AI augmentation will create $2.9 trillion of business value and 6.2 billion hours of worker productivity globally.” Basically, they define this term as the combined work of humans and technology, with the people at the center of the operation.

Source: Gartner.

If these forecasts are correct, executives should be clamouring for AI and automation investment. Even a small piece of this pie can level up your office, department, or organization writ large.

What financial process automation could mean for work structure

One of the biggest concerns associated with exploring financial automation and therefore implementing financial automation software is what happens to the employees and the roles formerly associated with those finance objectives.

There’s no doubt that introducing financial automation will change the roles of many employees and even the manner to which employees are trained or progress toward career objectives. One thing is for sure though, automation will replace low-value, simple, and time-consuming tasks, thereby giving staff the flexibility to expand their roles, and spend more time on value-adding activities to help drive a company’s competitive advantage.

In an article from PWC on change management, they outline five steps that can help firms adopting financial automation make the transition as smooth as possible:

- Prepare for human capital risks like you’d prepare for any other risks

- Help people find their way

- Create organizational support for success

- Expect changes to jobs, compensations, and structure

- Learn new ways to develop your team

To unlock financial automation’s full potential, managers must be willing to re-engineer processes, and redeploy resources to optimize efficiency and output.

Another consideration for anyone looking to adopt automation and AI technology is assurance and verification. This verification work ensures that the technology in place is doing what it’s supposed to do, at the level of work required to meet compliance requirements and quality assurance standards.

Internal teams can “test” automations by utilizing what are known as “Test Frameworks” for applications. Some examples of framework tools come from SmartBear and Selenium. However, it’s a lot of work, and unless you have dedicated developers that can help your team test automation tools, you’re sort of stuck. For many businesses, it’s much easier to work with platforms and tools that have done this testing themselves by utilizing a third party.

A future with financial automation

Although IA and machine-learning algorithms are still considered in their infancy, that doesn’t mean finance leaders should wait for them to mature fully. According to McKinsey, many automation platforms and providers that struggled a decade ago to survive the scrutiny of IT security reviews, are now well established, with the infrastructure, security, and governance to support enterprise programs. “Where a manager once had to wait for an overtasked IT team to configure a bot, today a finance person can often be trained to develop much of the RPA workflow.” The exponential growth in structured data fueled by enterprise resource planning (ERP) systems, combined with the declining cost of computing power, is unlocking new opportunities every day.

MindBridge is a great example of a pioneer in unlocking the expanded capabilities of AI and RPA within the finance sector. With AI-embedded risk discovery, MindBrige can risk-rate 100% of the transactions in general ledger and sub-ledgers to produce an aggregated risk profile of the data that makes up the business’ financial statements, facilitating laser-like focus on the areas that matter.

The future of financial automation seems bright, already beginning to reshape the way in which financial services are performed in organizations large and small. Incorporating AI, RPA, and other forms of automation can seem daunting at first, as there are many tasks and organizational changes that go into implementing new technologies and processes.

By empowering your finance team with AI co-workers, they reduce the time spent on mundane tasks, enabling your team’s human intelligence to shine operationally. Financial efficiency and accuracy means happy stakeholders, and a growing business. What’s not to love?

For more articles like this one, visit our Resource Center.