Deciding on the best audit approach isn’t a cookie-cutter process. While a long-standing relationship with a client or in-depth industry knowledge can give auditors a leg up, defining an effective audit approach requires careful consideration and planning for every engagement.

After all, your audit teams understand that every client is unique. So, deciding on the best ways to approach an audit will be too. Everything from the client’s objectives and business operations to known or unknown risks, internal controls, and much more will determine how you and your team go about any particular audit.

However, there’s something else you may need to think about that often goes unmentioned: the role of technology in your audit approach.

As this pandemic continues to propel widespread digital transformation and standards evolve to embrace new technologies, there is a growing need for auditors to consider updating their audit methodology too.

After all, a tech-driven audit approach can not only help auditors work more efficiently, but it may also allow them to deliver greater value to their clients. Whether it’s AI auditing software or other financial automation tools, technology serves to complement traditional auditing processes and lays a foundation for even better financial insights over time.

How does a tech-driven audit approach differ from a traditional audit?

A tech-driven audit approach considers the use of technology right from the get-go. It means there’s already some level of buy-in from management about auditing technologies, so your people are trained on the tech you’re using. You might even have data handling processes set up to fully leverage the capabilities of the new auditing solution.

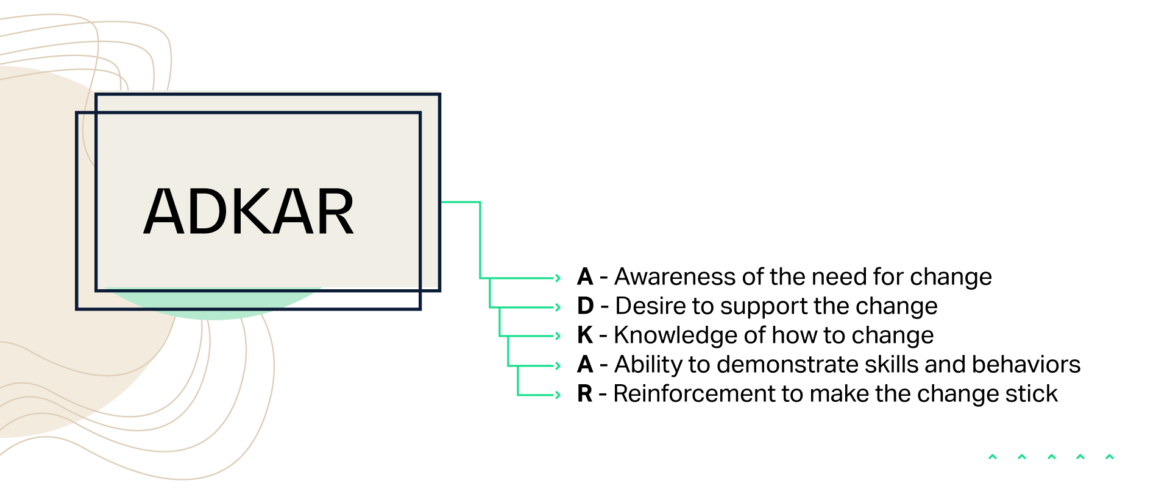

While reaching this level of technological adoption might seem overwhelming, it shouldn’t have to be. With a little support on your side from the right vendor and a solid change management plan, you’ll be able to easily trial new technologies and reach higher levels of adoption at your own pace.

Then, as you go into new audit engagements over time, it’ll become second nature for you to think about the role of technology, how it will complement your existing methodologies, and how it may support your resources. From the planning stages right through to completion, you’ll consider how to automate manual tasks, get extra validation and assertion, and perhaps even uncover new insights that are buried in the mounds of client financial data.

In other words, implementing a tech-driven audit approach means you’re thinking ahead about how to best use the technology to deliver a quality audit. And you’re identifying the specific procedures or tasks where the auditing technology will be most beneficial.

What are the key factors to consider in a tech-driven audit approach?

Defining a tech-driven audit approach isn’t entirely different than a traditional one. It just requires another layer of consideration about how the technology fits into your methodologies. Below, we’ll explore what a tech-driven audit approach might look like and the areas where technological considerations can be made.

Understanding the client’s business and objectives

Whether you use technology in your audit or not, getting to know your client is a given. You’ll need to consider the industry they’re in, their business operations, their audit objectives, and other unique factors that pertain to the organization to achieve an effective assessment.

When defining objectives, it’s also important to consider those beyond the financial statement audits too. In fact, in a recent Deloitte report, 95% of the 351 c-suite, finance, and audit committee executives polled said that audits should provide additional value beyond an independent report on the historical financial information. Essentially, clients are looking for deeper insights, analysis, and recommendations.

When you implement a tech-driven audit approach, your audit team will be able to automate manual tasks and work more efficiently. That’ll allow you to assign extra resources to added-value services such as helping your client uncover new insights. Using technology, you’re essentially able to broaden your service offering and point your clients towards new opportunities that will positively impact their business.

At this stage, you’ll also need to understand what financial software your client is using and how you’re going to best access the information you need. With all this in mind, here are a few questions to ponder to map out your tech-driven audit:

- How will the technology you’re using offer your clients more insights and value beyond the initial scope of objectives?

- Can your auditing technology support remote audits? Does the technology you have enable easy access to the financial statements and information?

- Does the technology ensure full ownership over the data and keep your client’s financial information secure?

Conducting the preliminary risk assessments

Identifying risks of material misstatement and their relative significance is an integral part of defining your audit approach. Because when you have a good understanding of the potential risks at play, you’re better able to plan for and execute a comprehensive and high-quality audit.

At this stage, auditors will look over balance sheets and income statements to spot any obvious inconsistencies. They might also dive into subledger data and run some preliminary testing on journal entries. The challenge here is that a traditional audit approach will leave so much data untouched and unexamined.

In a tech-driven audit approach, this is a key area where your audit technology can really make a difference. For instance, if you’re using an AI auditing platform, you’ll be able to test 100% of your client’s financial data and dive into accounts receivable and accounts payables subledgers to see if any other anomalies stand out. This allows your team to conduct a deeper level of preliminary risk analysis and potentially uncover risks that weren’t on your radar.

Consider the following on risks assessment when building a tech-driven audit:

- How can you use your auditing technology to get a clearer picture of the financial risks?

- Does your technology allow you to filter results and dive into your client’s financial data to get a better understanding of those risks?

- If you save time by automating risk assessment procedures, where else can you apply resources to offer your clients more value?

Evaluating the company’s internal controls

Evaluating the effectiveness of the company’s internal control over financial reporting is another critical component in your audit. Your auditors will likely perform a series of tests to validate how well internal controls are being upheld within the company.

In a tech-driven audit approach, the technology can either complement or replicate manual testing procedures to achieve higher levels of assurance. The technology might also point your team to riskier data that will then open up new conversations with your clients about potential weaknesses in internal controls.

For example, our AI auditing software automatically identifies control points to spot high-risk transaction data. The auditing team can also adjust these control points and use other capabilities within the platform to recreate traditional control testing models.

All of this will allow your team to move forward with greater confidence in the audit engagement while ensuring high levels of accuracy and diligence. Here’s more to think about:

- Does your technology complement internal control testing or replicate manual processes?

- What control testing models can you effectively carry out using your technology?

- Can you adapt control points and testing to different clients and industries?

Building the plan for the audit engagement

Putting together the audit plan outlines why, how, and when you’re going to execute the audit procedures. These include everything from the planned nature, timing, and extent of risk assessment procedures, controls tests, substantive procedures, and any other relevant audit tasks.

When putting together the audit plan, an auditor will usually provide examples and reports that justify why certain procedures will be critical for the audit. In a tech-driven audit, it’s important to consider how your technology can back up your findings and assessments and help you build a more complete plan.

This could include exporting powerful visual graphs and data that support your audit plan and substantiate the details of specific procedures. Ultimately, this gives the client a snapshot view of where the auditors have identified risks and why certain procedures are warranted.

Here are some tech-focused questions to consider when creating your audit plan:

- Does your technology allow you to easily export information to build a better audit plan?

- Can you customize graphs or visuals to support the findings of your preliminary risk assessment?

- Can you easily share information with your client to help steer conversations about the audit plan or other potential opportunities?

Are you ready to embrace a tech-driven audit approach?

The role of technology in audits is growing every day. More auditors are not only embracing new tools such as AI auditing software to support their audit strategies, but industry standards are also evolving to accommodate higher levels of automation in audit practices. Even the AICPA has announced the ‘Dynamic Audit Solution Initiative’, promising to create a new, innovative process for auditing using technology.

Auditors who stick with the traditional audit approach for fear of change are going to be left behind.

If you’re ready to implement a tech-driven audit approach using AI auditing software, know that the partner you choose can make all the difference. At MindBridge, we support our clients through the technology adoption process and offer value-add services that help you reach company-wide success.

Want to hear about what it’s like transitioning to a tech-driven audit approach? Read how Dixon Hughes Goodman LLP (DHG) embraces the power of AI to move their auditing practices forward.