COVID-19 — the coronavirus — has businesses around the world facing an unprecedented situation. First and foremost, we sincerely hope that you and your loved ones are safe and secure. Our current, shared situation certainly gives us pause and we recognize the importance of pulling through this together.

This new working environment most likely means that going into the office may not be viable for your audit teams, which means you may need to support remote talent.

We’re here to help you bring those audit engagements home.

We’re here for you

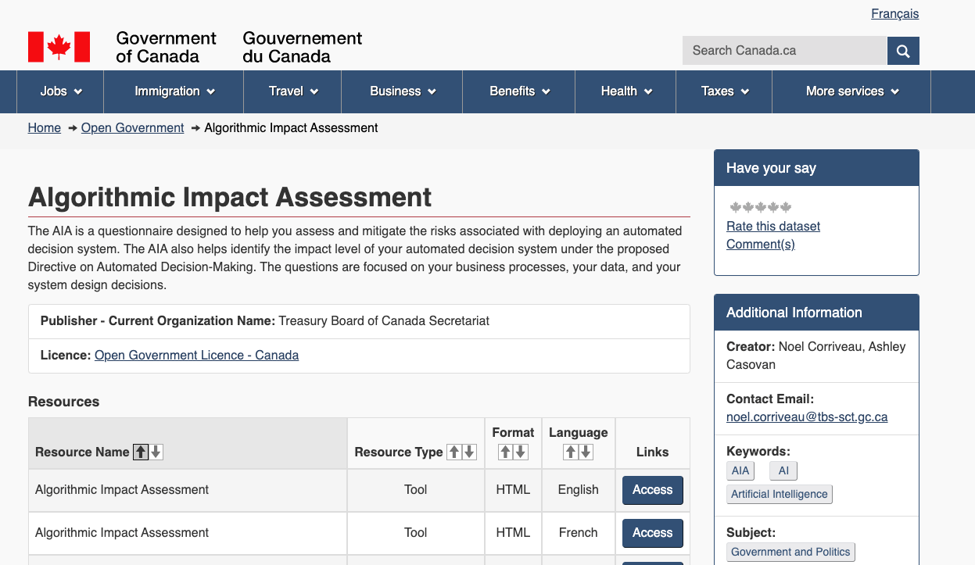

MindBridge continues to operate as usual and our teams are here to help you navigate any changes to your working model. As Ai Auditor is cloud-based and designed to help people in multiple locations work together, you’re already on your way to working remotely and having continuity in your processes.

We will update you with news and best practices to help you work productively. Keep this blog starred and check back for updates.

If you need to get in touch with support, contact your Customer Success Manager.

How to work remotely with Ai Auditor

Ai Auditor is built to support geographically diverse teams, meaning your audit team should be able to work together as they would normally. But as more team members start working from home, you may need to support additional geographically diverse users.

Considerations for expanding your infrastructure

- Ensure that remote employees have the right equipment to log in to Ai Auditor, usually a modern laptop with an internet connection is enough.

- Check with IT or your team on VPN requirements. While Ai Auditor does not require a VPN to log in, other files, applications, and communications tools to support your engagements might.

Best practices for engagements

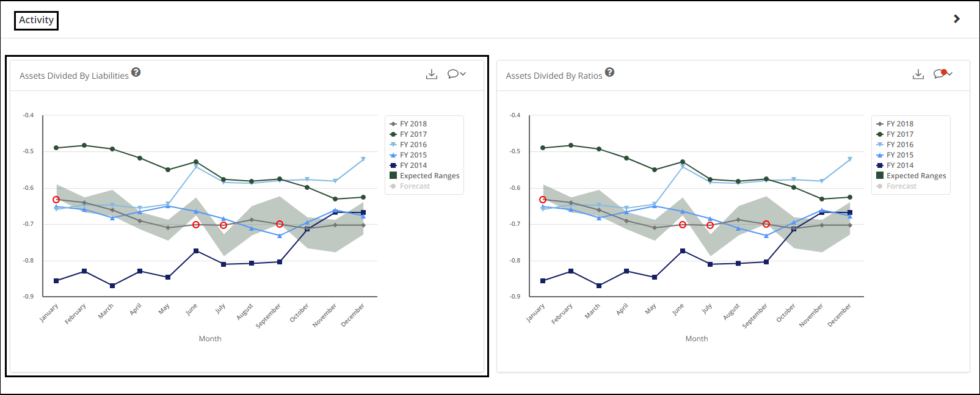

No matter where your team is located, all the capabilities that you’re used to in Ai Auditor are available.

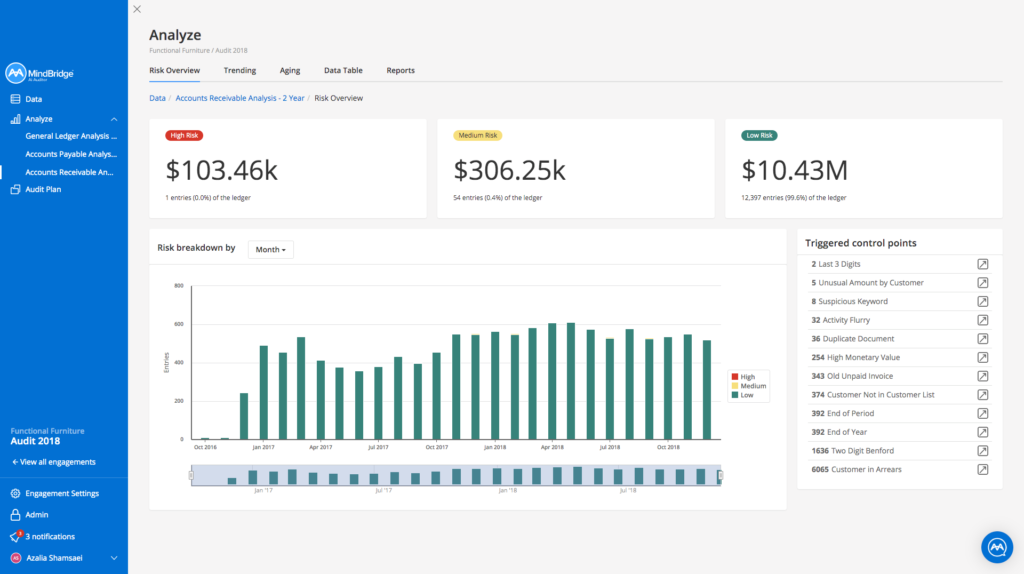

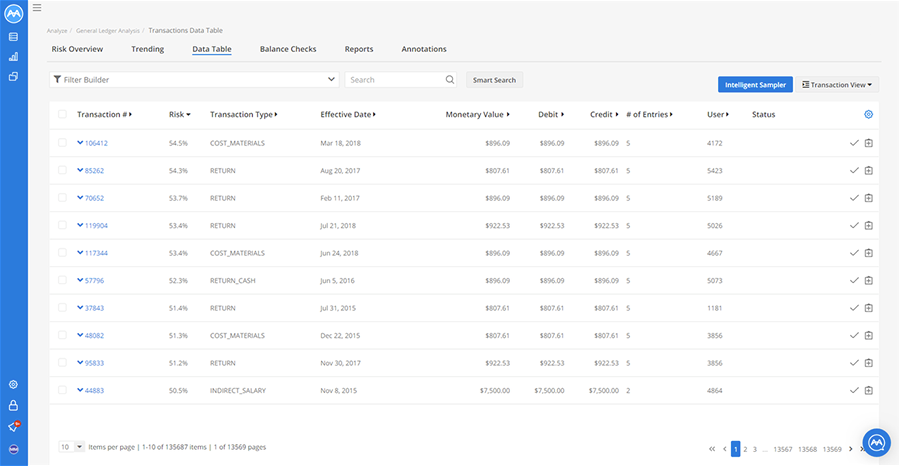

With the move to decentralized working arrangements, Ai Auditor provides the ability to manage your workflow transparently and for tasks to be allocated to team members. You can also use the tool to track responses and the real-time status of your testing plan at any point in time.

Has your client decided to postpone fieldwork or extend reporting timelines? Now could be the opportunity to think about the relationship between your methodologies and the appropriate approaches in Ai Auditor, including analysis and reporting. Your Customer Success Manager can help out here, and call upon one of our resident CPAs or CAs to find the best fit between methodology and technology.

Talk to your clients

Open and honest communication is critical during challenging times and your clients might be looking for support or wondering how the audit process may be impacted. This is an opportunity to connect with them on how they’re managing in these circumstances, reassuring them that you have state-of-the-art, cloud-based tools that maintain quality, support, and security in your service delivery.

Tips for maintaining productivity at home

Our very own Director, Transformation & Strategic Major Accounts (and fitness enthusiast), Gillian Fischer, created this guide for managing tasks, communication, and staying healthy while at home. We encourage you to take advantage of Gillian’s advice and let us know how you’re doing!

Read Gillian’s productivity tips >

Rather than focus on uncertainty, now is the time to embrace change and innovate. By working through the unique challenges presented before us, we’ll find ourselves responsive, ready, and well-positioned for the time when this storm has passed (and it will).

While the nature of markets, organizations, and your clients themselves could be very different from what they look like today, as history has shown, a sustained focus and a real commitment to the future, prevails. It is this focus and commitment that will help organizations deliver differentiated value and relevance.

We’re here to help you deliver that value to your team and your clients.