Perform T&E reviews more than once a year

Examine of all your travel and expense transactions continuously by scaling across hundreds of millions of data points.

MindBridge AI™ for travel and expense data

Provides actionable insights and comprehensive risk assessments across all travel and expense data, improving decision-making, resource allocation, and business outcomes.

Increase visibility and build risk resiliency

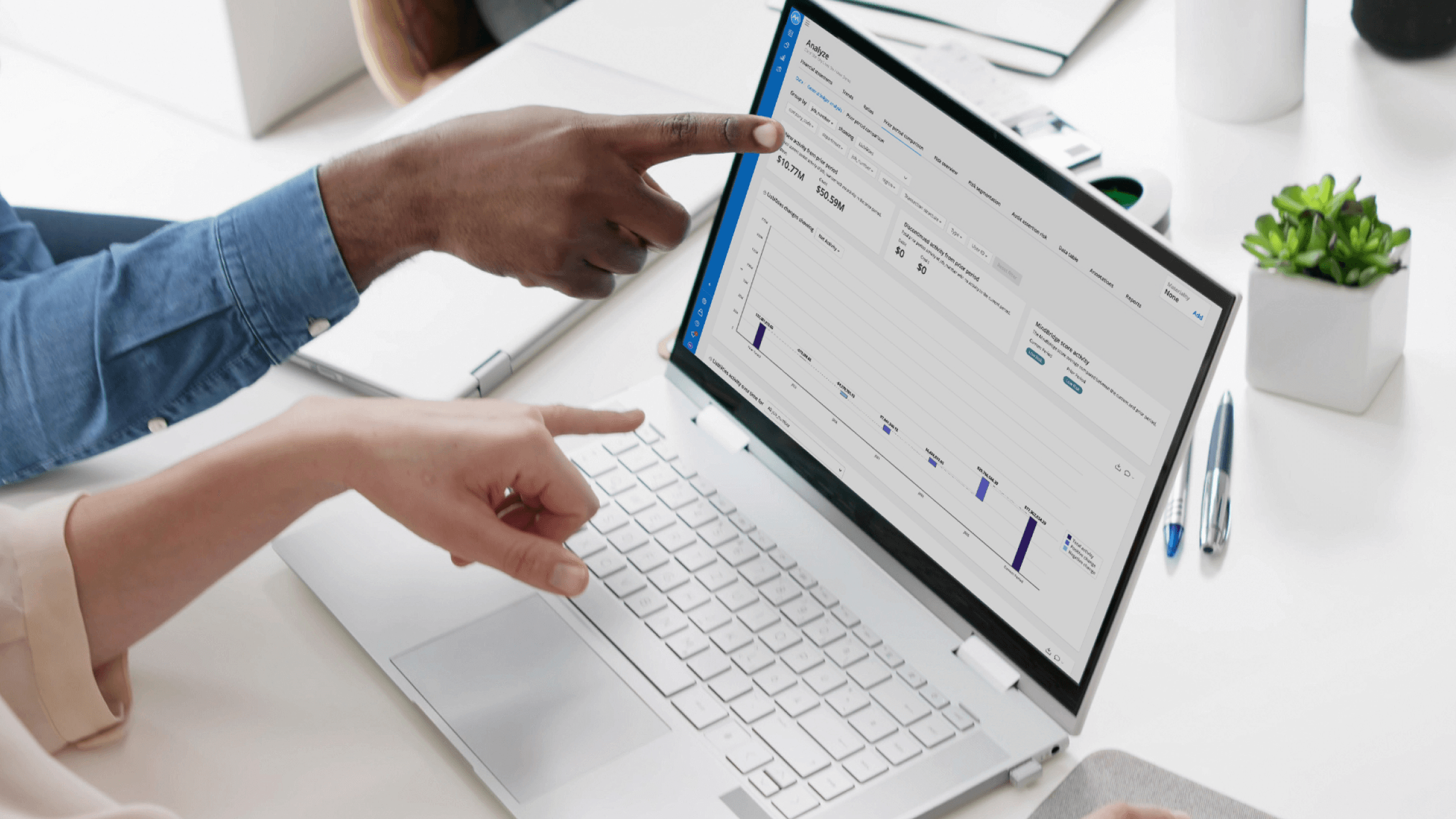

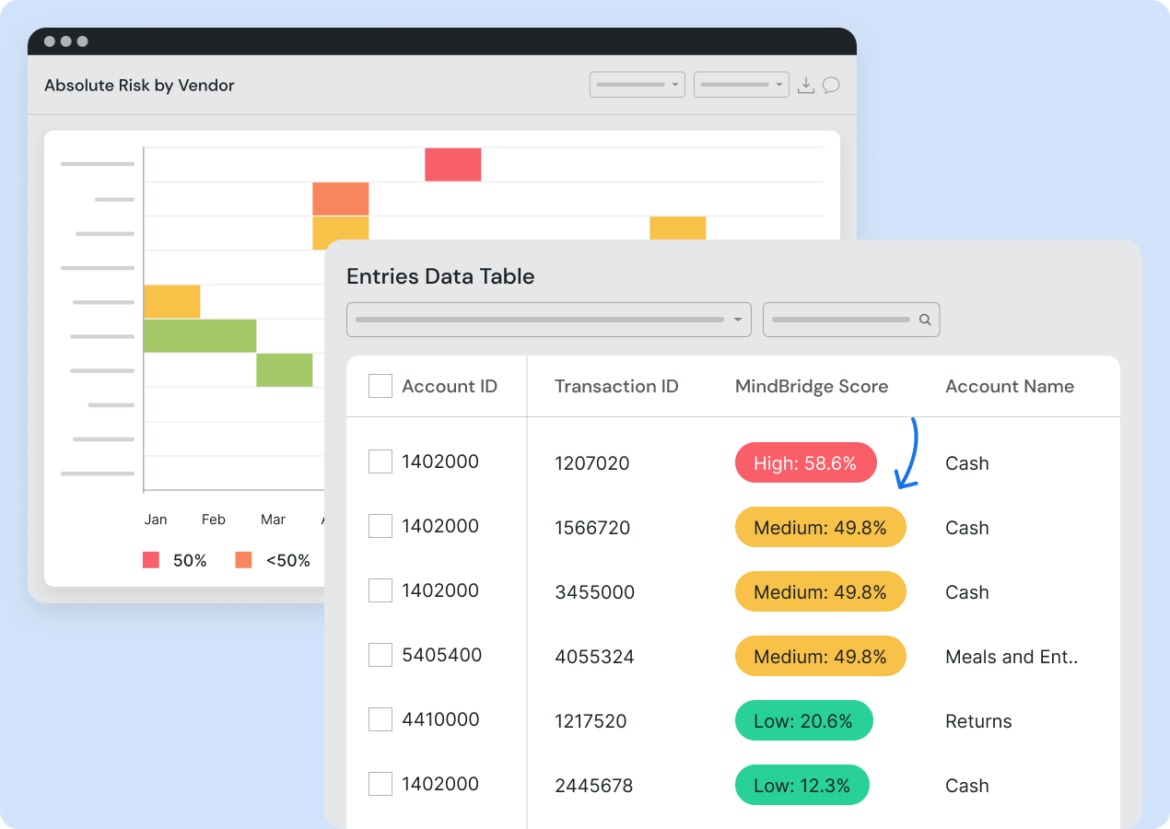

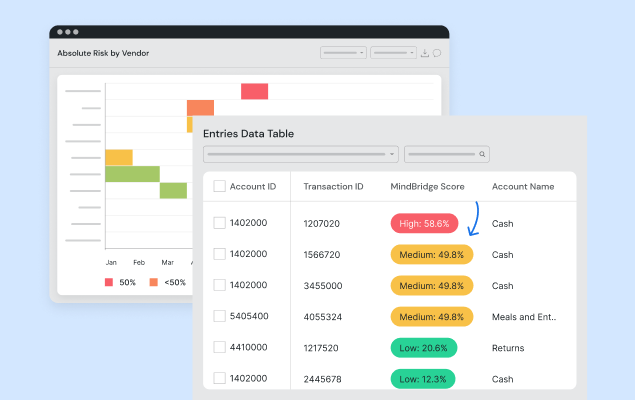

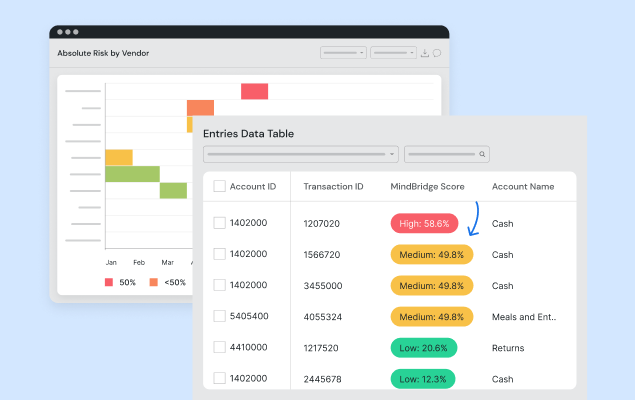

Data exploration

No scripting or formulas are required, making data exploration easy and user-friendly. Filtering capabilities allow for the handling of more complex tests, supporting nuanced financial analysis.

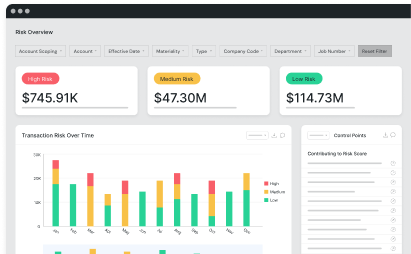

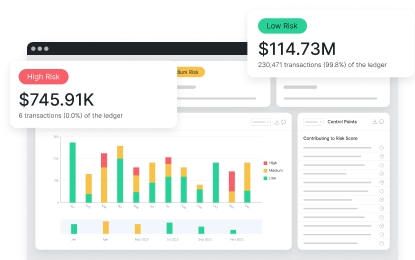

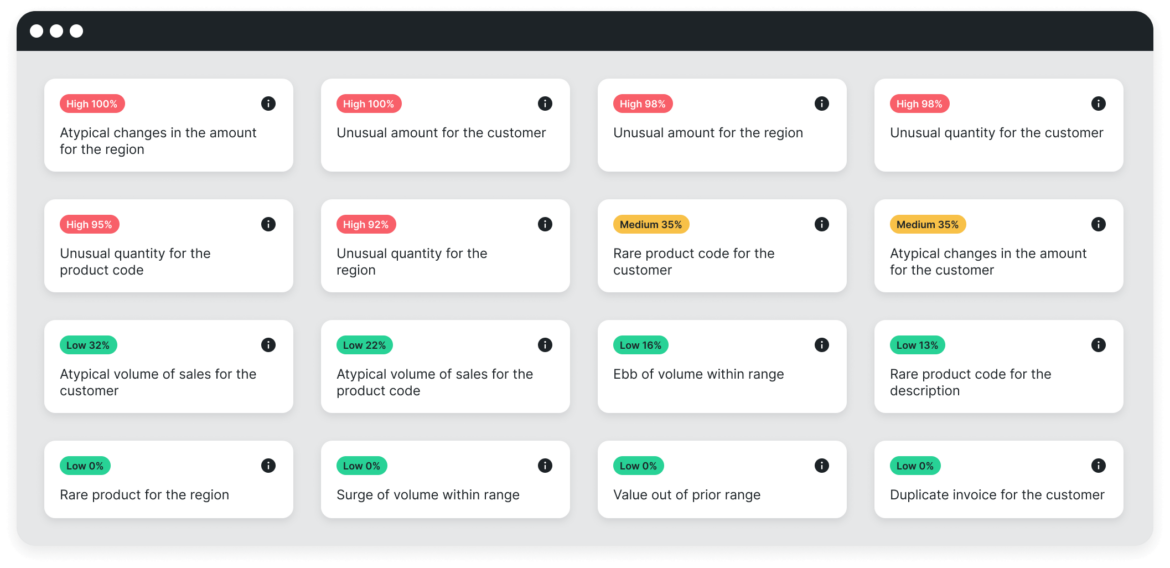

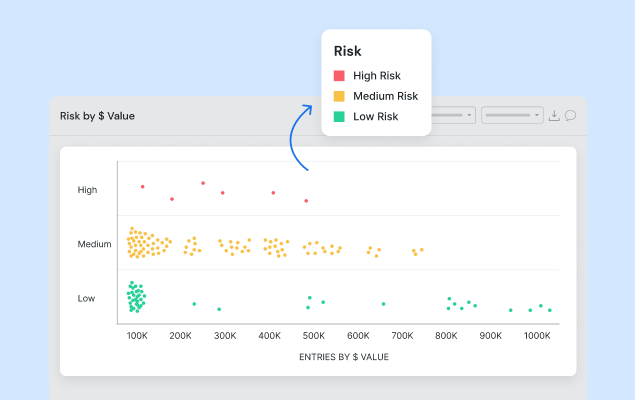

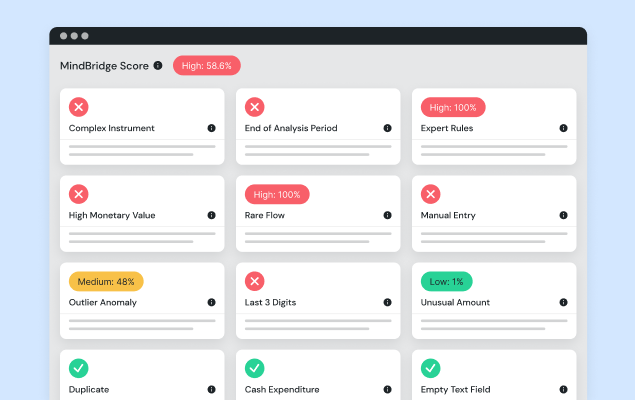

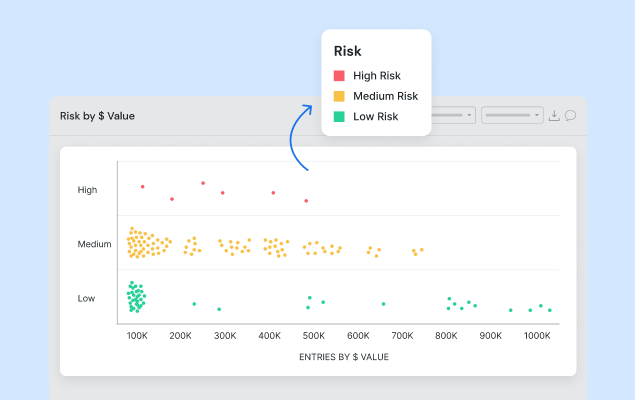

Risk scoring

100% of transactions are scored and organized based on the underlying advanced data analytics.

Configureable analysis

Configurable libraries based on industries enable the building of business rules and addition of fields to support customizable analysis.

Documented Results

Auto-generated reports based on dashboards and data exploration provide streamlined documentation for reporting.

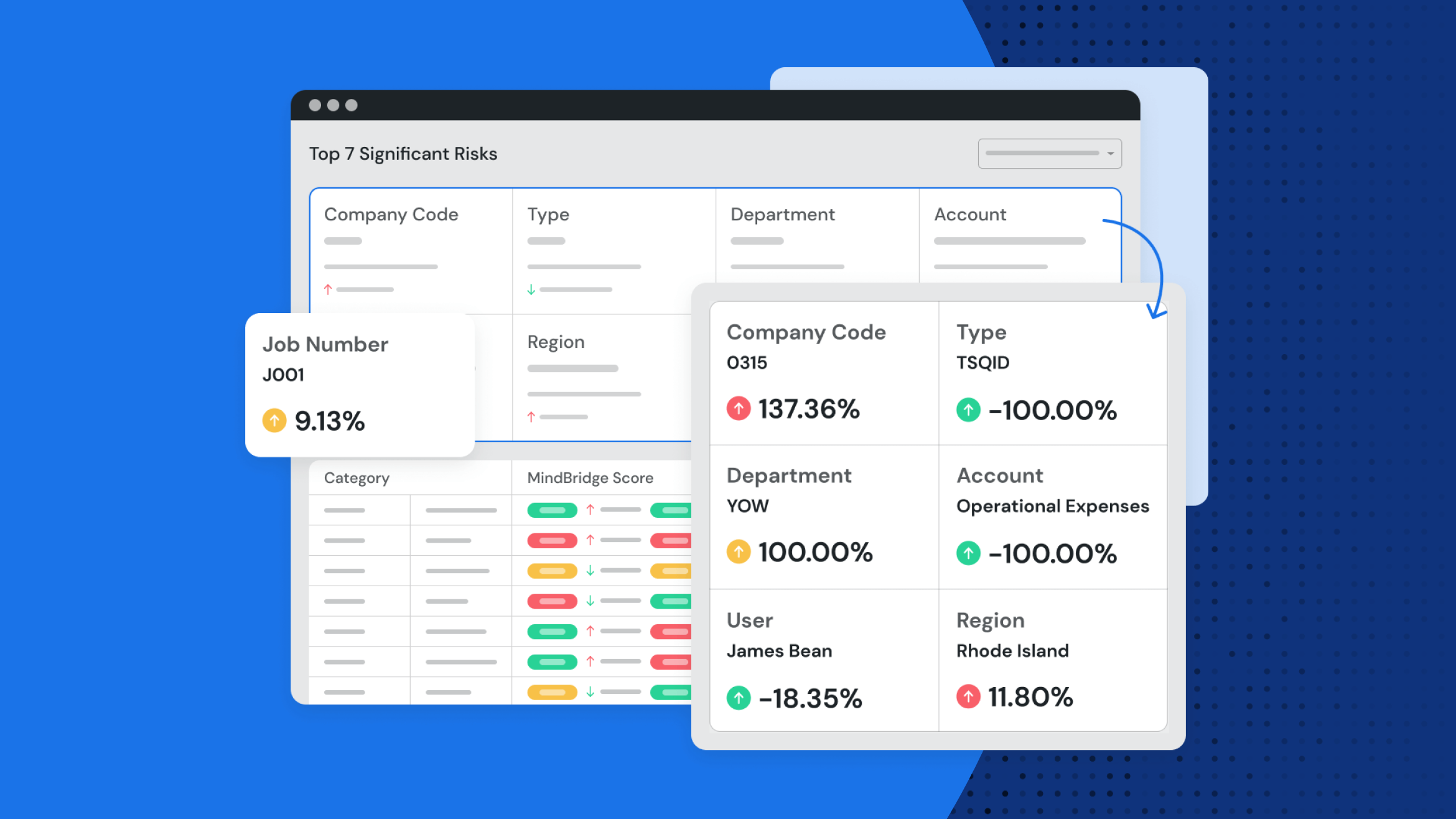

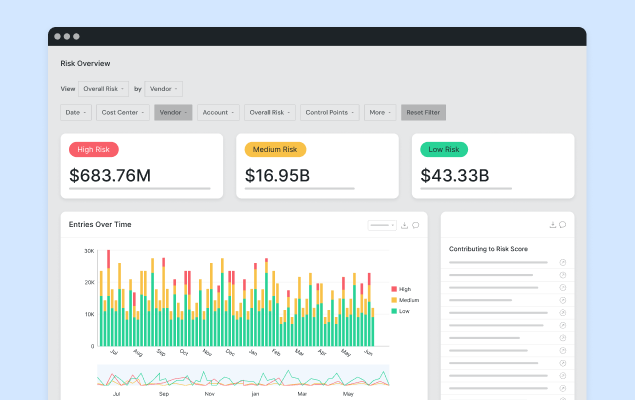

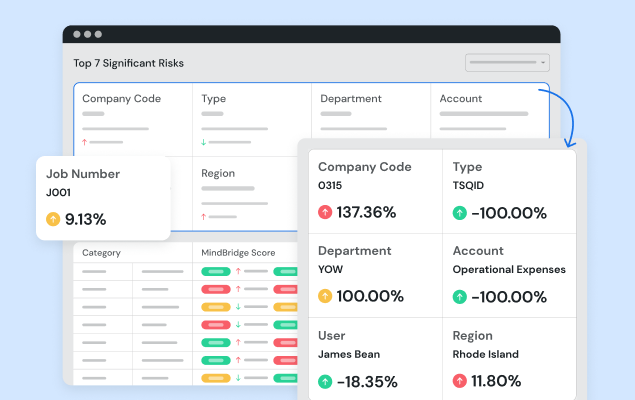

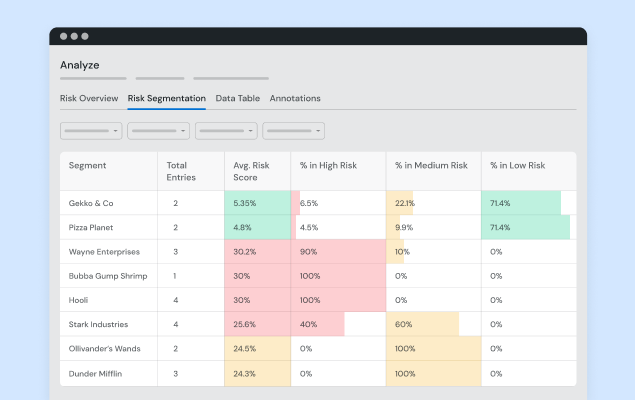

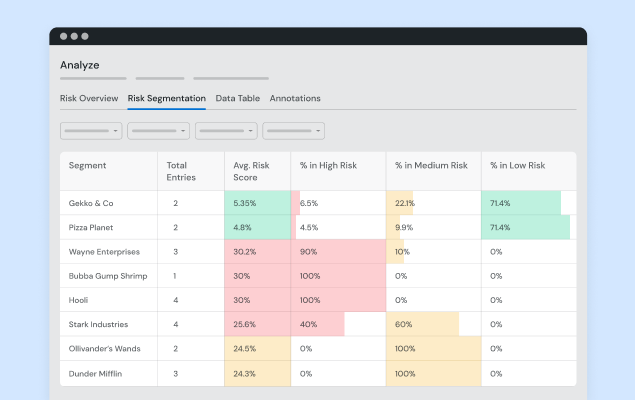

Risk segmentation

Targeted risk discovery, offering a dynamic and comprehensive view of risks within transactions across various operational aspects and risk drivers.

Why audit and finance leaders utilize MindBridge company card risk analytics

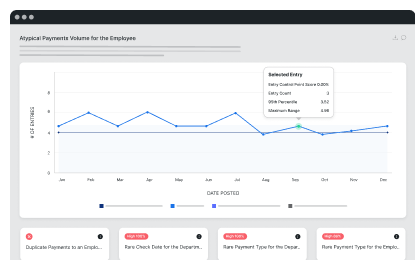

Anomaly Detection

Identifying irregularities and insconsistencies which may indicate potential fraud or errors, ensuring the accuracy and integrity of financial data.

Risk scoring

100% of transactions are scored and organized based on the underlying advanced data analytics.

Data exploration

No scripting or formulas are required, making data exploration easy and user-friendly. Filtering capabilities allow for the handling of more complex tests, supporting nuanced financial analysis.

Risk segmentation

Targeted risk discovery, offering a dynamic and comprehensive view of risks within transactions across various operational aspects and risk drivers.

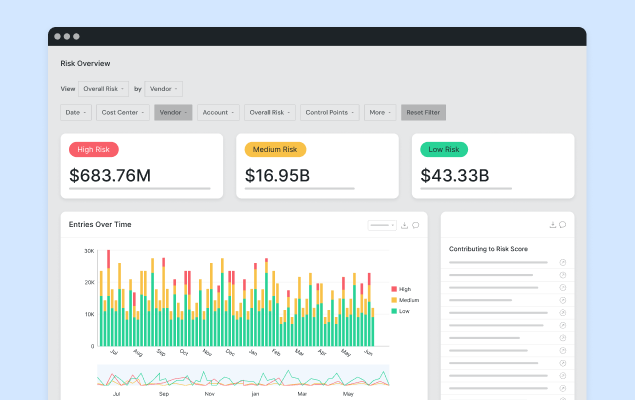

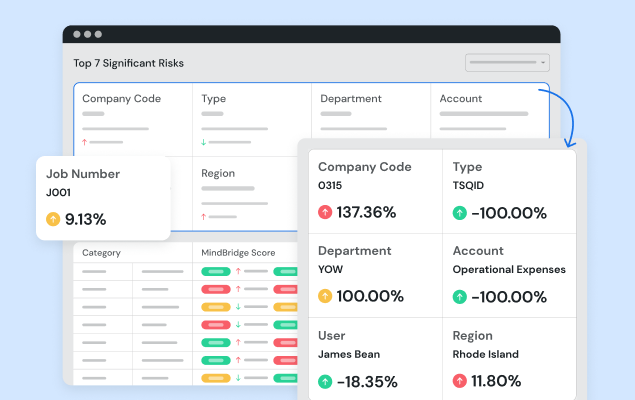

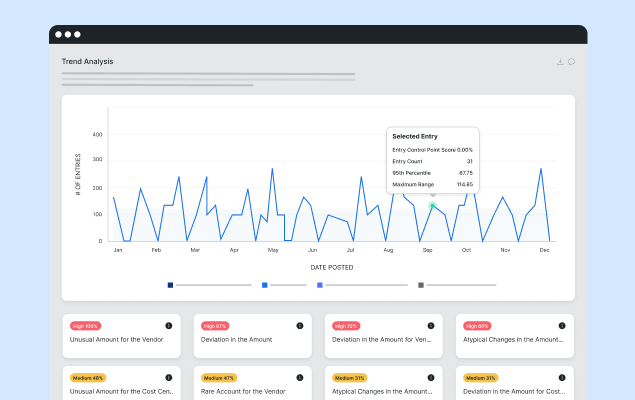

Prior Period Comparisons

Changes over periods are flagged based on analyzing transactional structures, risk levels, volume, and monetary value

Configureable analysis

Configurable libraries based on industries enable the building of business rules and addition of fields to support customizable analysis.

Documented Results

Auto-generated reports based on dashboards and data exploration provide streamlined documentation for reporting.

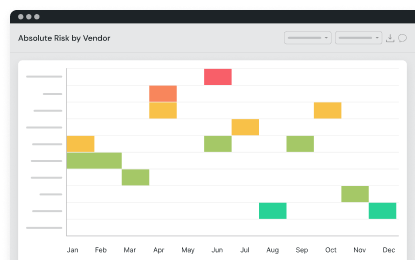

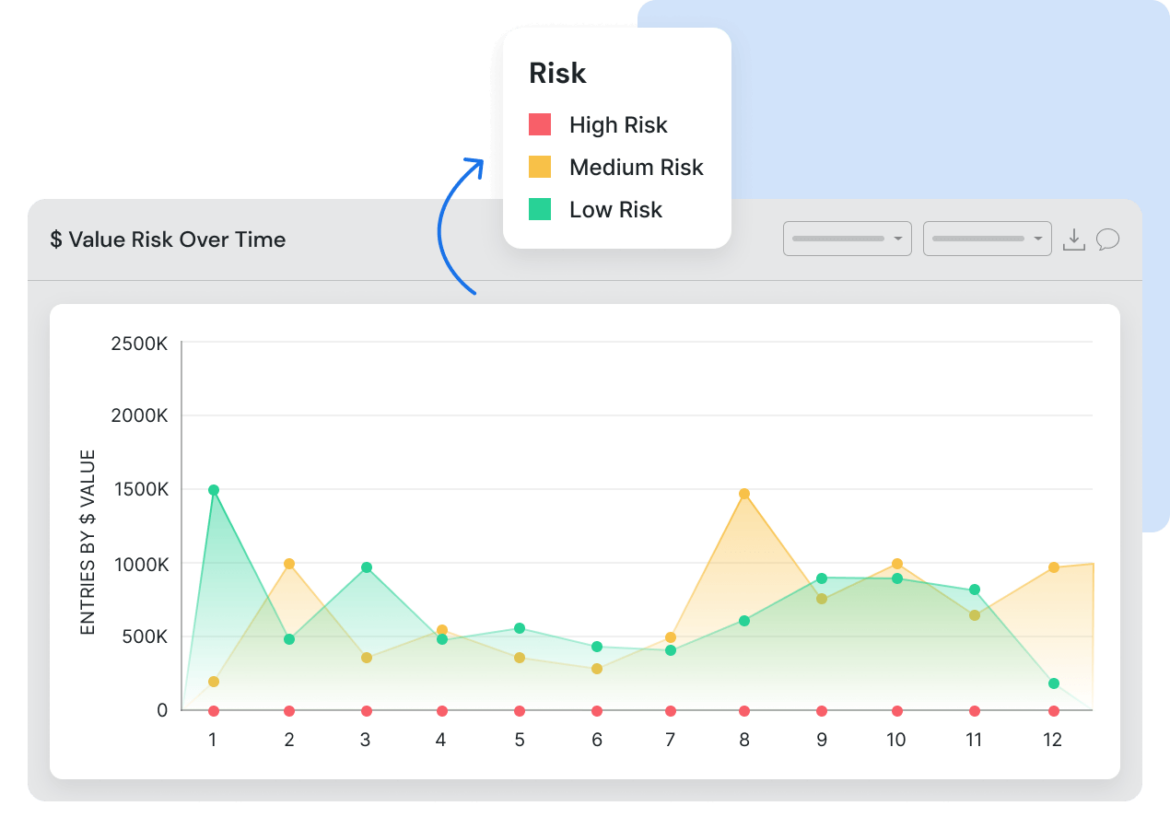

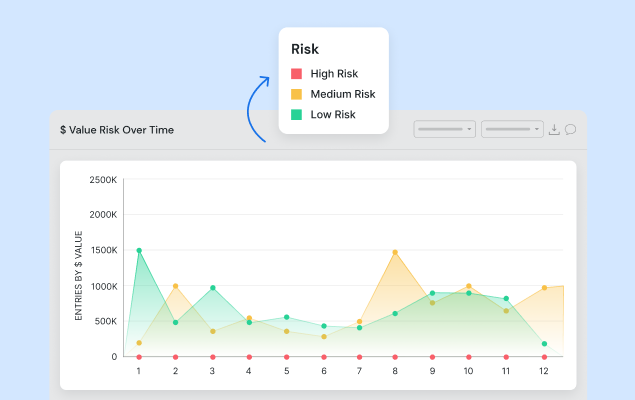

Trend Analysis

Trending visualizations enable period-over-period analysis based on activity, with the capability to dynamically filter using various fields.

Browse all products

AI-Powered T&E Risk Discovery

Read about how the MindBridge AI™ platform helps safeguard company expenses, build employee trust, and improve controls and compliance.