MindBridge Q3 2022 Release

Increased regulatory scrutiny and complex controls are driving the need for more informed monitoring and stricter oversight of financial systems. With accounting firms and businesses across industries leveraging MindBridge’s cloud platform, we are continuously advancing our capabilities to help align leading financial risk analytics with human intelligence for stronger professional judgment.

We are providing innovative capabilities to help align leading financial risk analytics with human intelligence for stronger professional judgment.

Enabling next-gen financial risk discovery and anomaly detection

New Application Programming Interface (API)

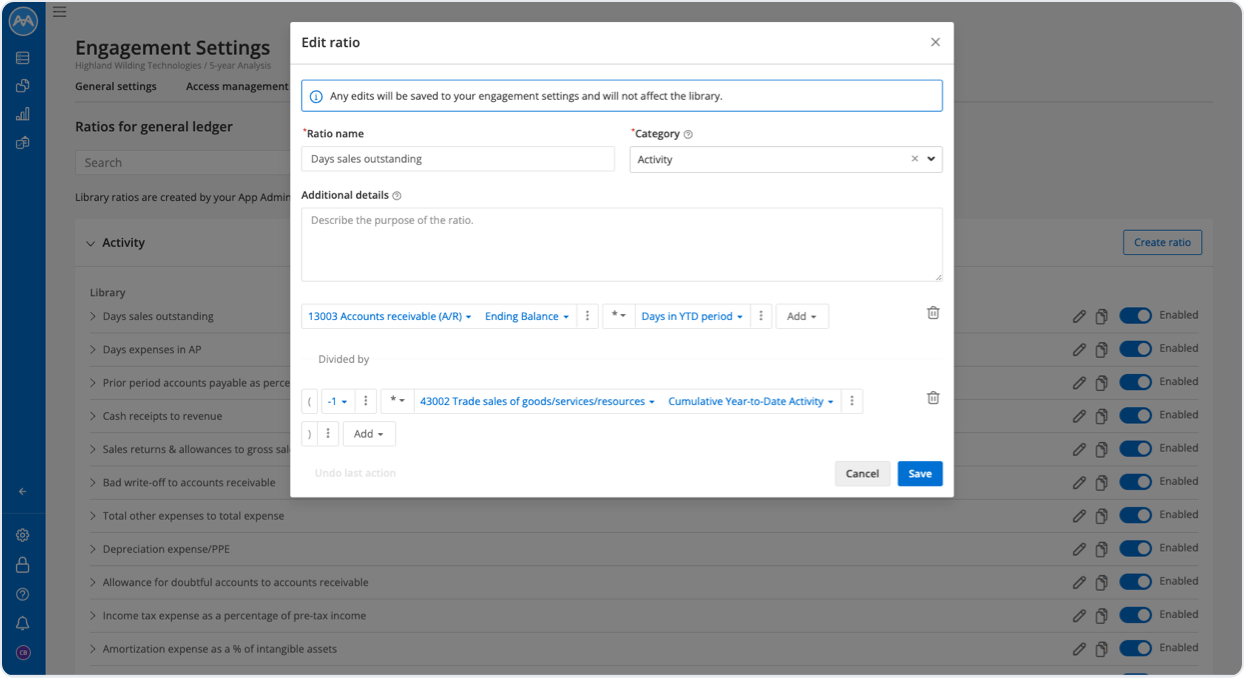

New Ratio Improvements

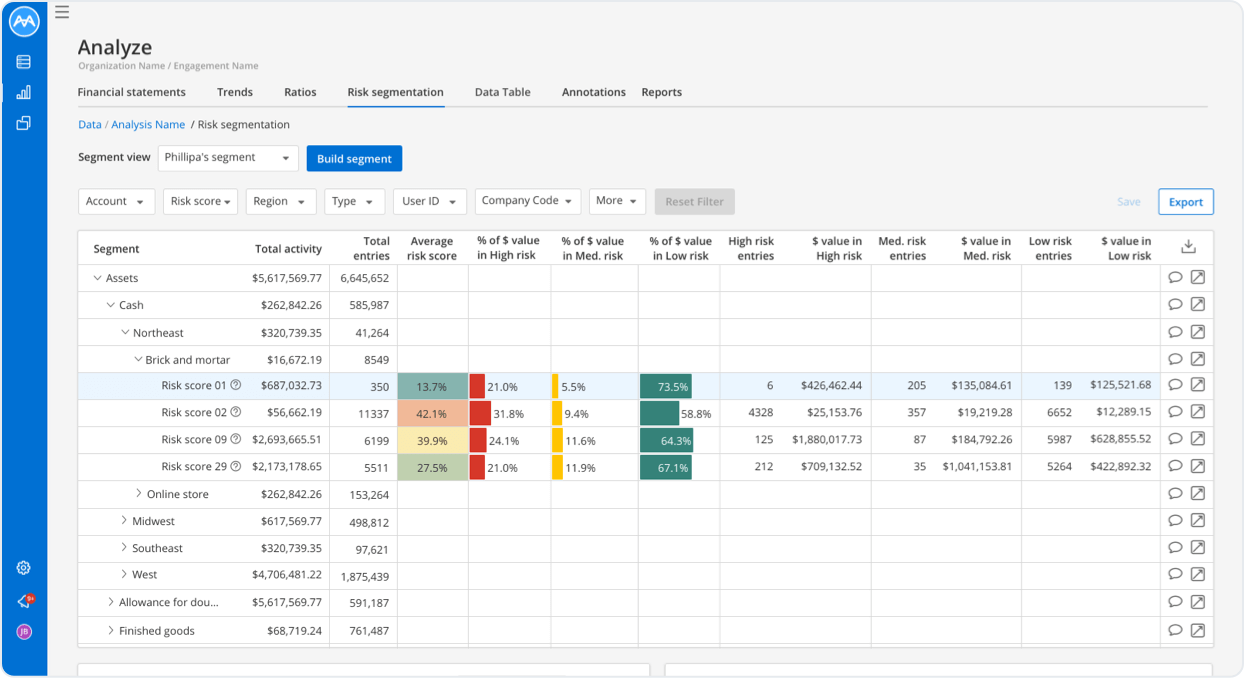

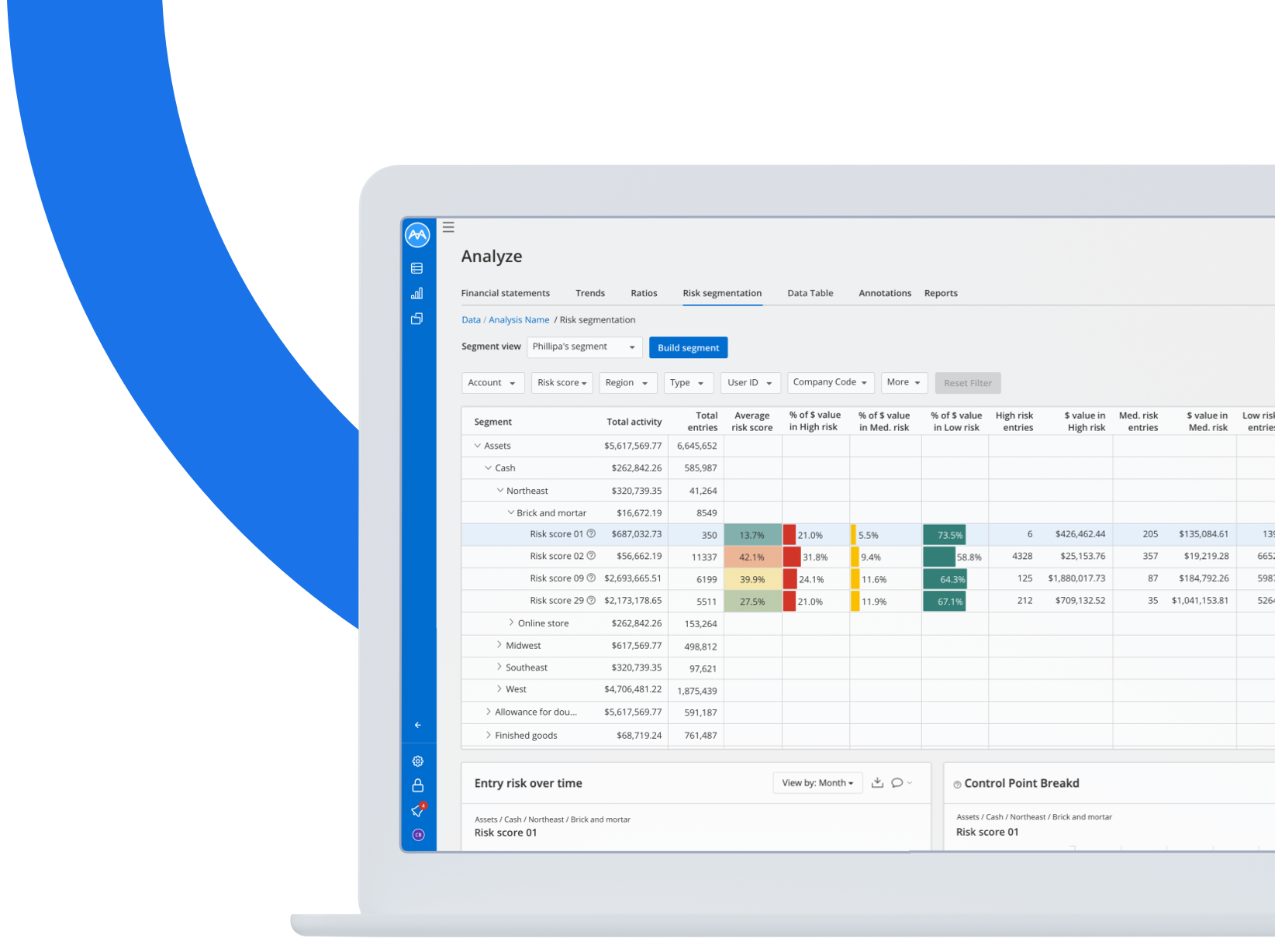

New Risk Segmentation Dashboard

Expanded Platform Localization and Services

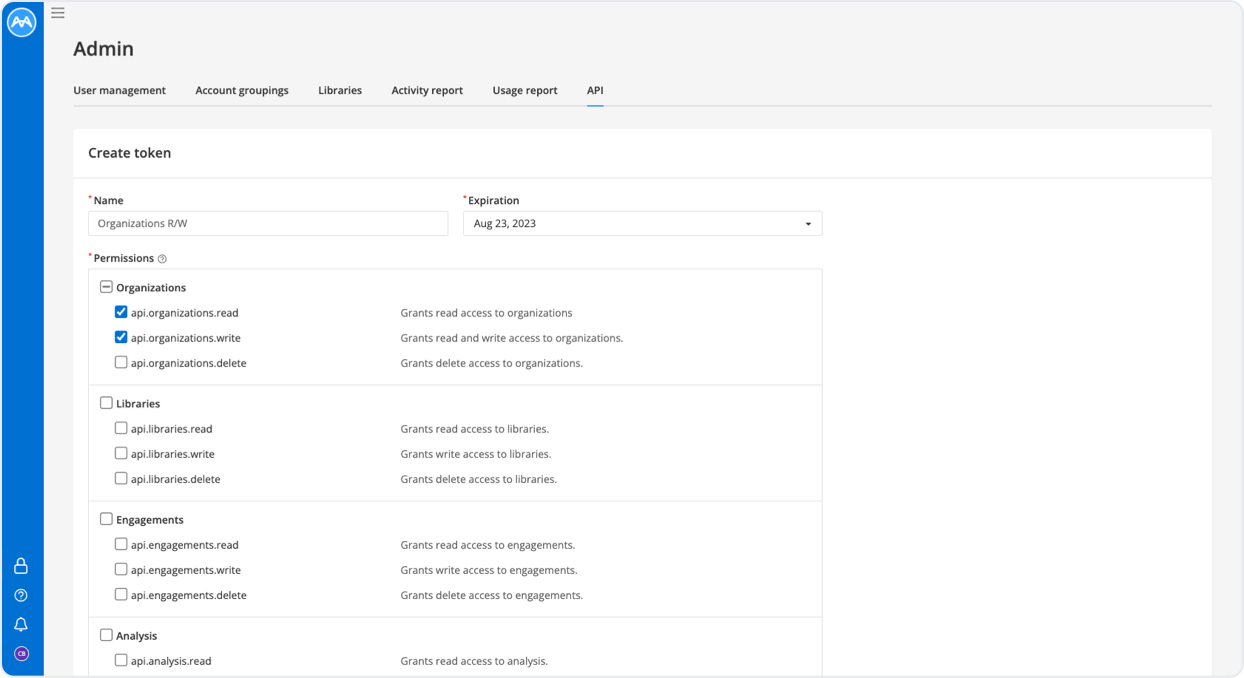

New Application Programming Interface (API)

Widespread adoption of AI is now common amongst our customers. The new MindBridge API will help you improve operational efficiency and expand integration of advanced risk analytics across your business. Automating tasks and capabilities within MindBridge, such as bulk importing and running analyses allows for better integration into your technology stack.

Expanded Platform Localization and Services

The MindBridge interface is now available in German, Parisian French, Canadian French, and Castilian Spanish, opening the door for accelerated platform adoption across international firms.

Additionally, we have added 30 new enterprise resource planning (ERP) guides focused on extracting, importing, and transforming your data.

The Knowledge Base has also been translated to support non-English speaking users allowing for greater access to anomaly detection and risk analytics across global firms and subsidiaries.

What else do we have for you?

MindBridge is constantly evolving with state-of-the-art technology to expand its unique financial risk detection capabilities and to help support the professional judgment of our customers.

Visit our Knowledge Base to learn more about this and other releases.

Contact info@mindbridge.ai to talk to us today.