Tackle margin suppression for greater confidence

See how CFOs and finance leaders are battling rising input costs and countering profit erosion with MindBridge AI.

The Challenge for Retail CFOs

Retail finance teams face unprecedented challenges: uneven consumer demand and lack of clarity across disparate and disconnected POS and ERP systems.

The result is more predictable profit variability by streamlining demand planning and forecasting processes.

The status quo is dead. Elevate your impact with AI-powered financial decision intelligence.

Why Leading Retail CFOs Choose MindBridge AI

Built for enterprise scale. Proven in manufacturing.

Why MindBridge AI?

Financial control that scales with your enterprise.

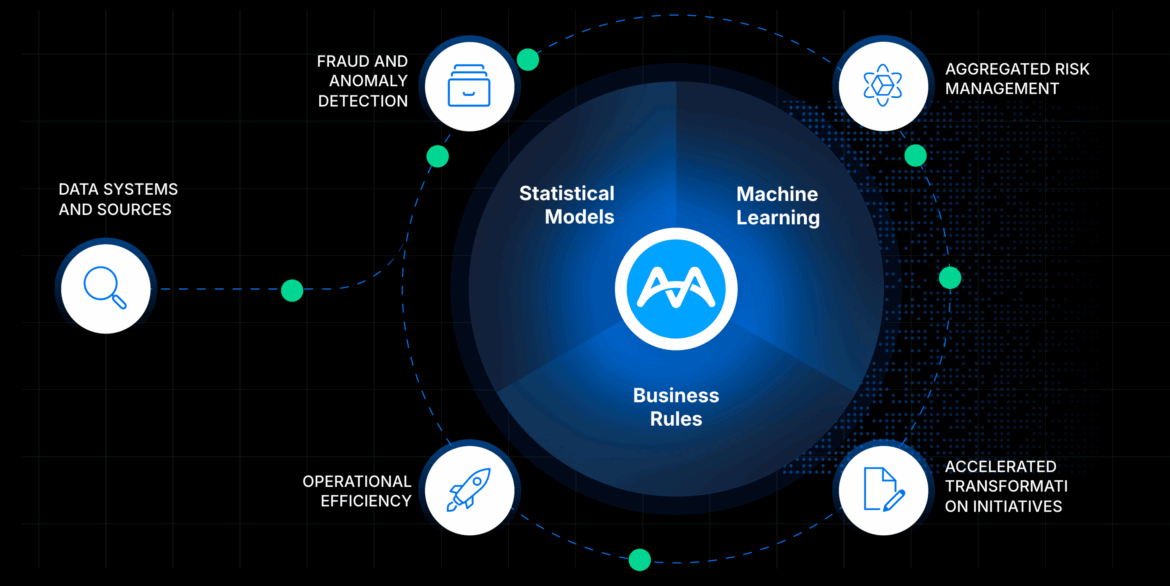

MindBridge AI’s Financial Decision Intelligence platform brings together machine learning, statistical modeling, and explainable AI to help CFOs:

- Detect supplier and production anomalies before they impact margins

- Monitor anomalies across billions of transactions with continuous oversight

- Bridge finance and operations data for a connected view of performance

How?

Built for scale. Designed for control.

Whether you’re managing inventory plans, demand forecasting, or eCommerce platforms, MindBridge AI equips finance teams with the intelligence to act faster, control variability, and reduce cost.

- Works seamlessly across multiple POS, ERPs and data sources

- Configurable analysis tailored for energy-sector complexity

- Supported by a transparent, auditable AI framework

Trusted by the world's most innovative companies

A unique ensemble AI approach

By leveraging multiple techniques simultaneously, enhance your ability to impact top-line revenue generating activities and bottom-line profit protection.

Align Technology’s Journey with MindBridge

Align Technology operates as a global, high-volume medical device leader.

As the organization expanded, their finance teams needed a more scalable way to surface risk, validate data quality, and understand performance drivers globally.

Using MindBridge, Align:

- Ingested and analyzed tens of millions of financial transactions in hours (previously weeks)

- Applied AI-driven anomaly detection to uncover hidden risks across general ledger, payables, and vendor data

- Strengthened financial data trust and governance through consistent, AI-driven analysis

- Enabled controllers and finance partners worldwide to access trusted insights without manual preparation

- Reallocated time from manual testing to value creation, accelerating financial decision-making

Transparency and trust — built into every insight.

The ROI of AI Driven Insights

Retail finance leaders using MindBridge AI report:

Up to 30% reduction in profit variability through connected oversight

Cost savings of 5–15% through anomaly detection and audit optimization

Higher confidence and trust across finance, operations, and audit teams

Because every insight counts and every transaction tells a story.

Flags entries with amounts that do not align with the expected distribution of amounts.

Ready for actionable insights?

In our meeting, we will cover:

- Where to find revenue leakage in your processes.

- What to look for when pinpointing margin drivers.

- How to turn your team into a decision intelligence hub.