Navigating Revenue with Precision: Use MindBridge Revenue Risk Analytics

Revenue isn’t just a number; it’s a story of your company’s performance and market engagement. MindBridge’s new Revenue Risk Analytics helps you read this narrative more accurately by allowing a meticulous month-over-month, quarter-over-quarter, or year-over-year review of revenue behavior.

By utilizing risk scores, you can discern subtleties in the income generated from sales, enriching your understanding of your business’ financial dynamics and ultimately maintaining a closer watch for a stronger financial risk posture. Revenue Risk Analytics adds to a list of growing products, which already includes out-of-the-box analyses for General Ledgers, Vendor payments and invoices, Payroll, Company Card analysis, and more.

Understanding revenue goes beyond merely tracking numbers. It’s about recognizing patterns and anomalies that could signal underlying issues. Are your inventories moving without a corresponding bump in revenue, or perhaps you are concerned with abnormal behaviors in receivables?

MindBridge Revenue Risk Analytics surfaces the unknowns, allowing you to dissect revenue by various factors such as customer behavior, time periods, and geographic regions. This level of granularity aids in proactively addressing risks related to inventory management, profit margins, and revenue recognition.

Sharpening Your Focus: Risk Segmentation Expands Across All MindBridge Products

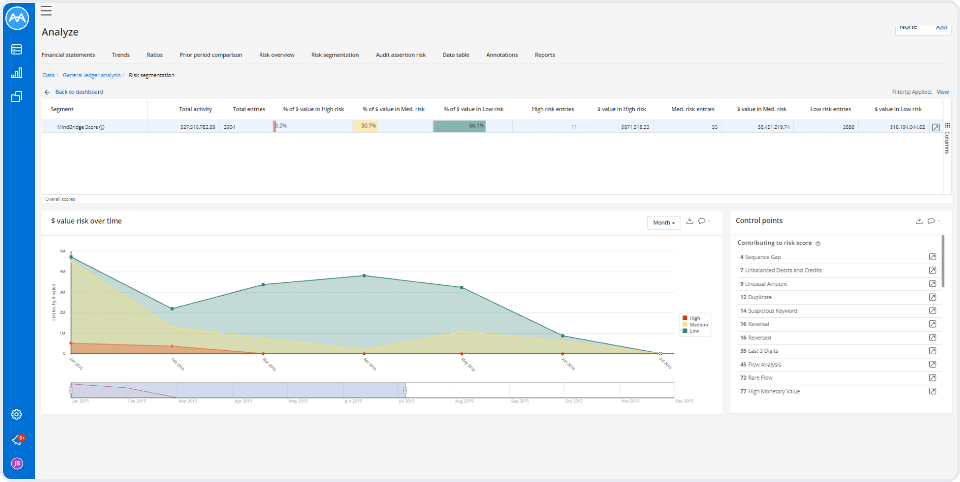

While evaluating financial health, one size rarely fits all. The MindBridge AI™ platform offers you the flexibility to tailor financial ledger analyses to your organization’s unique attributes. Now available across all MindBridge products, Risk Segmentation provides the ability to analyze the most relevant data, allowing finance control owners and auditors to assess risk consistently and respond efficiently to the unique risks faced by the organization.

Whether you’re keen to explore variations in posting behaviors or focus on regions with heightened anomalies, this feature lends depth to your risk assessment.

Complementing this is the Risk Segmentation Dashboard, providing an intuitive visual layout for your analytic-driven risk assessments. This capability not only enhances your understanding of the financial landscape but also refines your strategy for risk management. The dashboard streamlines how you maintain effective Internal Controls over Financial Reporting and offers the agility to adapt to your specific data range requirements.

Staying Agile: Risk Scoring Enhancements in MindBridge Flex Analysis

Risk isn’t static; it’s a constantly shifting landscape. Recognizing this, MindBridge Flex Analysis introduces dynamic risk thresholds and score normalization. These features make your risk management strategy as adaptive as the risks themselves, providing actionable and timely insights tailored to your evolving needs.

Connect at MindBridge Edge 2023

To learn more about how MindBridge’s AI-powered revenue analysis and risk management capabilities can help you take your understanding of financial risk to the next level, join us at MindBridge Edge 2023, a virtual two-day event on September 12-13, 2023.

At MindBridge Edge, you’ll learn from industry experts and peers, network with other professionals, and explore the latest advances in AI-powered financial risk discovery.

You’ll also have the opportunity to see how MindBridge’s solutions can be used to enhance your audit and finance strategies, identify and prioritize emerging risks, and integrate AI seamlessly into your financial workflows.

Register today and don’t miss this opportunity to learn about the future of financial risk and anomaly detection!