Change is scary. But with a little risk, a lot of planning, and some extra effort comes an opportunity for growth and reward. That’s what makes change management so important.

As a manager, department head, or executive how do you know when it’s time for change? How do you invoke change within an organization, and how do you get others on board?

Studies in what’s known as change management have shown that there is no one single answer to what most influences and leads to successful transformation initiatives.

In recent years, change management strategies have focused on soft factors like culture, leadership, and motivation. Each of these play a key role in a successful transition. But, for change to truly take hold, it’s also important to focus on the hard factors like duration, integrity, commitment, and effort.

In this article, we’ll discuss the definition of change management, address corporate responsibility during the process, what you and your team need to do to be successful, and show you the best ways to implement transition skills and best practices into your organization and projects.

What is change management?

Change management is a big, daunting term, let alone task. It’s a rather condensed way of explaining the process when an organization takes on projects or initiatives to improve performance, address key issues, and seize new opportunities. These endeavors may require companies to shift their methodologies, roles, organizational structures, and perhaps even the types of and uses for technology.

Successful transitions dependent upon four core principles. These principles are important to understand before undertaking a large shift in processes or anything else, no matter what the context:

- Understanding change – Understand the questions that need to be asked, the why, and the “ins and outs” of the change.

- Planning change – This looks different for every organization, but can include achieving high-level sponsorship, identifying stakeholder involvement, and motivational techniques and establishing a team responsible for managing the change.

- Implementing change – Roll out the change, ensure everyone has been trained on the new process, technology, etc, knows what their role is and the importance they play in affecting change.

- Communicating change – Tools to help everyone understand why the change is happening, the positive effects that will come and the steps to required to ensure success.

Now, that’s just a brief overview. Here’s an in-depth review of these four principles, and how each of them help you work toward successfully-managed change in your organization.

Understanding change management, implementing best practices

Understanding change management begins by understanding its three important levels.

According to Prosci, a change management solution, the three levels are:

- Individual

- Organizational

- Enterprise

In this model, enterprise change management is therefore dependent on both successful individual change management and organizational change management. Each of these aspects build onto one another to enact lasting, ingrained change across your department, team, or organization.

Individual change management – This will require tapping into the mind of your employees. It requires understanding how people experience change and what they need to handle it successfully, and thrive post-implementation.

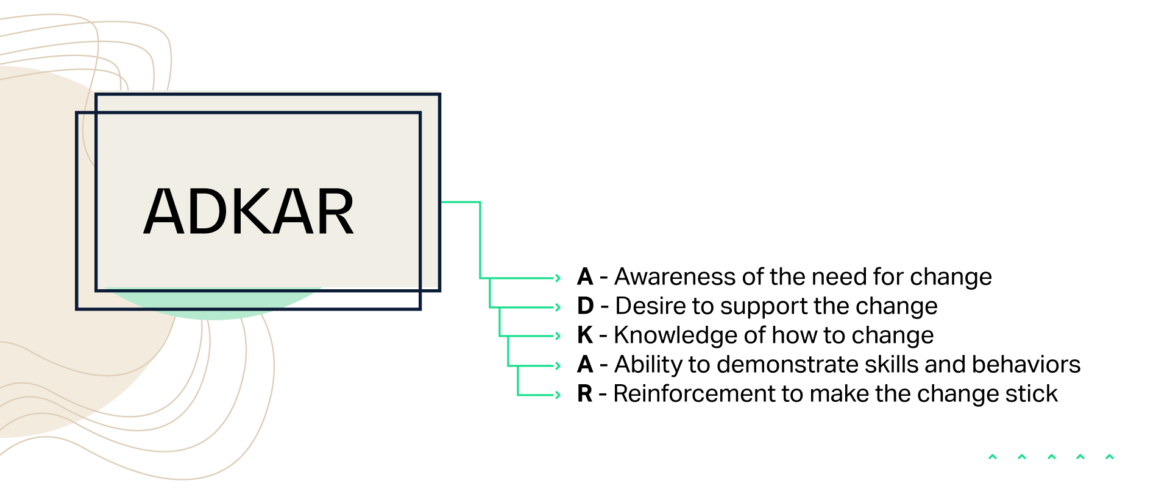

ADKAR is a great acronym created by Prosci founder Jeff Hiatt that represents the five tangible and concrete outcomes required for individual staff.

The acronym stands for:

A – Awareness of the need for change

D – Desire to support the change

K – Knowledge of how to change

A – Ability to demonstrate skill and behaviors

R – Reinforcement to make the change stick

A – Awareness of the need for change

D – Desire to support the change

K – Knowledge of how to change

A – Ability to demonstrate skill and behaviors

R – Reinforcement to make the change stick

For success at the individual level of change management, companies need to be able to communicate these five ADKAR elements to their employees in order for them to understand why the necessity of the change, where the change is coming from, how they can support the change, and how they will be impacted from it and the benefits the change represents.

Organizational change management – These are the steps and actions taken at a project level to support the individuals impacted by the ongoing change process. It starts by identifying the groups or people who will need to change, and in what ways. Once identified, successful organizational change management requires a customized plan for each individual to ensure that they receive the awareness, leadership, and training they need to be successful going forward.

Individual employees are at the center of successful change management processes; their success or failure will determine the success or failure of the processes that are changing organizationally.

Enterprise change management – This is the ‘final’ level of change management and essentially means that effective change management is embedded into your organization’s roles, structures, processes and leadership competencies. When it comes to enterprise change management, newly-implemented processes are consistently applied to initiatives, leaders will have the skills to guide their teams through the change, and staff will know what to ask for to be successful.

When embedded into your structure, enterprise change management capability means that individuals embrace change more effectively, and the organization itself is able to respond faster to market changes, embrace strategic initiatives, and adopt new technology much more rapidly.

Now that we’ve established the benefits and principles of managing change, how does it work, exactly?

Learn more about how MindBridge can help you sample less, and discover more.

A – Awareness of the need for change

D – Desire to support the change

K – Knowledge of how to change

A – Ability to demonstrate skill and behaviors

R – Reinforcement to make the change stick

How does change management work?

Change management relies on cohesive effort between management and employees to lead a successful transition. If leadership is not able to create a solid plan, and if employees are unable to “embrace and learn a new way of working, the initiative will fail.”

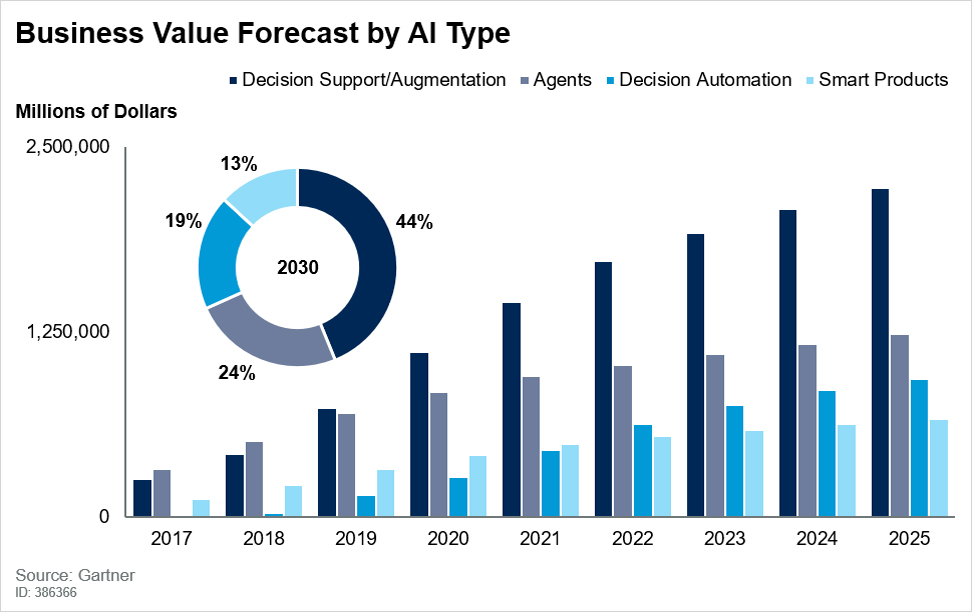

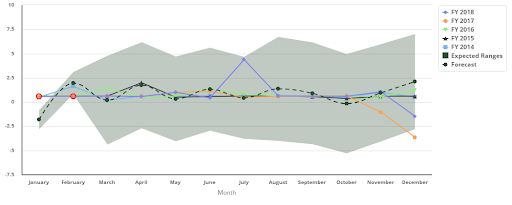

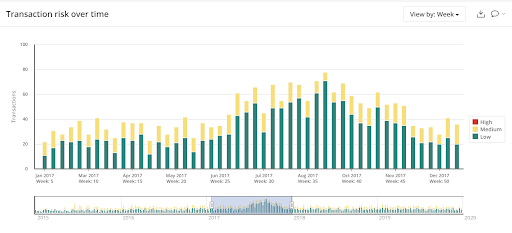

Take transitioning financial technologies and processes, for example. As technology improves and data sets increase, financial professionals and their departments are feeling the pressure to do more in less time. The trouble comes when the quality of work suffers as a result of the attempt to marry efficiency with quality. This is especially true of risk management and discovery.

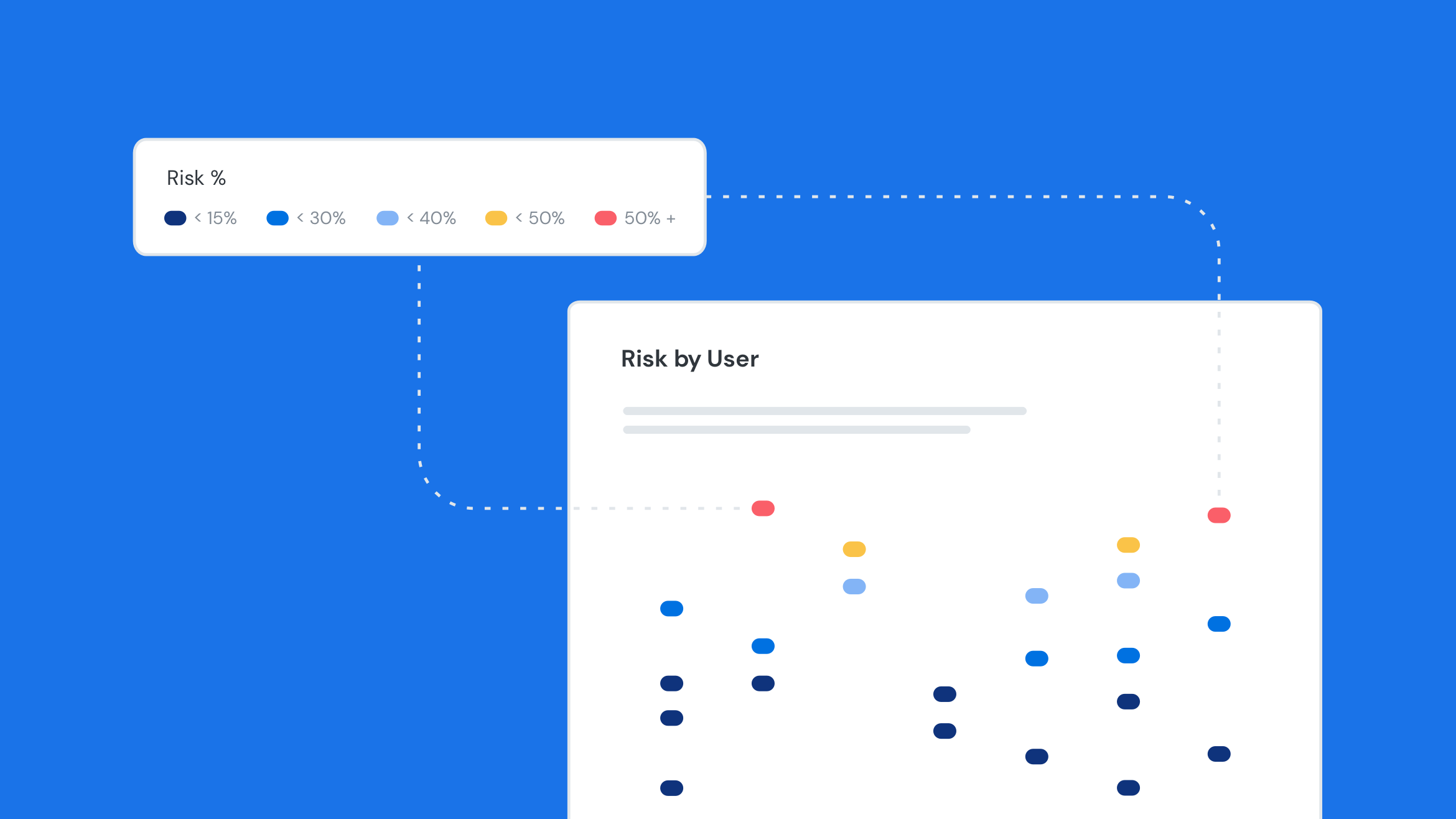

Platforms like MindBridge help organizations discover the known and unknown risk in their financial data sets. They can analyze 100% of transactions, provide insights to better communicate analysis with stakeholders, and ultimately produce higher quality work in a fraction of the time.

But, all of this requires a solid, well-executed change management plan. While new technologies are increasingly turnkey, unlocking their full potential takes buy-in at all levels of an organization, and investment in the principles of change.

At MindBridge, we strive to enable our customers with the tools, resources, and support they need to successfully transition their financial processes. But, for the organizations themselves, there is still work to do.

When it comes to changing any process or technology, the status quo is always simpler. But, those who are truly committed to growth and the future of their organizations aren’t content with the easy way out.

By integrating proper change management in the deployment process, companies and departments will be able to get employees on board and involved in the process to ensure as smooth a transition as possible. There will be headaches, and you may be uncomfortable. But that’s how change management works. If it were easy, everyone would be successful.

How to plan for transition

To help plan for the transition process, Harvard Business Review discusses the hard factors that need to be discussed more (along with soft factors like culture, leadership and motivation) when implementing change management strategies. These factors allow companies to measure, communicate and influence elements quickly to affect transformation. Before they start, companies need to understand the time allotted to complete the change, the number of people required to execute it, and the financial results that intended actions are expected to achieve.

To help lead a successful change management operation, there are four specific factors companies can use to determine the outcome and create a path to success:

Duration – The length of time it will take until the change program is complete, and the length of time between reviews built to measure success

Integrity – The ability to select the best staff to lead the program. Look for problem solving skills, results & methodological oriented individuals

Commitment – The level of enthusiasm and resilence from both management and employees to affect this change

Effort – Calculate the amount of time and effort beyond existing responsibilities, resources that are over stretched may compromise the change program or normal operations.

For future transitions

Change management requires focus, organization, and motivation. Not everyone will be willing to accept and help to invoke this change at the same time. The source of resistance is often individuals or groups, but it can also be systems or processes that are outdated or that fail to fit current business conditions.

Ways to mitigate these obstacles include rewarding flexibility, creating role models for change and repeating the key messages and goals of the project throughout the entire change program.

This is where the message of the “bigger picture” becomes crucial, if employees feel separated from the goals they will question their motivations. But by showing the concrete benefits of change for them, their department, and the organization more largely, you can demonstrate how all this added effort will lead to gains in the future.

For more on creating an effective transition strategy, watch our webinar, Change management 101: Strategies for leading change when adopting AI.

For more articles and resources like this one, visit our blog.

Ready to embrace AI to strengthen your remote audit?

Contact our team to schedule a demo of the MindBridge risk discovery platform.