Why audit, procurement and finance leaders use MindBridge Vendor Invoice Risk Analytics

Enhance detective controls, uncover vendor insights and possible risk

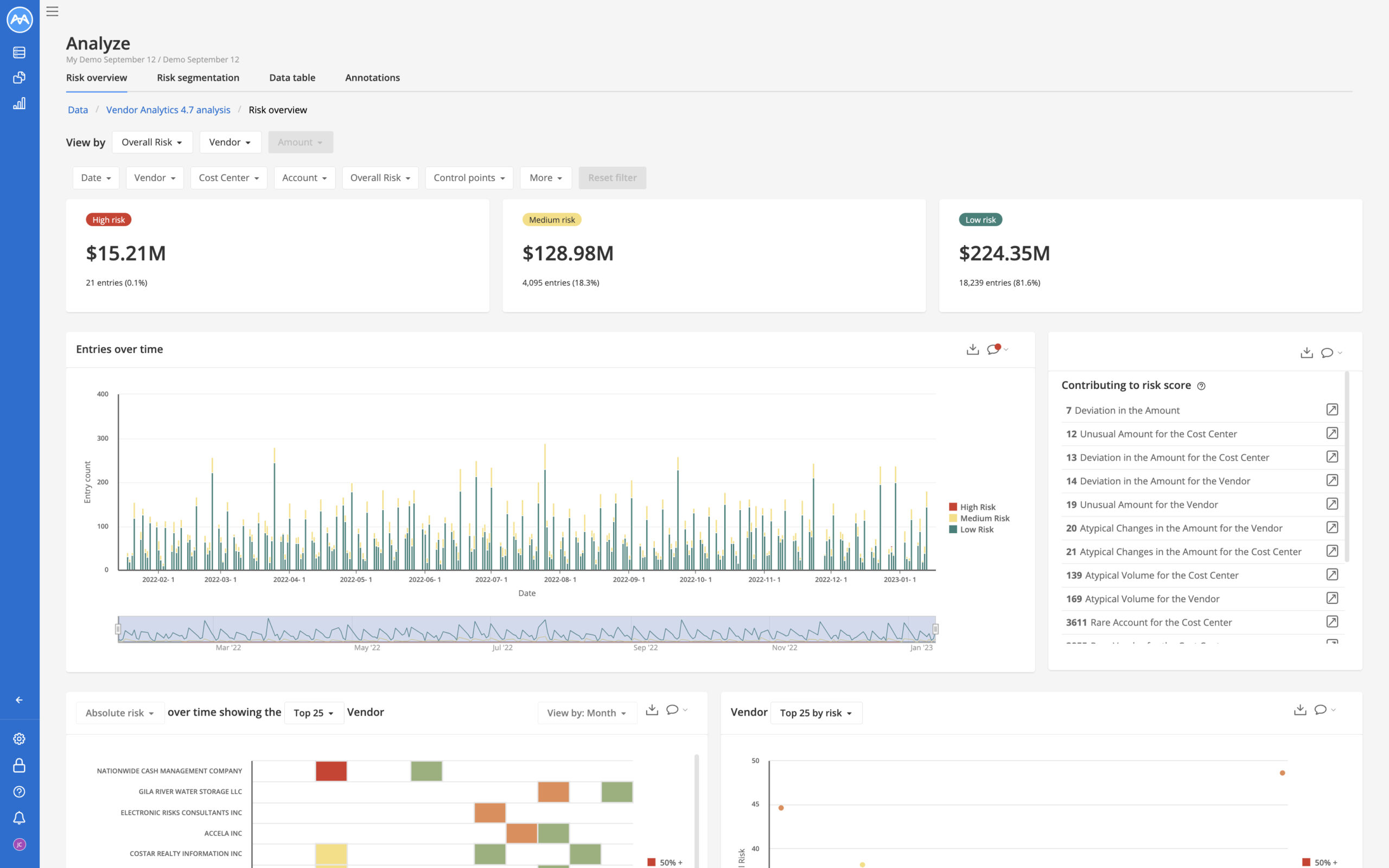

Replace manual controls and investigations with AI-powered automated detective controls over your vendor payment operations. MindBridge AI empowers finance and procurement teams with 100% automated analysis of the vendor invoices flowing through the financial operations with a comprehensive view of potential risk areas and/or anomalies in regular operations.

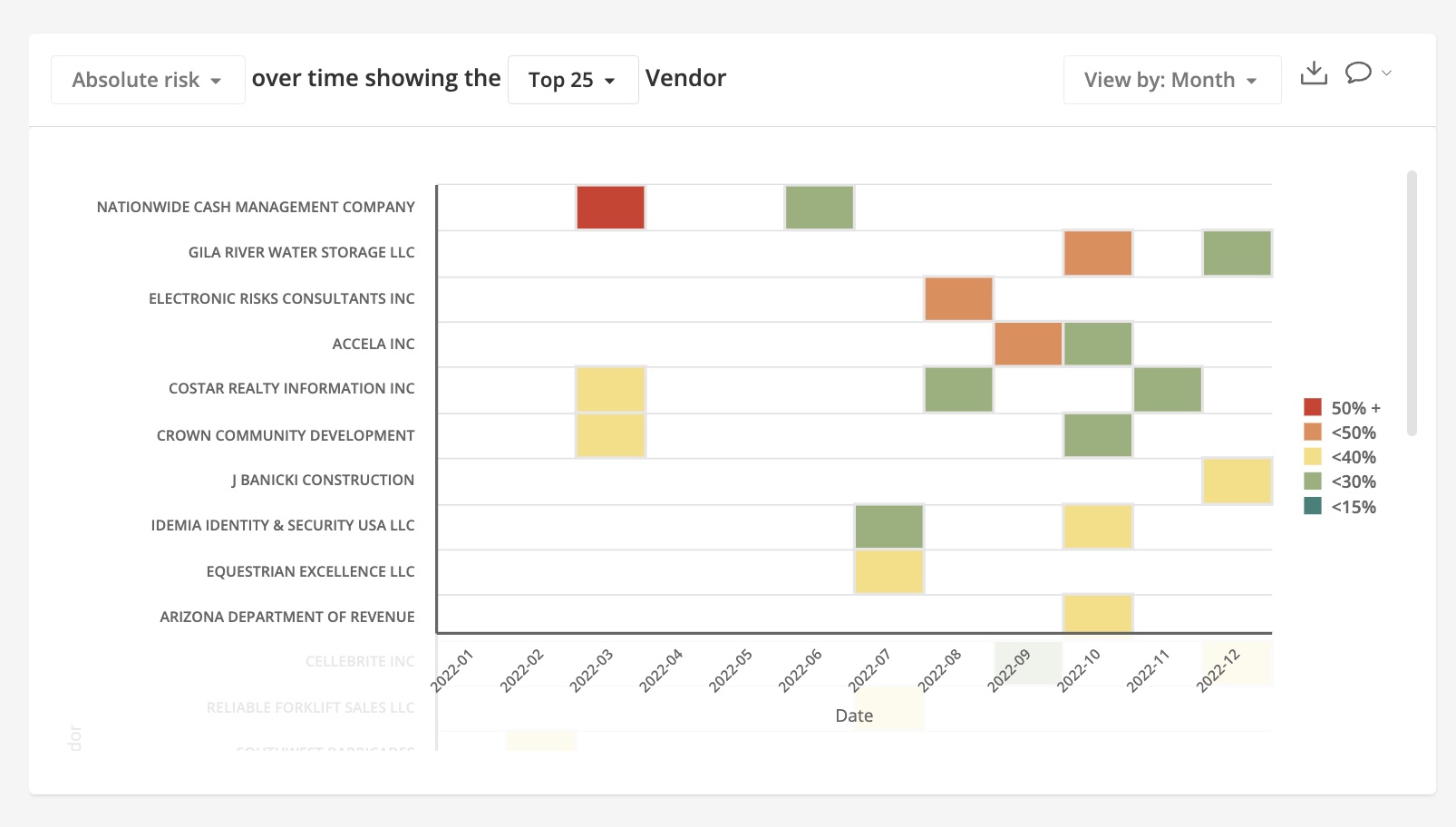

MindBridge examines vendor invoices and line items to identify unusual patterns across users, vendors, cost/profit centers, companies, and other categories used in your business. With unique machine learning algorithms across the various combinations of data, users can focus their efforts to spot anomalous activity, drill into details, or access pre-built filtered views for company specific testing.

Reduce Potential Financial Loss associated in the Vendor Invoice process

Add your data and go – no coding or advanced data skills required. Implement transactional risk analytics with little disruption and minimal spending. Enhance your ability to surface high and low risk vendor invoice and payment issues across departments, regions, and relevant categories.

Over time, as organizations change and grow, so do the amount and types of vendors change to respond to needs of the updated organizations. Teams not only need to look to verify the known-knowns but also to ensure that unknown-unknowns can be identified. MindBridge’s technology seeks out anomalies in your complex combinations that could indicate a previously unknown gap in internal control.

Augmenting Business Coverage

Integrate AI into workflows, analyses, and decision-making, allowing business transformation in vendor invoice risk analytics for improved global procurement and payables operations. Create explainable risk transparency of all vendor invoice activities to support ongoing monitoring of potential risk of over payments, under payments, incorrect cost center or expense posting, and trends impacting overall financials.

Harness AI-driven insights for vendor invoice risk analysis to automate routine tasks, optimize resource allocation, and identify opportunities with greater precision. Use MindBridge to build a better business to sustain growth and innovation in an increasingly data-driven world.