We are facing an unprecedented time of global uncertainty created by the COVID-19 virus that has unleashed a global healthcare crisis. Humanity is fighting a war against an invisible enemy that is attacking humans around the world and sparing no country. We need not be pessimistic or optimistic but rather realists and learn from the history of humanity. Human ingenuity will prevail, and humanity will survive.

We have entered a new world after COVID-19 with very different assumptions than we had in the old world when the world GDP yielded a record high of $85T. The world GDP has been severely impacted by the lockdown stipulations that were imposed to minimize the spread of the virus within the population. The key pillars of the economy are consumer and companies’ spending. If this slows down, it can lead to a recession and even depression. The lockdown restrictions are being relaxed and governments and central banks around the world are injecting massive amounts of funds into the hands of individuals and companies in an effort to reopen the economy to avoid an economic crisis.

How can artificial intelligence in finance help organizations pull through?

A renewed focus on financial errors

During economic uncertainty, an added vigilance is needed by those responsible to ensure the accuracy and integrity of the financial records that are being relied upon to make decisions about the operations of their organizations. A report by the Association of Certified Fraud Examiners (ACFE) “2020-Report to the Nations”- 2020 Global Study on Occupational Fraud and Abuse estimates that the yearly cost to the world due to fraud and abuse is about $4.5T or 5% of the world GDP. They examined over 2500 cases from 125 countries with combined losses of $3.6B with an average loss by case of $1.5M and a typical case lasting 14 months before being detected.

Whereas corruption was the most common type of fraud, the most costly were financial statements fraud schemes, even though they represented only 10% of the cases. The breakdown of the detection methods reveals that analytics plays only a small role in the detection of occupational fraud: Human tips; 43%, internal audit; 12%, management reviews; 5%, by accident; 5%, whereas external audit catches only 4%.

A 2019 survey by Blackline provided insights into the concerns by executives with inaccuracies in financial data. With over 1100 C-suite executives and finance professionals from mid- to large-size organizations around the world, the white paper stated that:

“55% are not confident that they can identify financial errors before reporting results, 70% claim that their organizations made a significant business decision based on inaccurate financial data and 26% are concerned over errors that they know must exist but they have no visibility”.

The power of AI in finance

Finance professionals that rely on outdated tools and methodologies do not offer the best visibility into finding errors, errors with intent, errors that are considered fraud, and general mismanagement of the financial dataset in their organizations. The world is already witnessing a major trend toward moving to the cloud and becoming digital native and these must be vigorously pursued by organizations that want to be of the forefront of growth post the crisis.

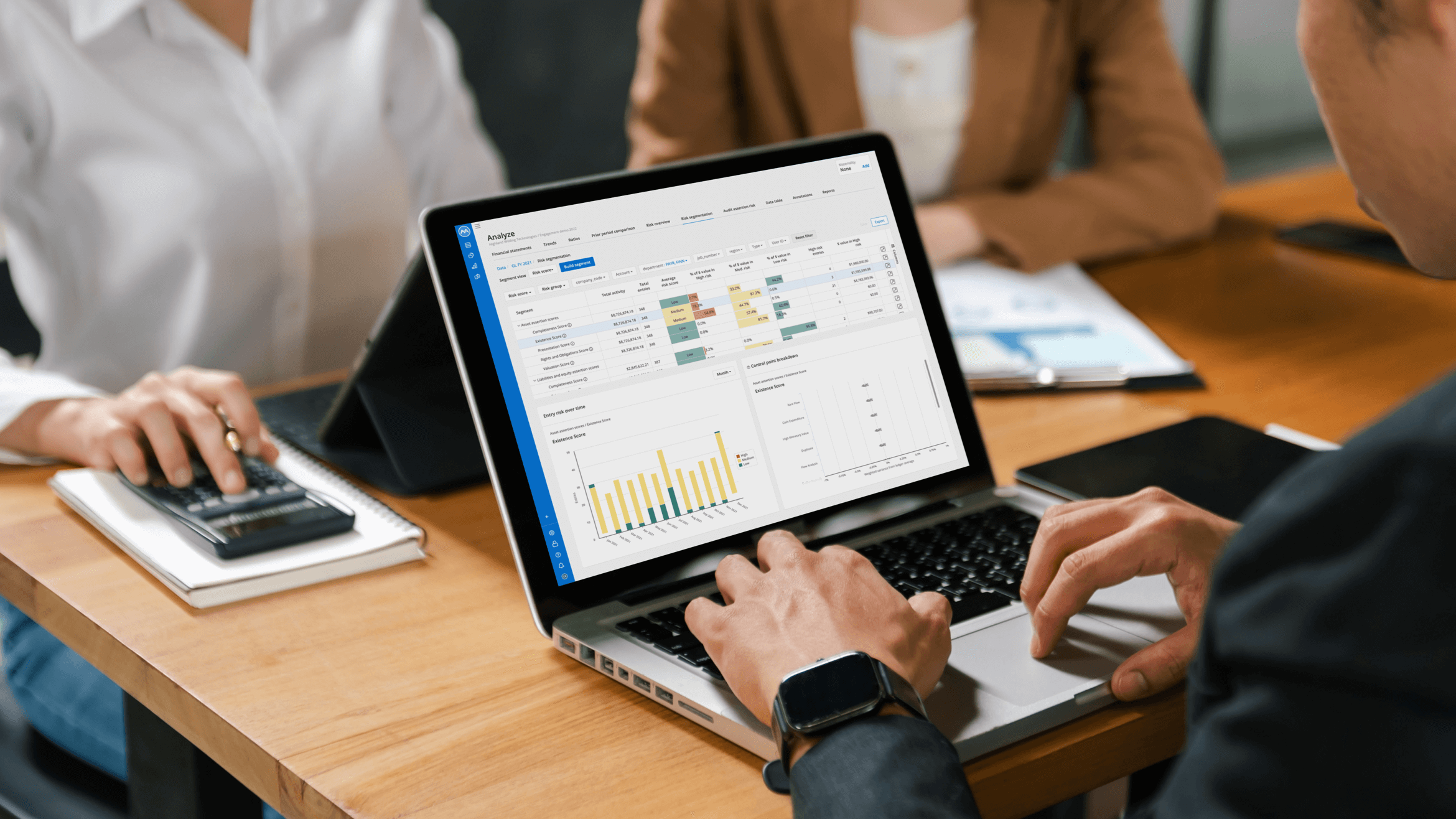

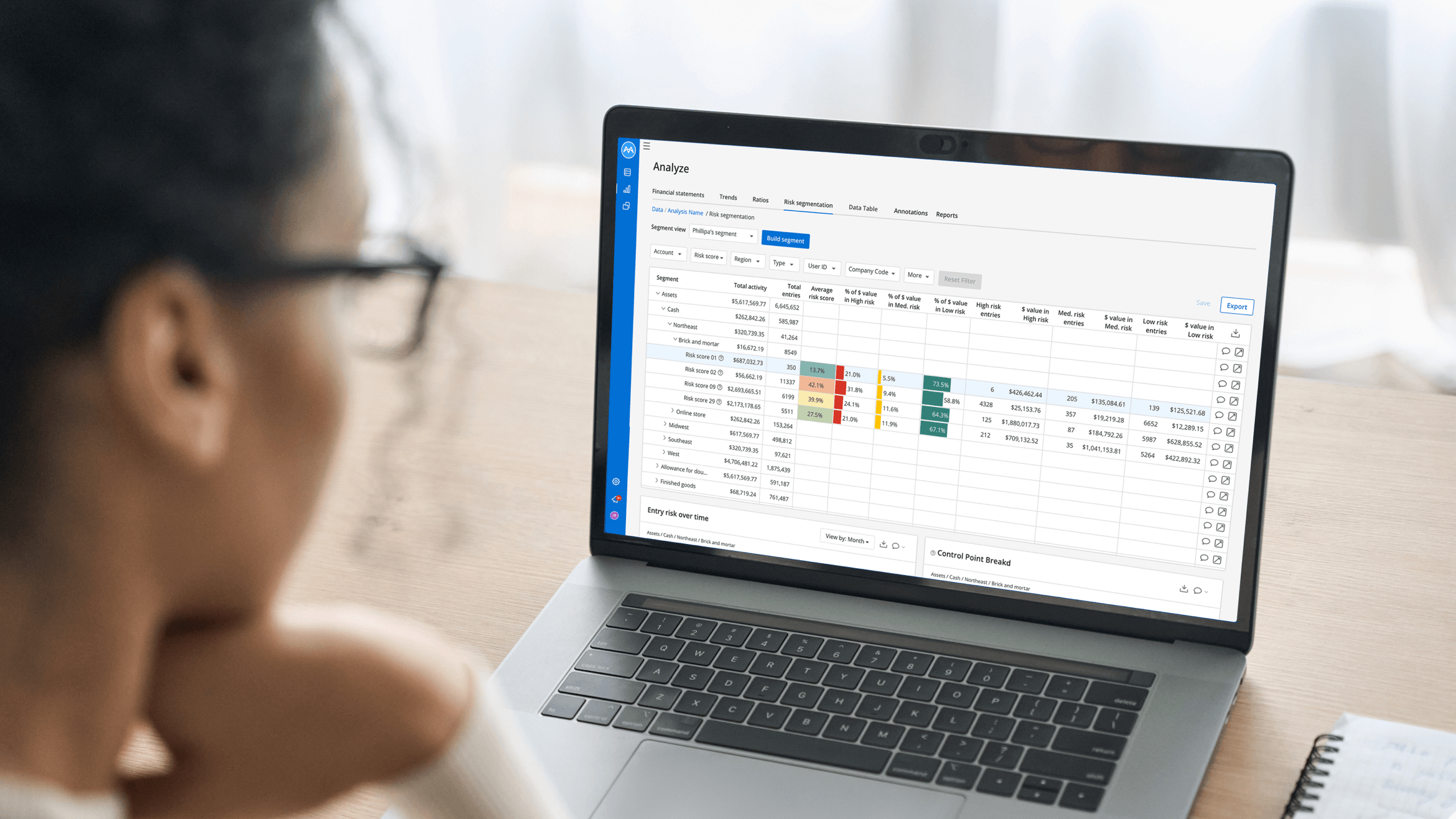

Becoming digital native enables companies to move towards a near real-time view of their financial data and, coupled with AI in finance functions, the ability to fully analyze 100% of transactions. This ensures transparency to key stakeholders such as board members and auditors and aids in the identification of any anomalies in their financial records.

Currently, a company’s financial records are examined by external auditors on a yearly basis and evaluated using a sampling method that leaves the bulk of the dataset untouched. This method of rear view-mirror assessment provides C-suite executives with a hindsight perspective and the fear that decisions are made based on inaccurate and untimely information. Using AI-based tools to review 100% of the financial records in near real-time offers C-level executives with insights into data and, by using the appropriate analytics built into the AI applications, offers foresights into the operations of the company.

The two most important behaviors that companies must have to thrive post COVID-19 are resilience and adaptability. Resilience is defined as the ability to withstand or recover quickly from difficult conditions whereas adaptability is defined as the quality of being able to adjust to new conditions. Companies must build their operations and culture around resilience and adaptability so they can work efficiently during the “new normal” when we emerge out of this dark tunnel will become stronger and better off.

An article published by the Boston Consulting Group titled “The Rise of the AI-Powered Company in the Postcrisis World” highlights the tremendous opportunity for companies that are going to digital native, moving to the cloud, and adopting AI in finance applications to supercharge their operations. Arvind Krishna, in his inaugural speech as IBM’s new CEO, said, “I am predicting today that every company will become an AI company – not because they can, but because they must. Digital transformation means putting artificial intelligence at the center of workflows, and using the insights generated from that process to constantly improve products and services.”