Why audit and finance leaders use MindBridge Payroll Risk Analytics

Empower finance teams, and amplify efficiency

Automated detective controls over payroll operations help streamline the ability to identify discrepancies early and proactively address risk to prevent loss. MindBridge AI provides an efficient compliance program to monitor and validate that payroll controls and assessments are effective.

MindBridge examines payroll hourly rates, hours worked, unusual payment patterns and more to reduce time and effort required for manual reviews enabling finance professionals to focus their efforts on strategic tasks and decision-making.

Adopt transactional risk analytics into your everyday

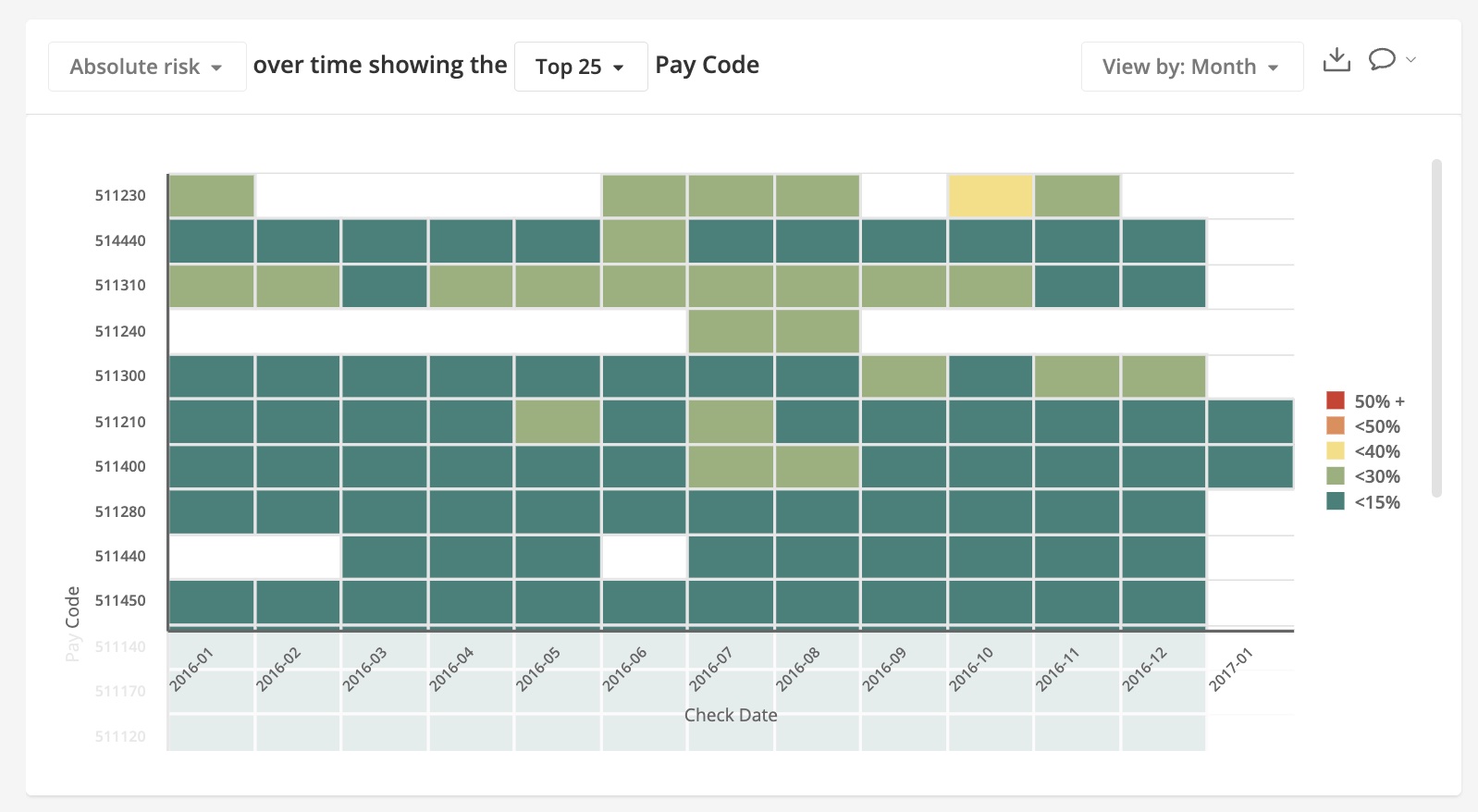

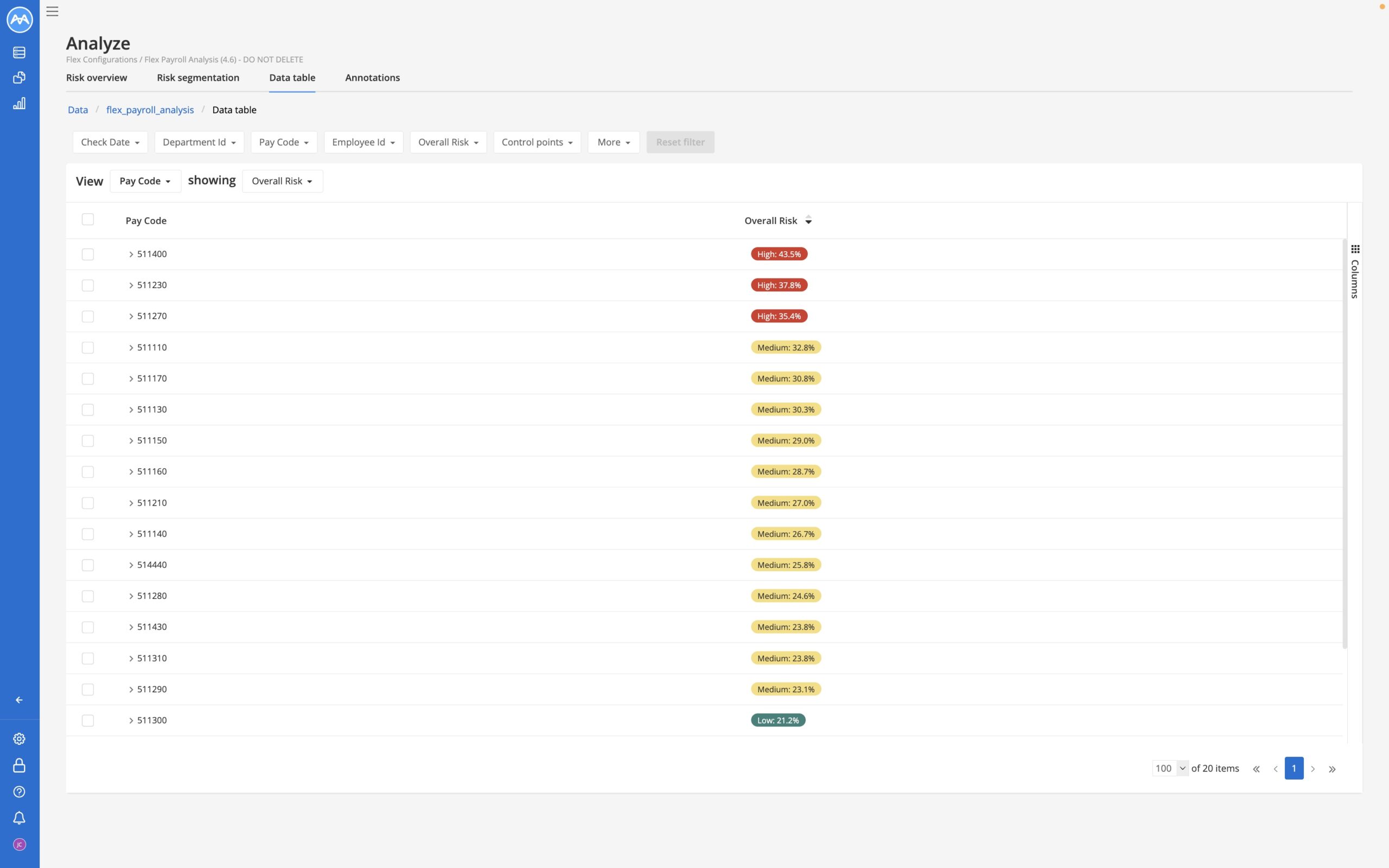

No coding or advanced data skills required. Implement transactional risk analytics with little disruption and minimal spend. Enhance your ability to find and prove payroll issues like off cycle payments, unauthorized bonuses, or commissions, pay codes by department or profile, and more.

MindBridge’s technology can seek out anomalous trends in the most complex payroll data and flag discrepancies and potential fraud before it escalates. Incorporate frontline defense across every transaction with preventative measures providing valuable insights into payroll risk detection and management.

Augmenting Business Coverage

Integrate artificial intelligence (AI) workflows, analyses, and decision-making processes, ushering in a transformative era where AI becomes your co-pilot in payroll risk analytics to support your global payroll and HR administration functions for better business operations. Accelerate decision-making by reducing cycle times across pay periods, and off cycle processing.

Harness AI-driven insights for payroll risk analysis to automate routine tasks, optimize resource allocation, and identify opportunities with greater precision. Use MindBridge to build a better business to sustain growth and innovation in an increasingly data-driven world.