Harnessing the power of advanced algorithms, MindBridge’s AI technology accurately analyzes vast amounts of financial data, skillfully identifies patterns, and effectively flags unusual transactions and inconsistencies. With over 90 billion transactions scored, MindBridge has unrivaled experience in empowering auditors and financial professionals to efficiently and accurately assess financial risk and focus their attention on the highest-risk areas of their business, allowing them to focus on what matters.

We’re excited to introduce MindBridge’s latest release, featuring impressive new capabilities like Transaction Tagging, Custom Control Points, Enhanced Risk Segmentation, and expanded analysis types—including the newly introduced Charge Card Analysis.

With MindBridge’s expanding capabilities, you can dive deeper into financial risk and anomalies. No other solution supports transparent financial reporting for leadership, customers, investors, and employees, giving you a comprehensive understanding of your intricate financial landscape.

MindBridge’s advanced AI capabilities continue to transform how you understand and interact with financial data as an audit or finance professional.

Transaction tagging: evolved segmentation for populations of transactions

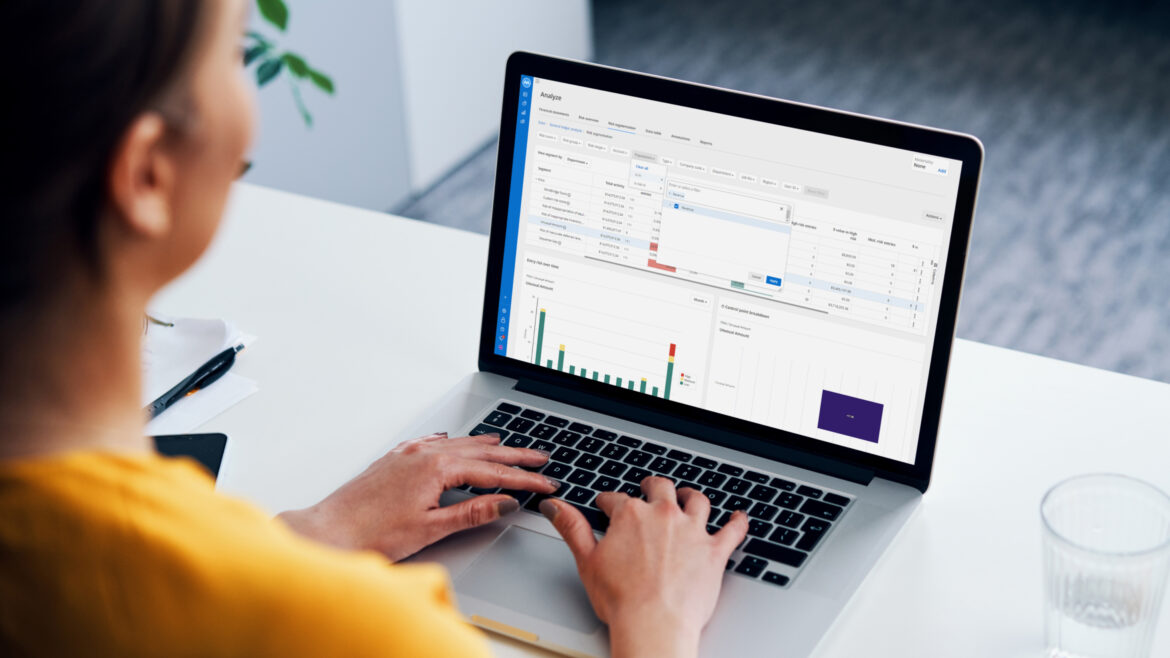

Transaction tagging, a standout feature of this MindBridge release, empowers you to precisely identify and mark subsets of data within your General Ledger for a more refined and focused risk view.

This tool enhances the efficiency of analyzing large transaction datasets, allowing for the isolation of known high-risk areas while ensuring regular reviews to catch unexpected anomalies. It enables the flagging of unusual expenses above a specific threshold, facilitating cohesive group analysis within our Risk Segmentation dashboard. It also extends to identifying specific debit and credit pairings, thus improving the precision of data review.

Transaction tagging allows you to include or exclude tags based on your needs across our dashboards, facilitating a streamlined workflow for users. This results in a refined understanding of potential threats and increases knowledge captured in the system over time.

By saving time and ensuring standardized results across teams, transaction tagging enhances collaboration and understanding among stakeholders. Additionally, by configuring risk segment views at the library level, consistency and reliability are assured, providing an invaluable tool for risk assessment and management.

Custom control points

With the custom control points, you can now construct your own control points based on business rules. For example, you can personalize a custom control point to find only your risky account flows.

This new feature opens the door for more nuanced risk identification, ensuring that potential threats unique to your business and industry don’t go unnoticed. It’s another step towards making financial risk detection more robust and reliable.

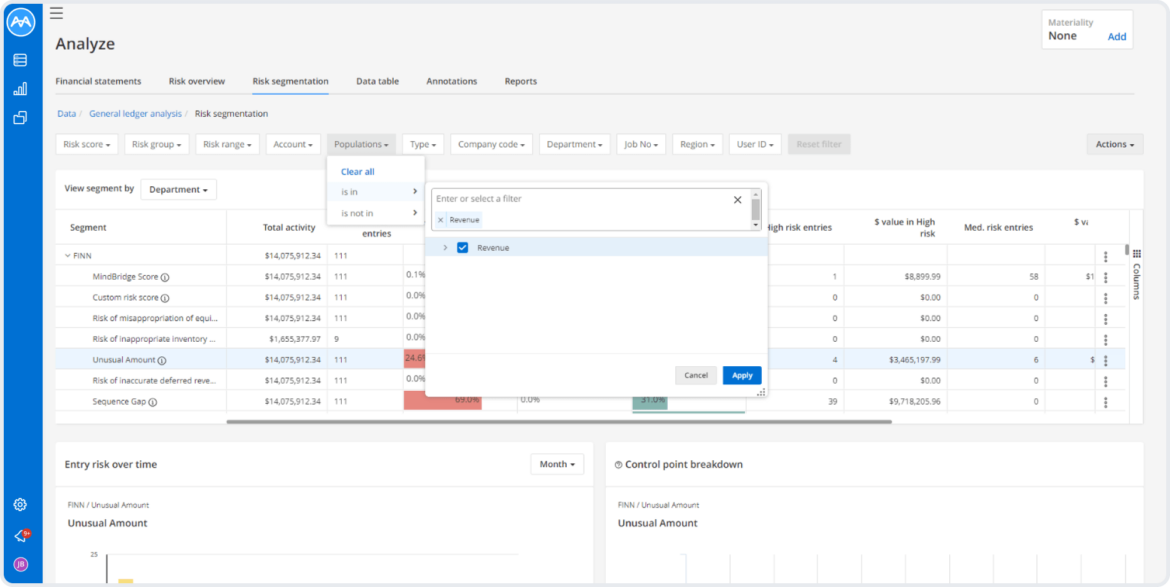

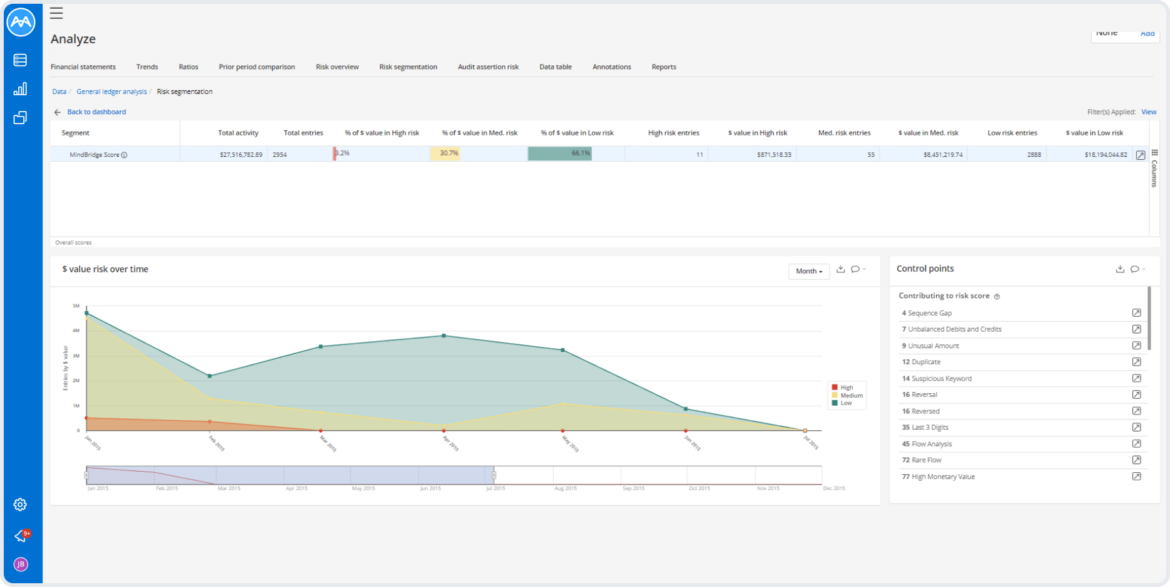

Risk summary: Investigating segments

Risk Segmentation allows users to understand which area of the business is driving risk. Whether it be subsidiaries, users, or cost centers, the Risk Segmentation will highlight where investigations should take place next. New to this release is the ability to drill through on a risky segment to get a breakdown of the risk indicators driving risk, the breakdown of risk over time, and the ability to further generate insight through visually inspecting the segment’s transactions.

Additionally, these views can be saved for reuse later, allowing enterprises to configure and view the segments they care about. This supports a tighter link between an Enterprise’s risk and control framework and its view of risk in MindBridge. It also supports Audit firms in designing views that support their audit testing framework.

Charge card analysis template: mitigating key risks

Analysis for charge cards presents a critical risk area for process controls and audits. To address this, we’ve introduced a template specifically designed to analyze and mitigate risks associated with charge cards. This flexible template enables you to uncover potential issues such as unusual purchases or irregular employee behavior.

With this new template, you can effectively manage and scrutinize charge cards, ensuring the same level of precision and effectiveness as with other financial aspects. It offers an additional layer of protection against financial risks, enhancing the robustness of your overall risk management process. This novel feature complements our growing suite of pre-configured analyses, which cover areas like accounts receivable, accounts payable, payroll, revenue, and vendor payment analysis.

Shaping the future of finance with MindBridge

Our innovative features are redefining risk analysis and empowering finance professionals to make informed decisions, enhance risk management strategies, and strengthen organizations. The latest release incorporates a range of ways for businesses to tailor their risk insights to suit their needs, from flexible dashboards to risk scoring. Guiding professionals towards appropriate actions based on AI insights, MindBridge builds trust and confidence in results.

To learn more about the latest release, check out the What’s New page. Or, if you’re ready to explore these cutting-edge features, reach out, and our team will be delighted to discuss the details with you.

With MindBridge, you’re not just keeping up with the future of fintech—you’re shaping it.