Unless you’ve been living under a rock for the past several years, you’re well aware that Shopify is one of the biggest IPO success stories in recent history. One of the individuals who was integral in taking Shopify public in May 2015 (and doing so successfully) is Russ Jones, former CFO of the Canadian tech giant from 2011 to 2018.

Recently, our very own founder hosted a virtual fireside chat with Russ.

Given Russ’s experience, it’s no surprise that he had a wealth of insightful information to share – from his time with Shopify and taking the company public, to how best to present financial information, and what the future holds for CFOs.

Below is an excerpt highlighting some of the key discussion points between Solon and Russ.

This interview transcript has been edited for clarity and length.

Solon Angel: Russ, instead of me talking about you, why don’t you introduce yourself and tell us a bit more about yourself?

Russ Jones: Sure. I’m a CPA, and I’ve been in the industry for 40 years now, so I’ve been around the block a little bit. My most recent full-time role was the CFO at Shopify, which I joined when the company was 50 employees and my team was a part-time accountant and the CEO’s mother-in-law. I took public in 2015, and then I positioned myself as the first official retiree from Shopify. I retired about three years ago, and since then I’ve been doing a number of board and advisory engagements.

Solon: What got you interested in finance in the first place?

Russ: I really credit it back to an excellent high school teacher who was a CPA and then decided to teach. I had that individual for both accounting and economics courses, and I did quite well in those. I found a lot of interest on the finance side, in numbers and thinking about businesses. The skills that you get opens up a number of doors. Because you have that finance skill set, you get involved in lots of the conversations, so it allows you to understand and add value to a business and partake in a lot of the decisions that get made.

Solon: When you mentioned Shopify and how early you joined them as CFO, at an early stage like that, did you know one day you would take them public? Did you see that this company could be a unicorn and Canada’s most valuable tech company?

Russ: Absolutely not. Although I had a number of signals that I used to sort of gauge opportunities. One of the things was that Shopify, as a Canadian company, had tier-one U.S. VC (venture capital). So, to me, that’s always a good indicator.

The other thing that attracted me was that the thing the company needed to get to the next level was a skill set I brought to the table. I was the grey-haired person in the room helping these young entrepreneurs to keep the company going and scaling.

The last thing I really liked was the business model; Shopify is a business where you get paid every day. Having been involved in companies that are doing enterprise software where at 11 o’clock on the last night of the quarter you don’t know whether you’re going to do five or 10 million dollars, it’s actually nice to have a company where you know you’re going to get some revenue every day. So, those three things are what attracted me .

Solon: Looking back, what was the biggest problem that you had dealing with financial operations at Shopify? What was your biggest success?

Russ: Right from day one that I joined Shopify – and this goes back to your question about did I think they would go public – obviously at that stage, no one knew, but my view is that you always build a company so that it could go public. On the scaling side, the biggest issue is how to introduce finance requirements and controls in a very entrepreneurial-type environment. you really want not to be seen as just a sort of police force of the company and always saying no. And so, about creative ways you can add value and assist in the company’s growth versus becoming an impediment there.

One of the things we always thought about at Shopify is in the same way that tech companies think about building up technical debt over time, how do you keep reducing managerial debt. A lot of companies, if something goes wrong, they’ll introduce a whole process to make sure it never happens again. I think a better approach is if someone has done something wrong, deal with that. Don’t introduce something that’s going to slow the company down.

The other point I would like to hammer home is that there is a difference between going public and being public. These days, it can be faster for a company to go public. But if you’re not ready to be public, that’s where a lot of the challenges arise. It’s important to think about both things – am I ready to go public, and am I ready to be public?

Telling the story of the numbers as CFO

Solon: In your time with Shopify, what was your experience with internal and external audits? Were they effective?

Russ: I think on external audit, to start down that path as soon as you’re ready is a good discipline to have. It also forces some operational best practices within the finance group and the company itself. In terms of the internal audit function, that is one you can start to add a little bit later in terms of the function itself, though the underlying controls you should start to put in place early on because trying to add them later is never the most effective way of doing it.

“As the finance leader, you need to be able to transition into the story of the numbers versus just the numbers themselves”

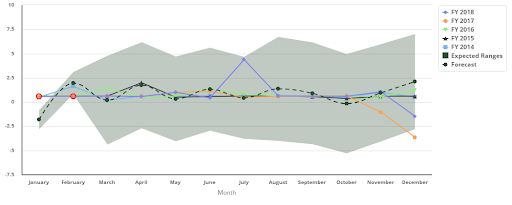

I think there are a couple of even more important things. As the finance leader, you need to be able to transition into the story of the numbers versus just the numbers themselves. I think that’s the real skill. The other thing to think about is what are the key metrics that I need to talk about to explain the company and how the company is run. But, on the flip-side, you also think about metrics you don’t want to talk about how do you answer questions around that.

An example is that, for Shopify, one of the metrics we didn’t want to talk about was the unit churn number. The reason for that is the role of Shopify as a platform is to allow lots of different merchants to try to start their business. The whole philosophy of making it easy to get up and running and making it very cost-effective was really ingrained into the company. The best way to keep your unit churn number down is not to have people join the platform who aren’t going to be successful, so you make it tougher for them to join. We never did talk about that externally, but every investor we met with would ask us that question. The way that we dealt with this is we had a revenue retention number of over 100%. So that way, we could explain that not every merchant is going to be successful, but the ones staying on the platform generate more revenue as a cohort month over month.

Solon: That is a very important point. I think a lot of people underestimate the power of positioning facts in a meaningful and valuable way for people to understand.

Russ: And as you move up in finance in terms of leadership roles, that ability to summarize and present the information is the real skill that gets developed over time. I see that as a tipping point for some people that, for example, would send the board Excel workbooks with just reams and reams of information, where really at that level you want one or two slides that tell the story and then you can answer questions.

The current and future role of the CFO

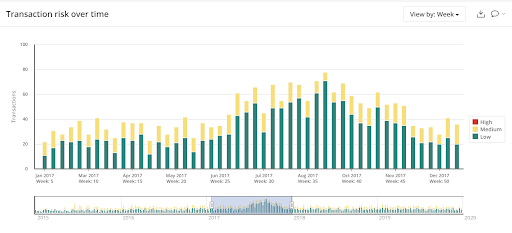

Solon: To what extent is a CFO involved in managing and mitigating risk for a company like Shopify? Does that role change when the organization gets larger?

Russ: I think risk is something that companies have from the very beginning. As bigger, you start, on both the finance and the legal sides, hiring people that spend a larger percentage of their time on just that. But is a cross-company type of thing. The high-level risks that a company deals with aren’t just financial risks or legal risks; they’re operational risks to a large degree. Understanding what those risks are and making sure that the right group is taking care of them is an important part of any fast-growing company.

“As data and machine learning and artificial intelligence become more important, I think there is a real role for finance to play”

Solon: When thinking of the finance industry at large and the role of CFOs and finance professionals, what concerns you the most today in what you see in the profession?

Russ: Yes, there are concerns, but I’m also excited about all of the opportunities out there. I think the one concern I have is with the industry right now and the number of SPACs (special purpose acquisition companies) out there chasing companies. I do worry about companies that aren’t ready to go public starting to go public. But having said that, I do believe the finance role itself is expanding. As data and machine learning and artificial intelligence become more important, I think there is a real role for finance to play. So, overall, I would say I’m quite excited about it.

For more industry and thought provoking articles, visit our blog.