The audit industry has seen a bit of a shakeup in the past few years. New technologies, regulator crackdowns, big firms acquiring and merging, and a general push for improved processes and a review of age-old standards are all signs of new things on the horizon for our industry. But while there was a lot of talking, we didn’t see much walking.

But, all that changed, at least for auditors, with an announcement from the AICPA in 2018.

Nearly three years ago, the “Dynamic Audit Solution Initiative” was announced. Projected to release in 2021, the Dynamic Audit Solution, or “DAS,” as many in the industry affectionately call it, is a “multiyear initiative to create a new, innovative process for auditing using technology.”

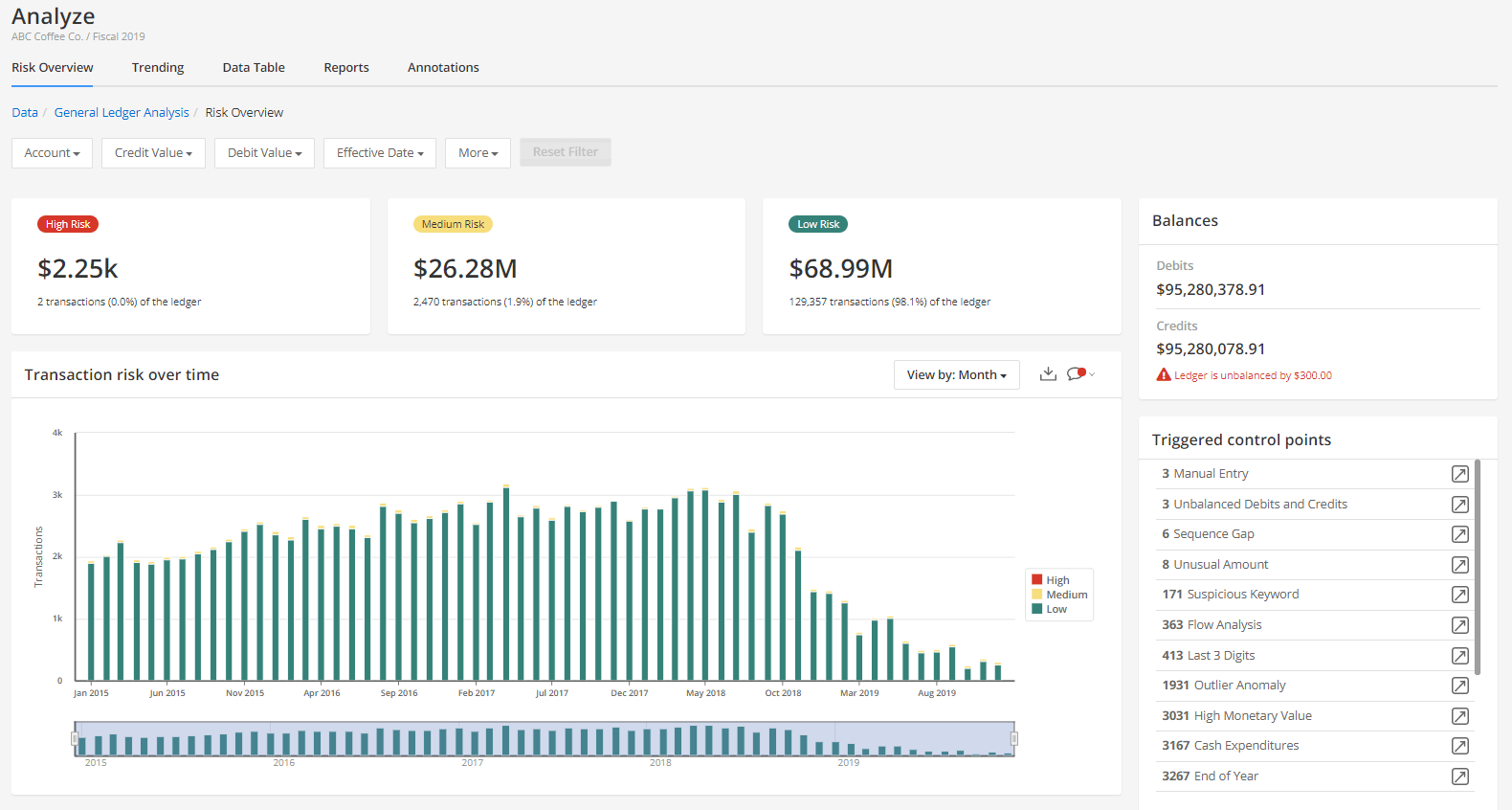

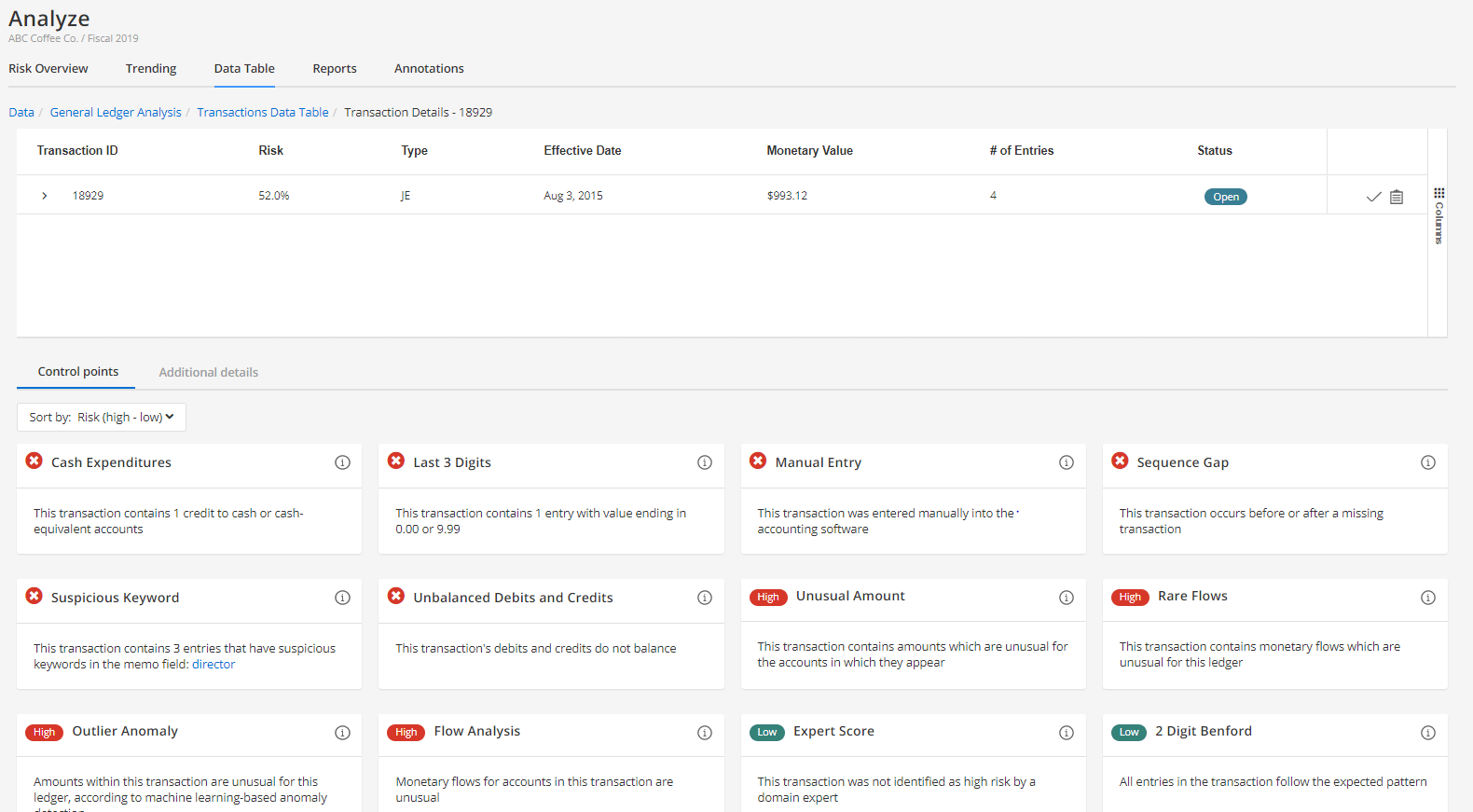

As the beta release approaches, we wanted to take a look at the Dynamic Audit Solution in more detail. As a pioneer in AI-powered risk assessment, MindBridge is highly invested and interested in any and all innovations in our space. When it comes to DAS, we want to know what it is and what it means for us and our industry.

In this article, we’ll answer those questions and consider what the impact of a Dynamic Audit Solution might be, for better or for worse.

What is DAS (the Dynamic Audit Solution)?

We don’t know a lot about the Dynamic Audit Solution, but what we do know is exciting. The AICPA sees DAS as the next step toward the future of audit and assessment by leveraging technologies never before seen on a large scale. That, obviously, has a lot of people excited.

There aren’t a ton of details on what exactly the AICPA’s DAS will look like. We haven’t seen any product screenshots, and the core functionality hasn’t been mentioned in any major press coverage.

But, there are a few key aspects of the technology that have been announced, as well as some information on what the team behind the product are considering as they are building it.

AI, automation, data, and AICPA

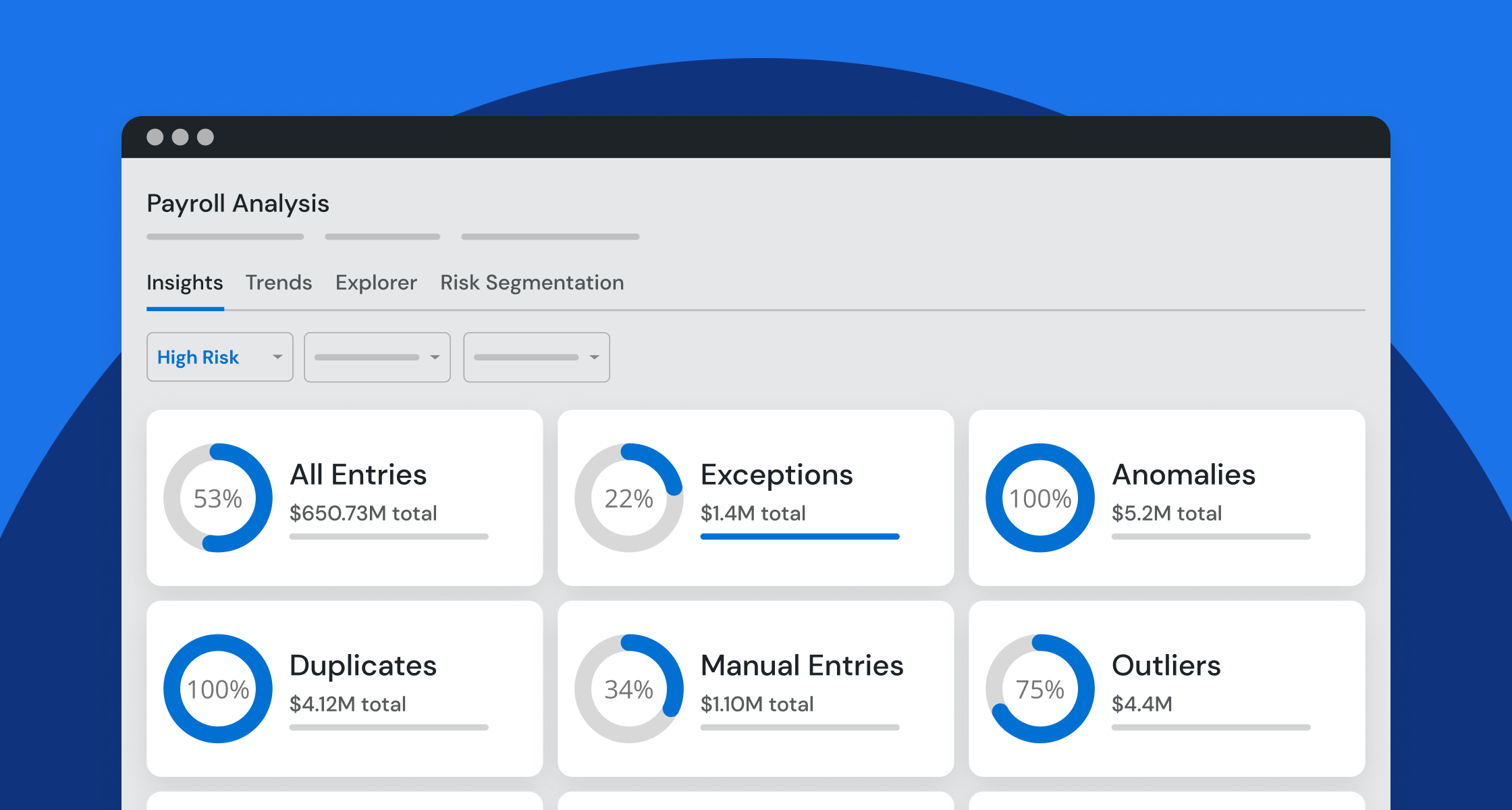

At its core, the Dynamic Audit Solution will be an AI-powered product. In an interview with AccountingToday, Matt Dodds, CEO of CaseWare, one of the organizations involved in the project, made a point to note that “the solution is driven by data analytics and AI.” The idea here is that artificial intelligence capabilities will allow auditors to process more data more efficiently, allowing them to create higher quality audits in a fraction of the time.

It isn’t quite clear what areas of the audit solution will include artificial intelligence, or how the AICPA auditing standards will regulate and legitimize control points, risk assessments, and other key factors to a quality audit. But, the need for AI to process increasingly complex and large data sets is clearly at the top of the priority list for the AICPA. As are data analytics.

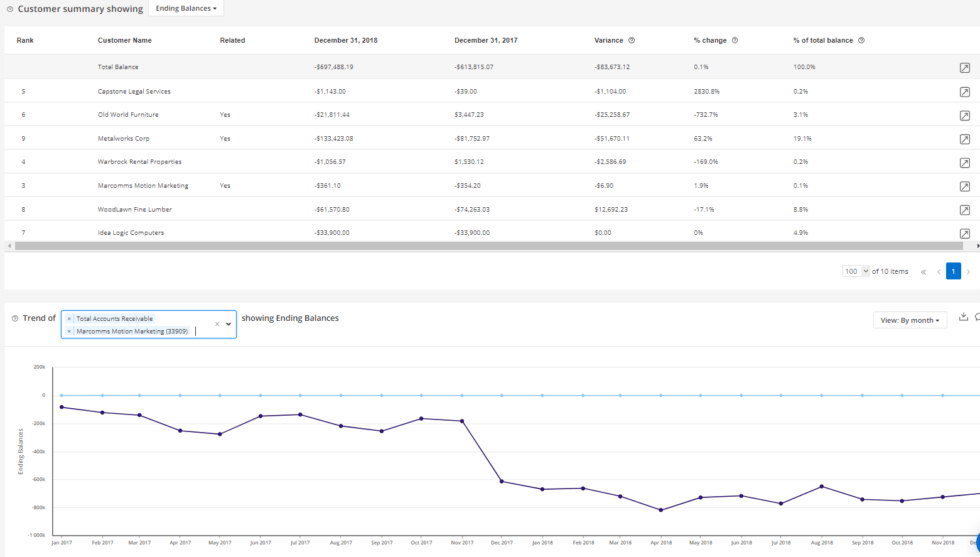

According to the AICPA, the Dynamic Audit Solution will require “audit professionals become conversant in data science, data integration and analytics.” Essentially, artificial intelligence and automation will allow auditors to become experts in the data that they spend so much time analyzing. Once that data has been processed, though, auditors will be able to better understand and communicate the results of an audit to clients.

As the traditionally manual tasks of an audit are automated, audit professionals will be afforded more time to converse with clients. This will allow auditors to offer clients a true assessment of the audit findings, while also expanding into a more continuous audit through advisory and consulting services, avoiding independence issues wherever possible.

All of that being said, what does the Dynamic Audit Solution mean for auditors themselves, and for the industry largely?

What does the release of DAS mean for the industry?

The Dynamic Audit Solution is going to mean different things to different people. For auditors, it means a potentially new technology to help them create more efficient and quality audits. In theory, that is. As well the automation of certain audit tasks will allow auditors to become data science professionals, consultants, and any range of financial experts to help their clients better understand their data and assist them in their endeavors.

But, such a large scale release of an AI-powered solution has industry-wide effects as well, which the AICPA have outlined.

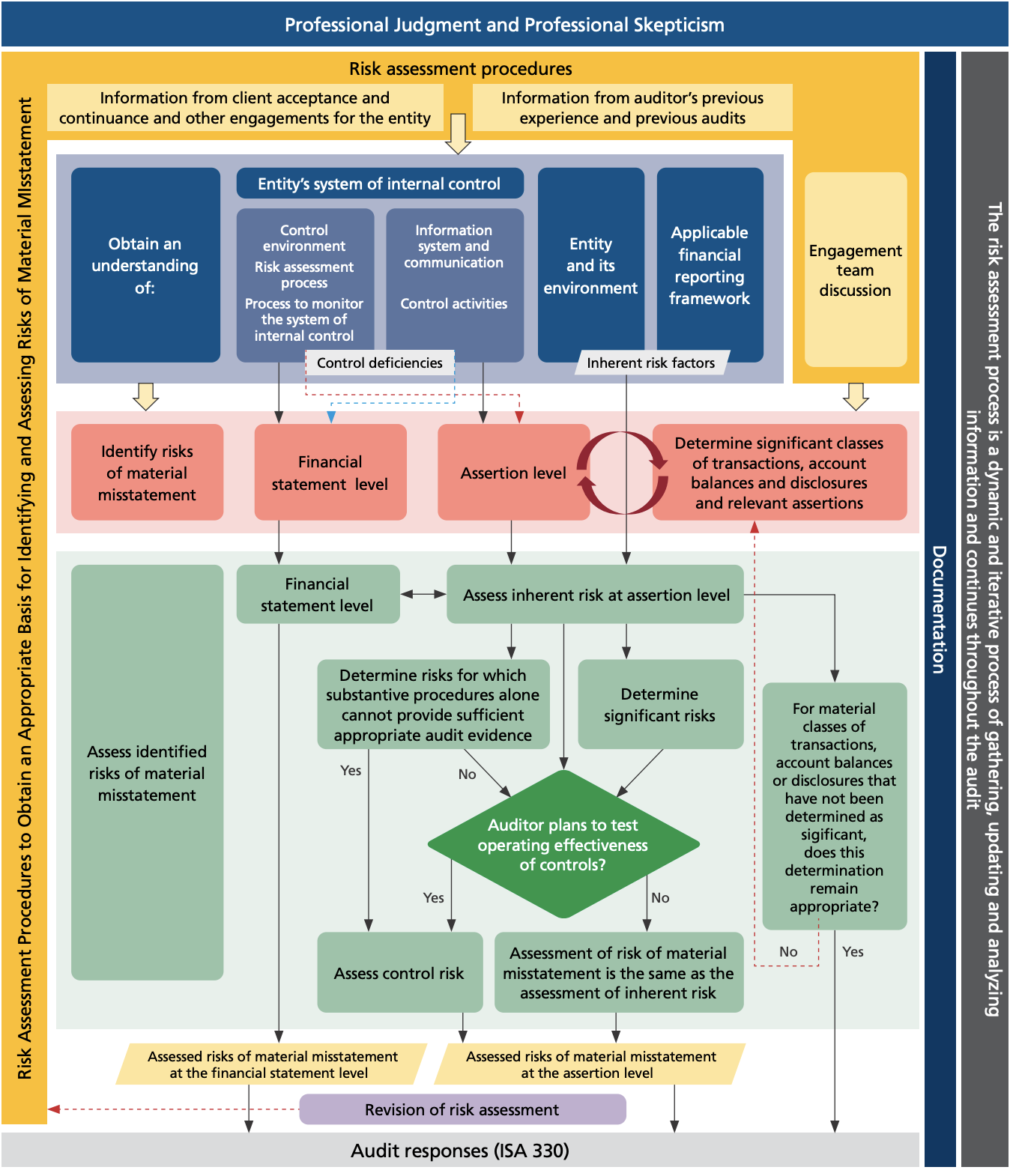

Technology is considered to be one of the four “key drivers” of the DAS project, according to the AICPA. The other three are Methodology, Standards, and New Skills. Artificial intelligence is at the heart of the Technology driver, but is also the reason that the three other drivers are mentioned at all.

As the AICPA introductory document to DAS notes, audit methodologies, standards, and skills will need to be reevaluated and evolved to meet the demands of artificial intelligence. This means that, as an industry, we are potentially looking at a large-scale overhaul of the AICPA auditing standards, regulations, and methodologies that we’ve come to know over the past 100 years. In fact, some of these revisions are already in motion.

While it might be scary to some, this evolution was all but inevitable, hence the push by the AICPA to introduce DAS in the first place. In fact, in many parts of the world, organizations like the AICPA are being pressured to revise regulations and standards to meet the needs of today and tomorrow’s audit professionals.

While many have feared the advent of new technologies in the face of storied regulations and standards, large organizations like the AICPA are helping to fix that by entering a new age of tech-driven audits and accounting services.

The question is, can it be made to work?

The Dynamic Audit Solution: A new hope?

Everyone seems to have a different opinion on the Dynamic Audit Solution. Whether or not you think it will work depends on your perspective, and what outcomes you want to see from it. But, as the development process continues and feedback is given, ultimately, the Dynamic Audit Solution can be made to work, even if some of our fears come to fruition.

We’ve outlined what the AICPA and their collaborators hope to achieve with DAS, including automation of rote tasks, expansion of service offerings from auditors and firms, and a revision of AICPA auditing standards and methodologies. What these achievements mean for various auditors and firms will surely vary, so it’s hard to say whether or not the DAS will “work” for everyone, so let’s talk about whether or not it can achieve what the AICPA hopes it will.

The AICPA is an important and storied institution in our industry. It has been a stalwart of standards, regulations, and a representative for CPAs everywhere since its founding in 1887. But, that might be exactly the problem.

Old dog, new tricks?

While the Dynamic Audit Solution is a great sign of evolution in our industry, it’s a little late to the party.

MindBridge, along with many other innovators in the audit and accounting industry, have worked on this for a long time. We know the market, we know the challenges, and we know what it takes to create a robust product that services not only the auditors on the front lines, but the larger firms, businesses, and stakeholders that invest in technology.

We had a running start, while DAS is still at the starting line. We understand that agility and flexibility are necessary to address user needs, and delight our evolving industry with a tight feedback loop, among other considerations that come with time, practice, and experience.

Companies like MindBridge are ultimately closer to the needs of enterprises and stakeholders in the audit industry. These are the people pushing firms to do more with less, and produce more effective and high quality work with less resources. We understand the struggle in the market in a way that the AICPA and other organizations may not.

Part of the challenge will be to establish systems of review in order to meet the needs of an ever-evolving industry. The AICPA is a storied organization that may find it challenging to balance procedure with market need.

Even still, it may be even more difficult than that.

As a standard setter in the audit industry, the AICPA may find themselves in an awkward position with regulators and other standards enforcement agencies.

Audit Standards vs. Innovation

Comparatively, standards setters have been historically less agile than innovative and tech-forward firms. Large organizations have enough hurdles to jump over as is, without being the literal standard setter pushing back on these technological developments.

The AICPA’s involvement with regulators and imposing audit standards poses a unique challenge to the development, release, and review of a Dynamic Audit Solution. As they mention in their own Introductory Document for DAS, the AICPA anticipates an upheaval of standards and regulations that have inhibited the use of AI-powered technologies for audit in the past.

It will be interesting to see how a standard setter like the AICPA can build a tool and roll out their procedural recommendations at the same time. This brings to light questions around feedback and updates, and whether or not large organizations are flexible enough to meet the needs of our ever-evolving industry in a timely manner.

At the heart of this is the ability for tech firms to move quickly, update and adjust to new risk factors, changes to normal business processes, and therefore stay ahead of the standards curve.

Can the standard setter balance that need for speed and agility to enhance client satisfaction while also delivering on software changes needed for a dynamic business environment?

DAS will bring us a long way with standards that embrace technology. However, we will want to make sure that the AICPA focuses more on standards agility to help their members impact and delight the outcomes for the entities they audit.

We will have to wait and see what becomes of DAS in light of current or amended standards, but it’s more than valid to suspect that the industry-wide perspective shift may take some time.

DAS, and the future of audit

Ultimately, the AICPA’s investment in AI and data analytics, and the development of the Dynamic Audit Solution as a result, is exactly the type of thing our industry needs. Big players like the AICPA need to step up and embrace technology, and look to the future of audit and accounting more generally.

At MindBridge, innovations like these make us hopeful for the future of our industry, and have convinced us that we, and our peers in the industry, are having a marked impact on the present and future of audit and accounting.

As our Founder, Solon Angel, notes in his own article on the Dynamic Audit Solution:

“The bottom line is that artificial intelligence is being considered by all players, and this is something that I welcome with open arms. No matter how small or large the investment, every hour or dollar spent works to improve our industry. In light of recent fraud cases around the world, there is a clear need for as many initiatives as the Dynamic Audit Solution as possible, using different AI approaches is better than the status quo.”

We couldn’t agree more. We’re looking forward to the release of the Dynamic Audit Solution to make us better and challenge us to continually improve, evolve, and engage with our expanding client base. For more articles on the audit and accounting industry, visit our blog here.

MindBridge is performing tomorrow’s audits, today.

Find out how AI empowers the financial leaders of the future.