AI-powered anomaly and risk detection

Experience the next generation of financial transaction risk analytics

Our AI-powered platform creates an unparalleled view of risk across each and every transaction. Designed for audit and finance professionals, MindBridge scales across your analysis workflow. We can show you in minutes.

Please provide your business email, we will get back to you right away.

Find the unknown needles in the haystack

Surface patterns and connections between transactions and across sub-ledgers and accounts. Narrow in on errors 100x more effectively than spreadsheets or legacy rules-based data analytics tools.

Templated solutions including general ledger, payroll, revenue, vendor invoices, and company credit card analysis across large financial and operational data sets. MindBridge AI delivers quick time to value with analysis of your data in an easy to understand, risk-focused manner that you can operationalize right out of the box.

Understand risks earlier and with deeper accuracy

Power your finance and internal audit teams with faster and more enriched data results to stay ahead of known and unknow risk.

No other solution analyzes your data using artificial intelligence along with statistics and rules in parallel with full drill-down and explainability capabilities for the best in transparent AI.

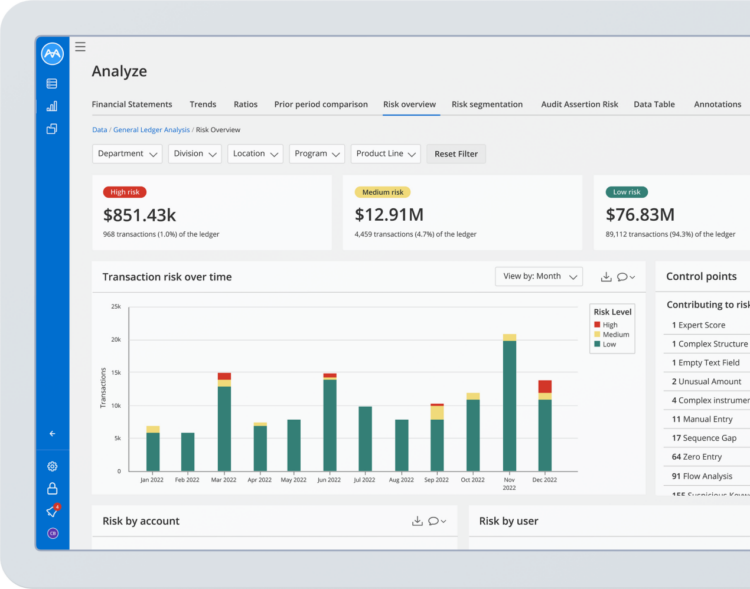

Analyze 100% of transactions and your risk landscape using combinations of MindBridge’s 45+ control points for incredible results.

Unlock more time for judgement, and accelerate

Power your audit and assurance teams with the AI learnings of over 200 billion transactional reviews and counting from MindBridge AI, in just a few clicks.

MindBridge runs advanced tests automatically to evaluate if there are transactions bypassing controls and helps improve your business or client’s control environment.

Save time before auditors come on site, or during client audits, and redirect those savings to ask more insightful questions of the business as a result of MindBridge’s transaction risk analytics platform.

Designed for internal and external auditors

Stay ahead of regulators and competitors

MindBridge engages with regulators around the world and is built with future standards like SAS142 & ISA315 in mind.

Quick to learn. Easy to use.

Become trained in just hours, from no-knowledge to proficiency. Load from any ERP, and navigate results within seconds.

Super-charge your best staff

Offer top talent with new capabilities, progressive technology, CPE credit courses, and self-guided education, all provided by MindBridge.

Does MindBridge fuel tangible value?

“During expense testing in a client audit, the Ai Auditor platform had flagged a $1.67 transaction on the high-end of moderate risk, and that caught our auditors’ attention. We later discovered that the client had accidentally overpaid a supplier by $60,000. We would have never known if it wasn’t for MindBridge”

“Performing…procedures in MindBridge has saved us a ton of time on revenue testing by helping to reduce our sample sizes. It’s also saved us time on journal entry testing.”

" Leading-edge tools like MindBridge make the responsibilities of practitioners easier today. "

" We do not have the resources to develop AI, and building a larger data team is resource-intensive. Tools like MindBridge give us what we need to be competitive and efficient. MindBridge is easy to pick up and run with. The whole team can use the tool. "

Discover how MindBridge can help you accelerate

Book a demo & learn how MindBridge can help you:

- Take a data-driven audit approach that aligns with methodologies and standards

- Enhance audit quality and internal controls efficiency

- Discover new, value-add opportunities and savings in your data

- See how organizations like yours are leveraging MindBridge for AI transformation