- Products

- Industries

- Resources

- SupportGetting MindBridgeUsing MindBridgeConnecting MindBridge

- Company

AI-powered financial risk discovery for internal controls and audit

MindBridge AI™ provides data-driven analytics with the most effective and highest-quality insights for better internal controls over financial reporting, SOX, and three lines of defense framework.

A connected effort for better results

MindBridge AI is a global leader in financial risk discovery and anomaly detection that delivers a better way to work by identifying, surfacing, and analyzing risk across broad financial and operational datasets.

MindBridge combines audit and finance expertise with data science and AI ingenuity to support professional judgment and serve the human need for financial transparency.

Transaction reviews can be time-consuming, manual, and tedious. MindBridge delivers AI for internal controls over financial reporting (AiCFR™) and unlocks resource time, quickly confirming known risks and anomalies and shifting focus to discover new and emerging transactional risk patterns.

Explore our comprehensive MindBridge AI™ Transaction Risk Analytics platform and empower your business with the robust capabilities of General Ledger, Vendor Invoice, Revenue, Payroll, and Company Card Risk Analytics to ensure unparalleled insight, compliance, and risk management across diverse financial data sets.

How do we help finance and audit teams?

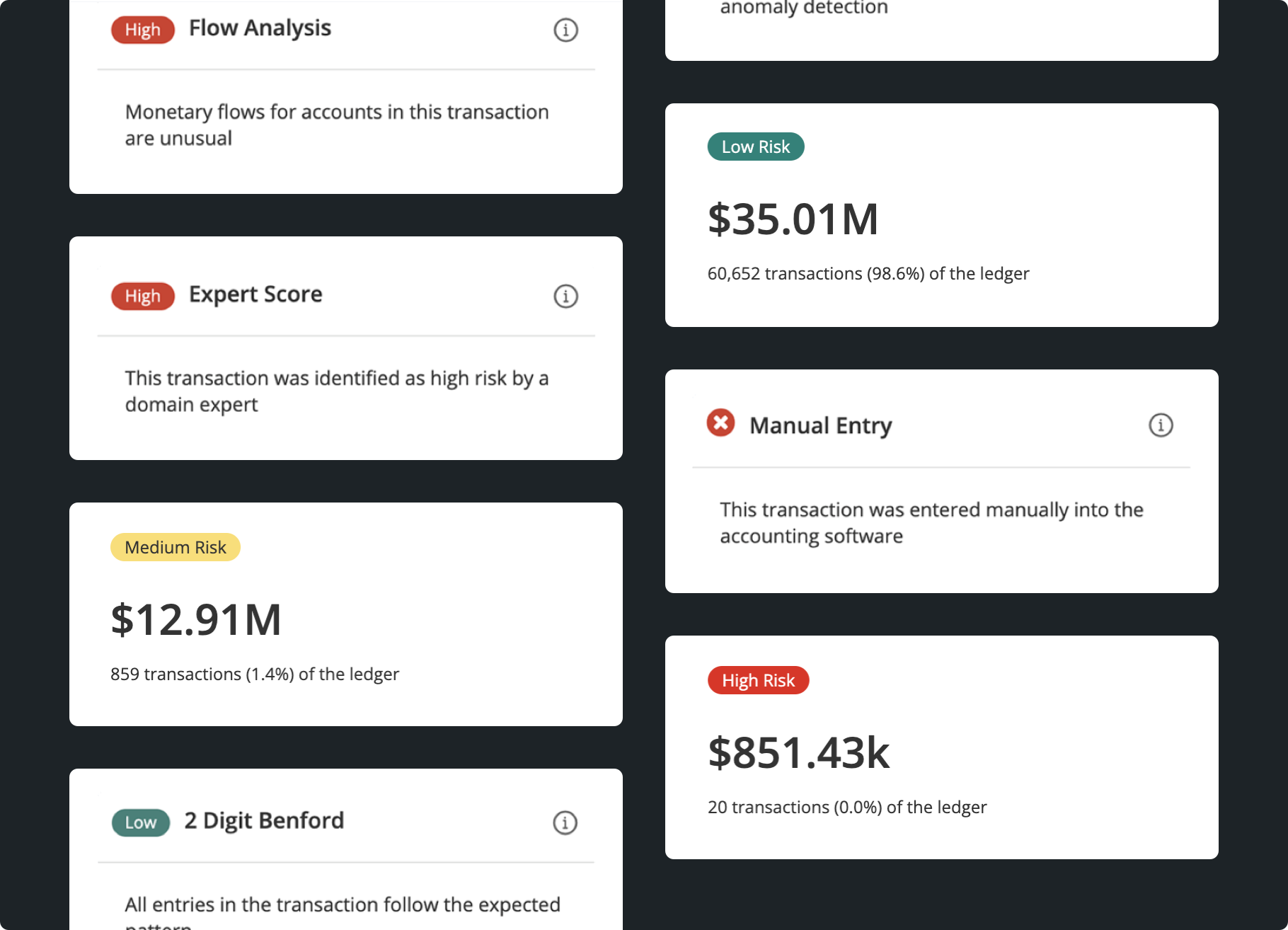

MindBridge compares your data across more than 40 capabilities to identify the level of risk for 100% of transactions. We call these capabilities ‘control points’. The MindBridge control points help build an ensemble relevant to your data set to identify known and unknown risks.

What is unique about MindBridge is how we identify existing patterns in your data. We use advanced risk intelligence tests in your ensemble and provide deeper data understanding at a granular level of financial detail you can’t get elsewhere. MindBridge reduces the distractions and pinpoints a much-needed understanding of the business’s financial risk.

MindBridge is designed for auditors and financial professionals to analyze entire volumes of data and surface patterns and connections between transactions and across sub-ledgers and accounts. MindBridge delivers insights in a fraction of the time it takes to uncover risk using manual or traditional methods and is flexible to work within your internal audit framework.

Built by financial professionals, for financial professionals

We know that all of the new and improved technology in the world can’t make up for the preparation and stress of an internal or external audit.

The MindBridge team of CPAs constantly tests our product to make sure we meet your expectations, and continue to improve and expand. On top of that, our Customer Advocacy Program captures consistent data to help our team deliver on our promises.

Finance-grade security

We keep pace with the latest data protection and cybersecurity practices to make sure that our AI auditing platform and solutions are resilient, compliant, and fully secure. MindBridge is certified SOC 2®, SOC 3® and complies with the American Institute of CPAs Security Organization Controls (SOC).