Internet companies have been driven by data for decades. For instance, Amazon was using basic AI systems over 20 years ago. Netflix, Microsoft, Google and many others have dominated their categories by using a data and algorithms-first approach. Yet when we look at the accounting world, many still believe that data and analytics are a novelty, optional, or separate from the work that they do.

When it comes specifically to journal entry testing, most auditors today have been using antiquated approaches and sampling techniques. Many justify the use of these limited audit risk methods by saying they comply with existing standards. But these standards such as SAS 99, Consideration of Fraud, actually only require auditors to gain an understanding of the business and focus on identifying items that warrant further auditor considerations.

According to SAS 99 or other international standards, there is nothing to discredit the use of advanced methodology and latest AI-powered technologies. In fact, almost 20 years ago, the American Institute of CPAs published the 2003-02 Practice Alert with guidance for the use of analytics. Today, recent advancements in auditing software allow accountants to better evaluate audit risks and deliver pertinent insights to various stakeholders.

The challenges with traditional journal entry testing

Traditionally, accountants had a lot of groundwork to do during an audit risk assessment. First, they would spend a considerable amount of time doing data preparation on usually limited data columns and file sizes. Then, they would try to determine which analytics to apply to the data.

As Enterprise resource planning (ERP) systems grow more complex, not all audit procedures can keep up. Data clipping or manually converting a GL report into an Excel file is known to exclude data or cause errors during the audit process.

Existing script-based data analytics engines are exclusionary based, meaning they extract data as an auditor applies various procedures. This decreases the chance of detecting anomalies and doesn’t allow for a truly comprehensive audit risk assessment. This is why many leading accounting firms, including the Big Four, are moving away from these outdated auditing procedures. These more traditional methods for risk-based journal entry testing cause inherent liability and poor quality.

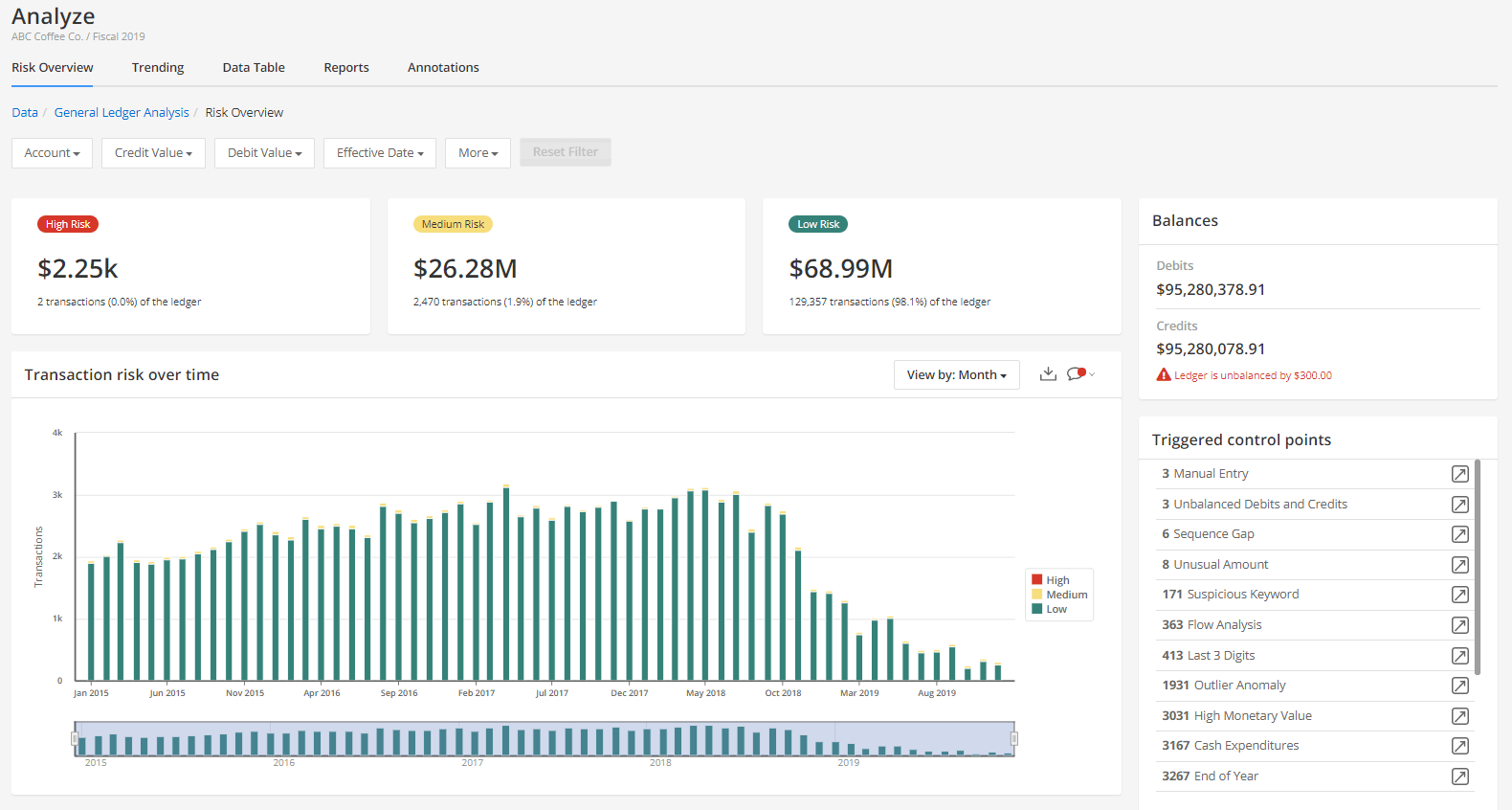

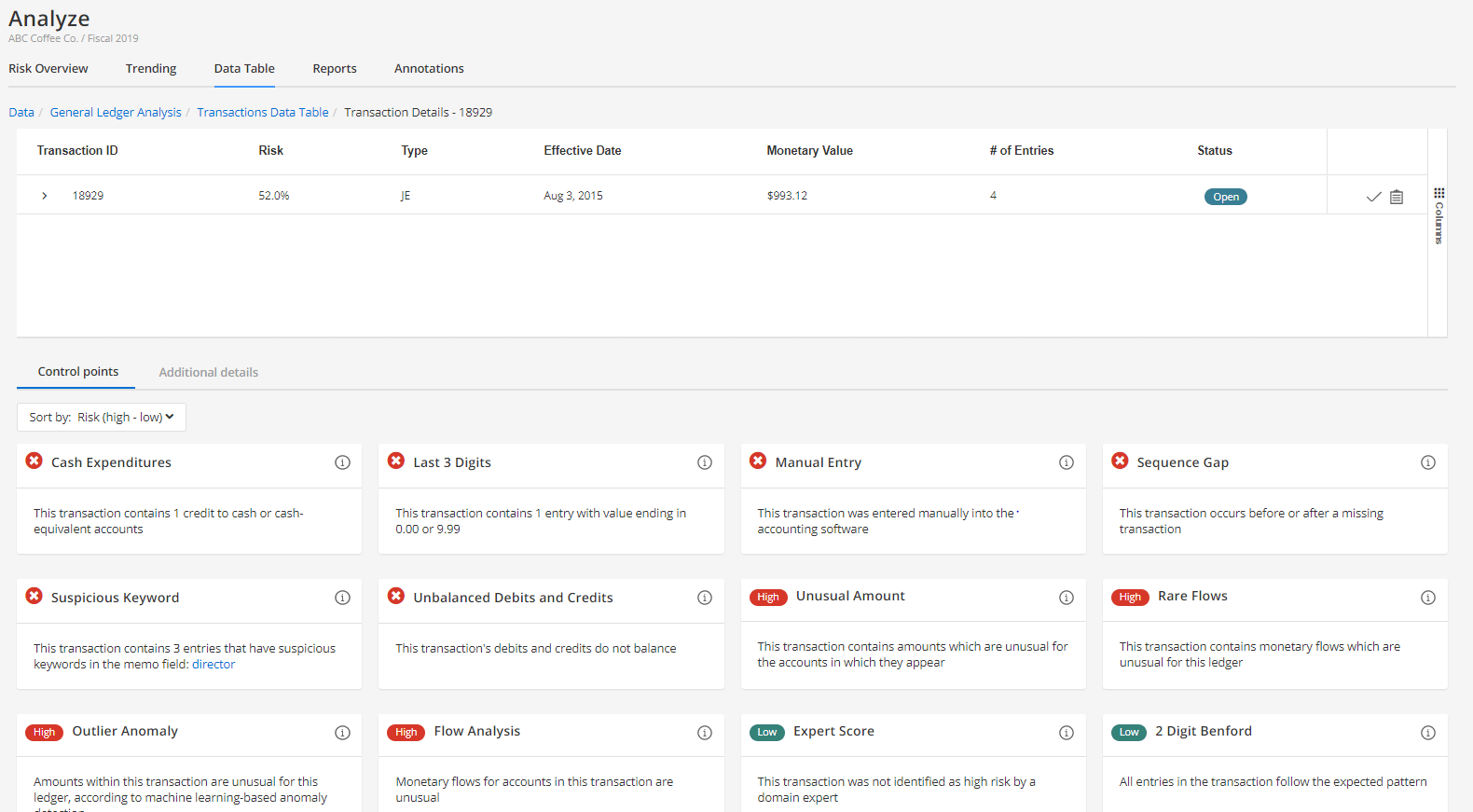

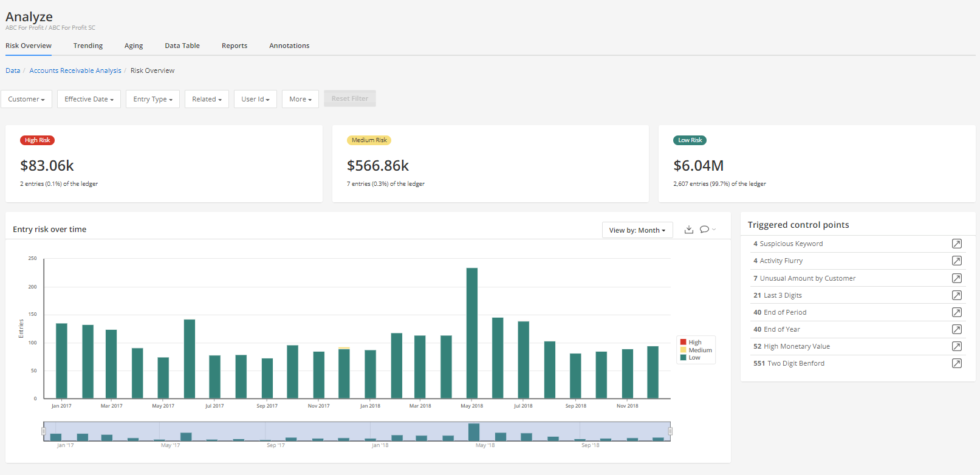

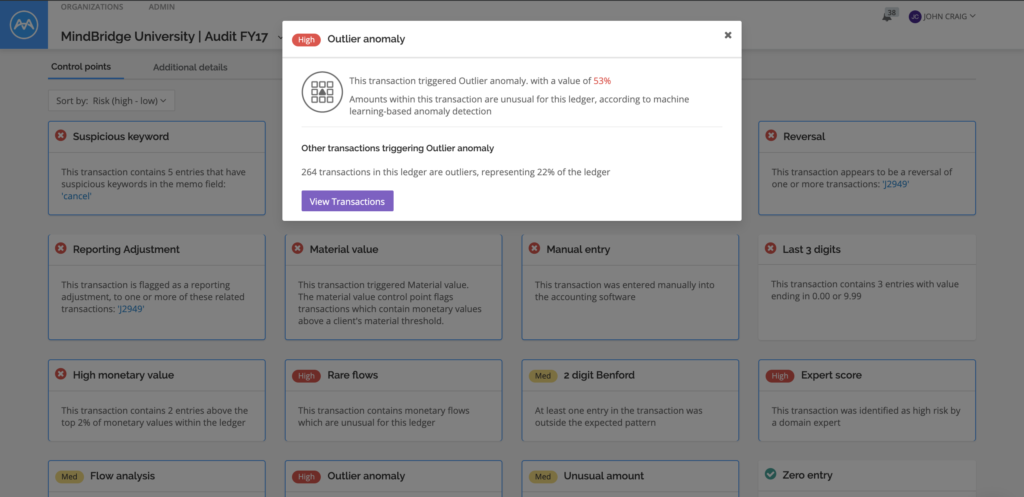

Using more advanced AI-powered auditing software, an audit team can gain more far-reaching insight. By pinpointing control points, the AI auditing software can identify and learn what’s normal or not and then analyze a wider range of data without inherent exclusions.

3 ways to automate risk-based journal entry testing

1. Start with a data-first approach

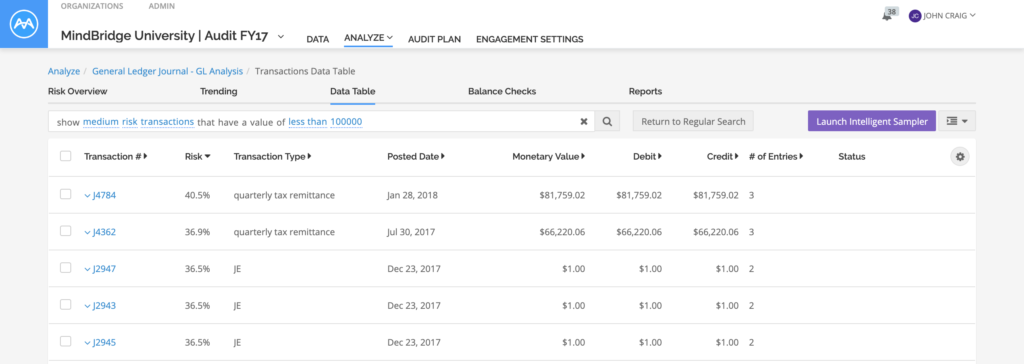

Before thinking about which audit tests or procedures to apply, you need to start with the data. This is called a bottom-up approach to audit risk assessment, instead of top-down. The idea is to let the data speak first. Then, you can look for standard procedures and identify any underlying risks.

Seek to get as much information on the system available as possible from your client: GL reports, Charts of Accounts, opening and closing balances, bank statements, as well as the previous year’s data.

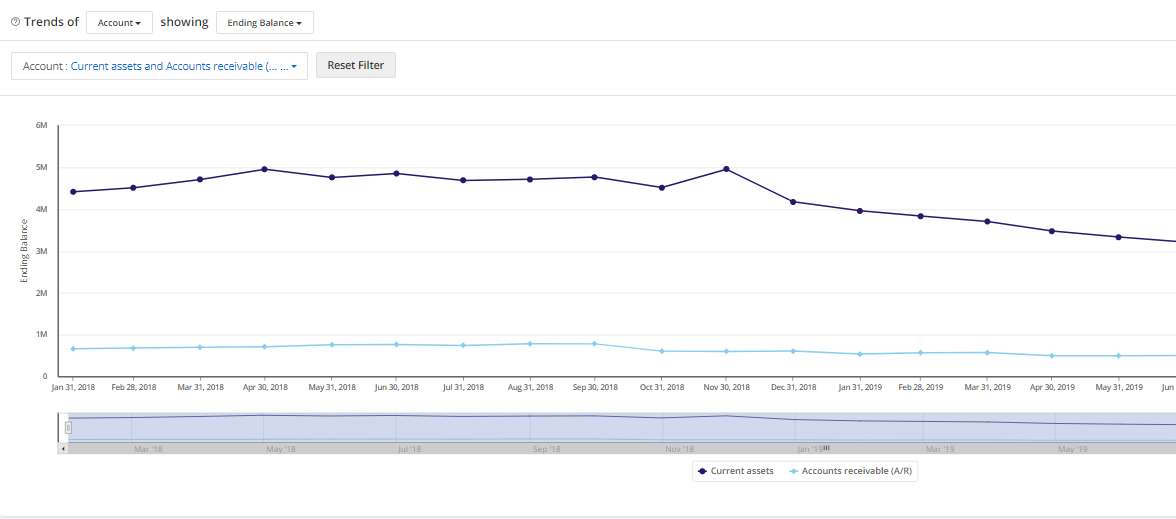

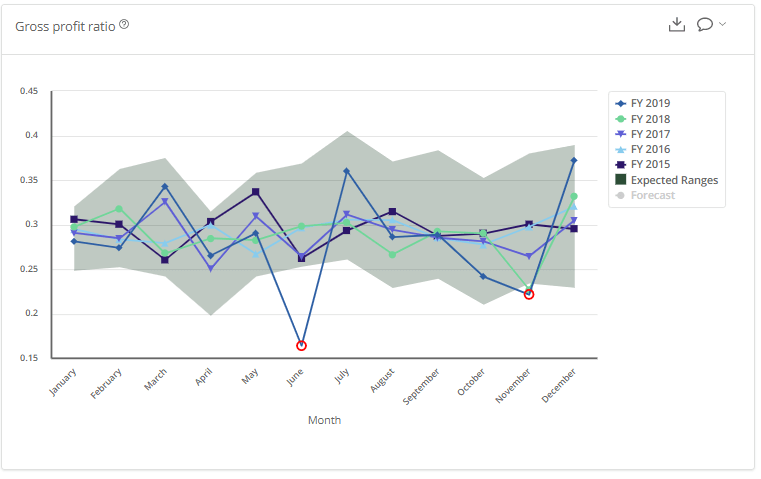

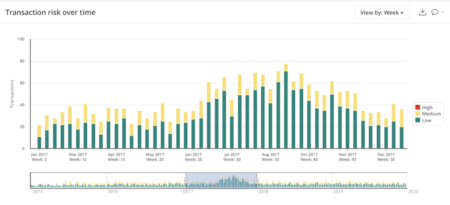

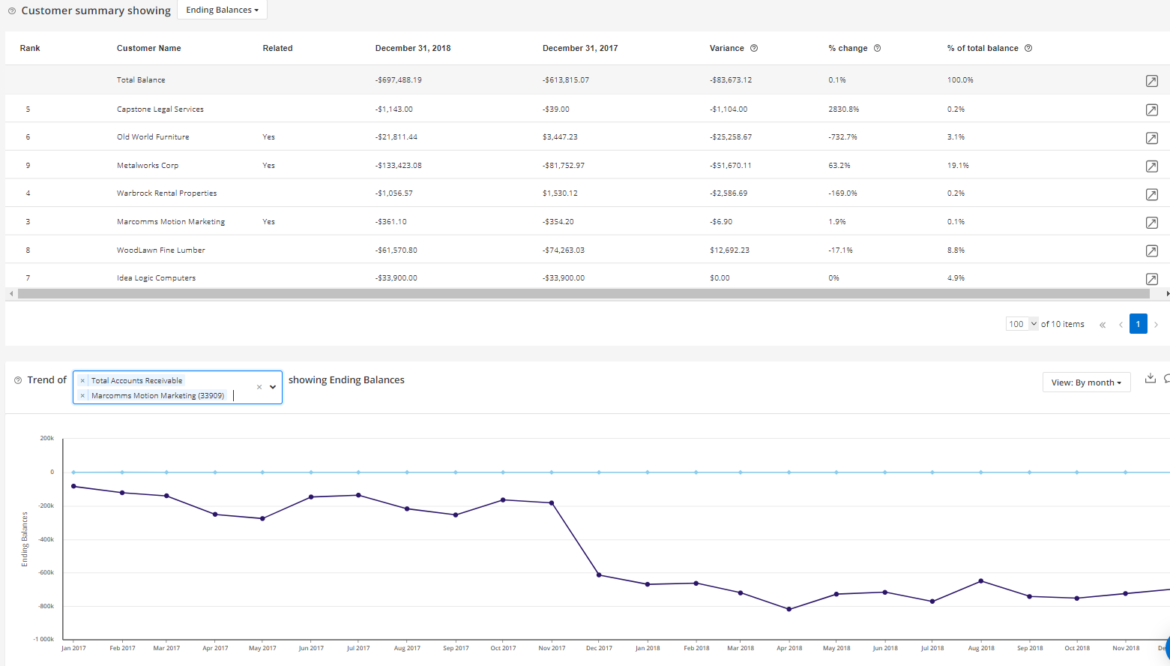

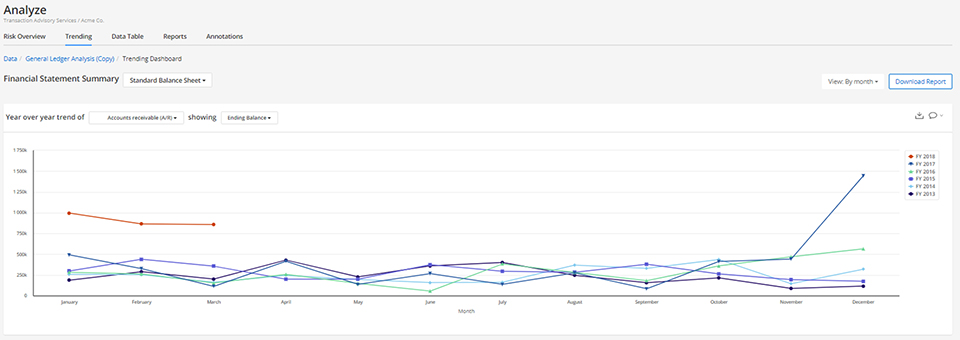

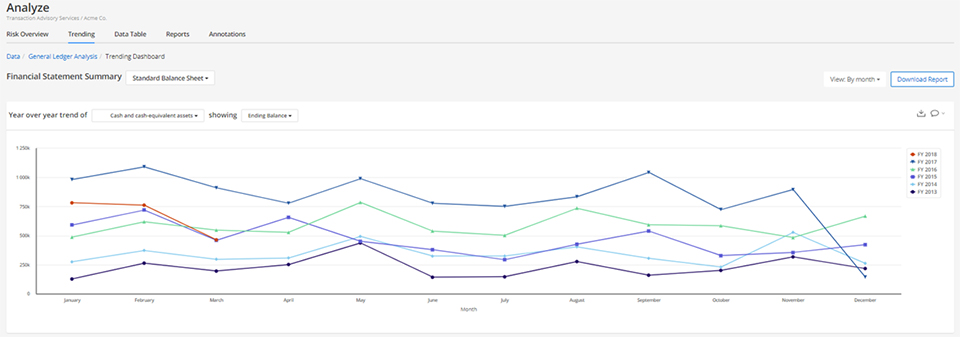

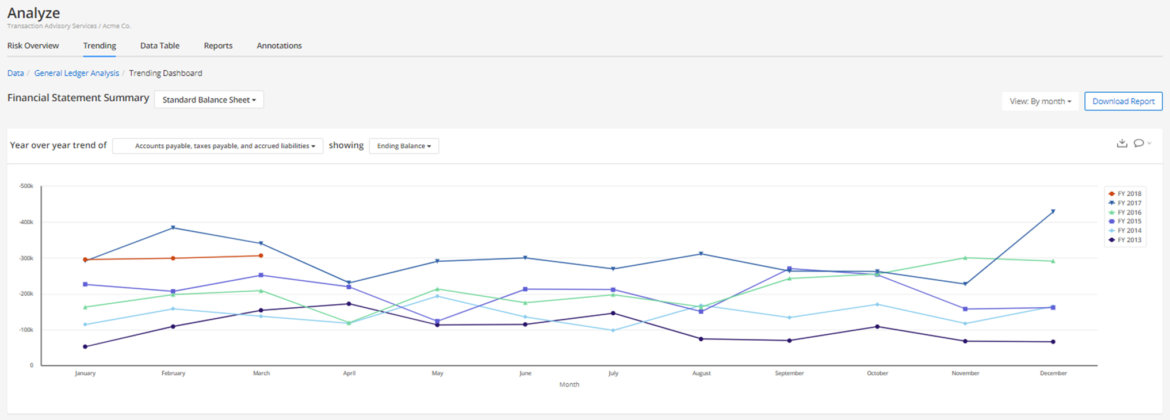

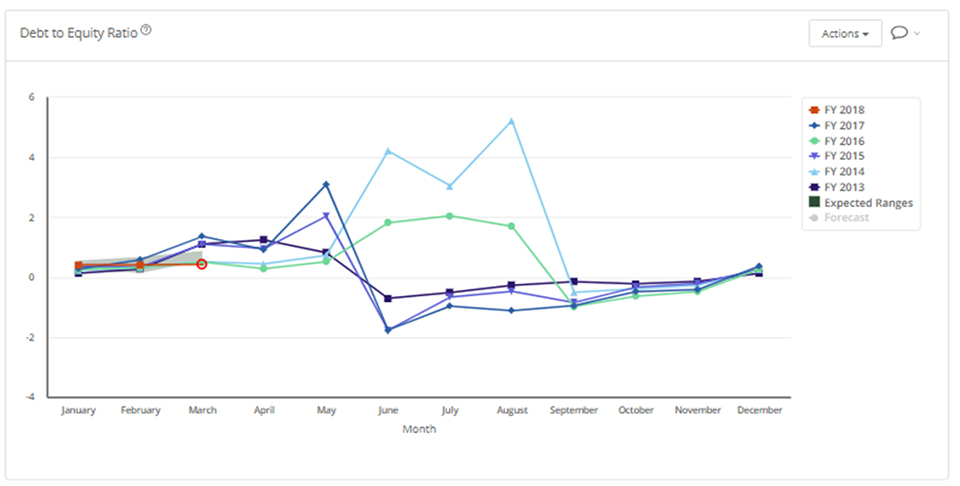

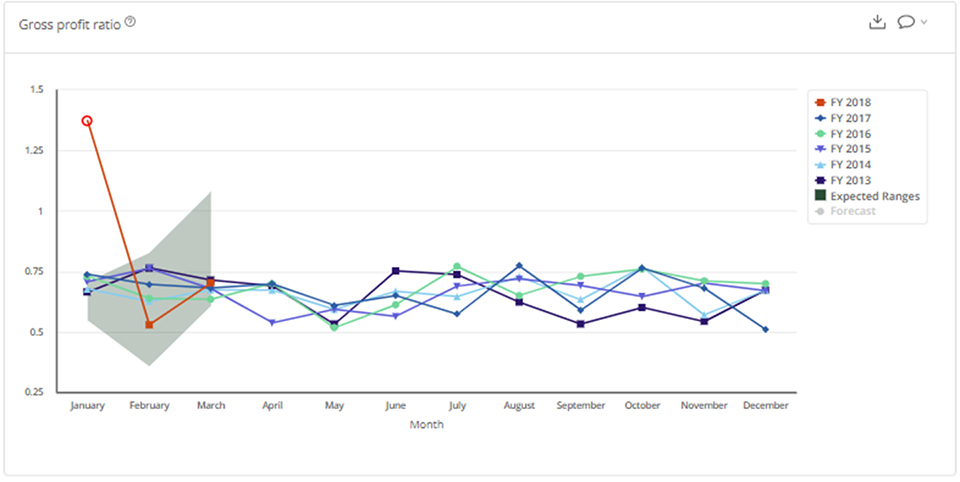

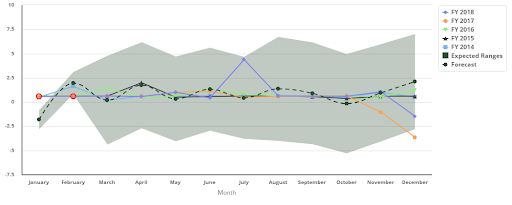

With this modern approach, you can leverage historical data in new ways. This can include automatically doing pre-emptive calculations and forecasts to better understand potential audit risks.

For example, MindBridge Ai Auditor automatically generates ratios and forecasts that you can annotate and add to your audit plan, seamlessly.

2. Leverage the community effect

Try to avoid reinventing the wheel and be curious of what automation can accomplish. It is not just about using new auditing technology. Try to understand the definition of risk that is built into the automation. A few AI or cloud accounting software vendors like MindBridge have spent countless hours with industry partners embedding specific risk analysis into their software packages.

Auditors are required to “test the appropriateness of journal entries recorded in the general ledger and other adjustments”. In the past, you would have had to define the procedures yourself. But today, with everyone connected online, communities have emerged around your choice of tools. These communities include other accountants that might have implemented fully automated procedures into their methodology and are eager to contribute best practices and tips with others.

During the Influence 2020 conference, some MindBridge Ai Auditor customers such as Baldwin CPAs and GRF CPAs shared their first-hand experience of using our AI accounting software as well as practical advice for other users.

3. Pay attention to complex transactions

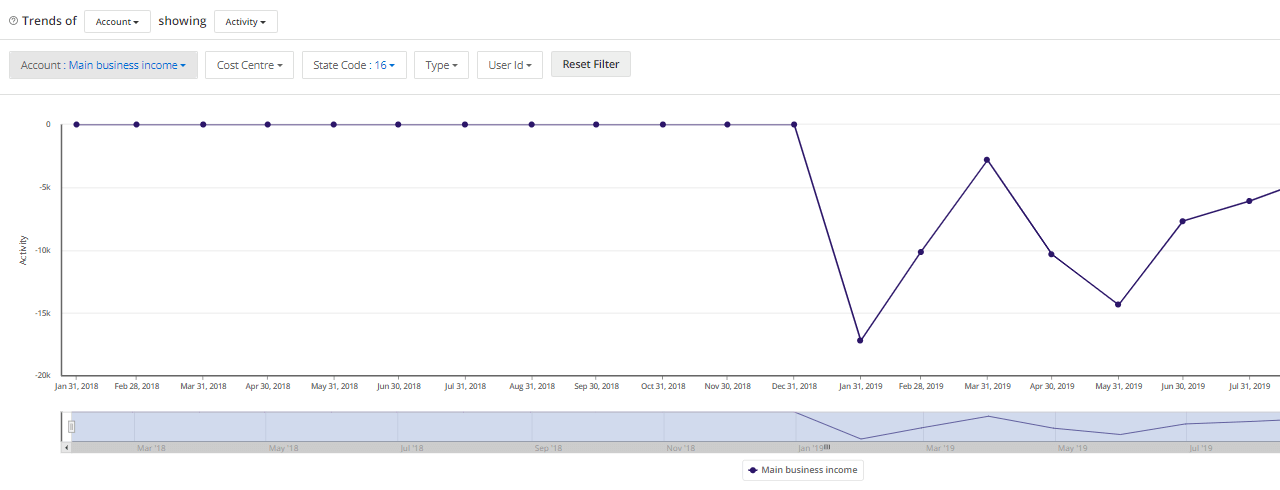

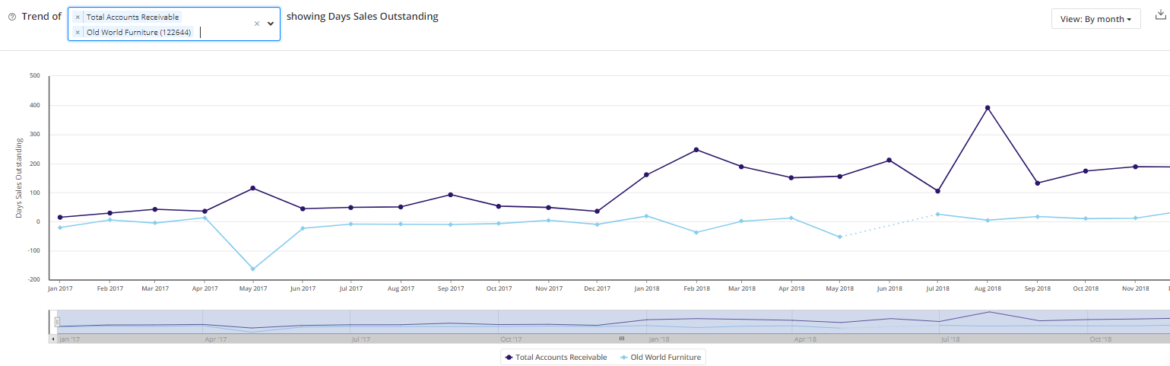

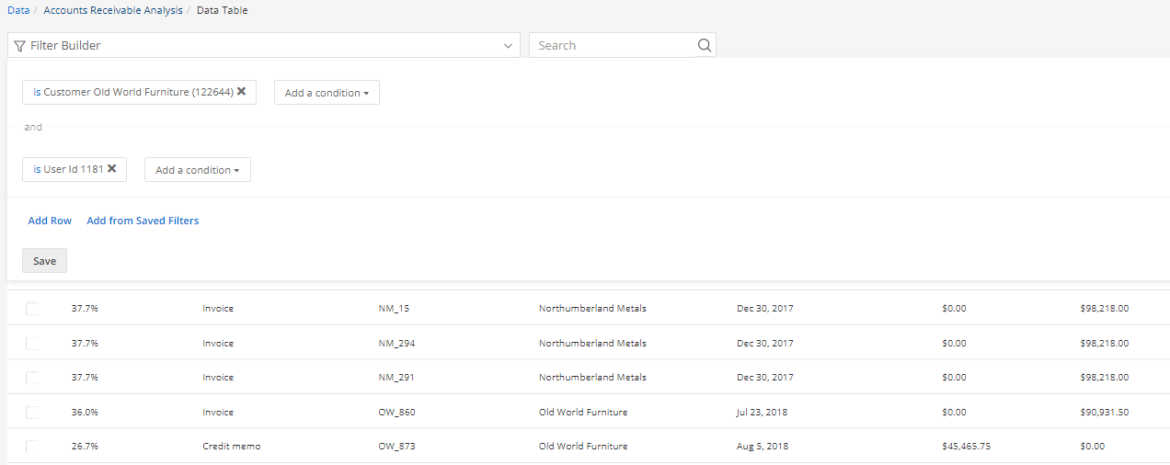

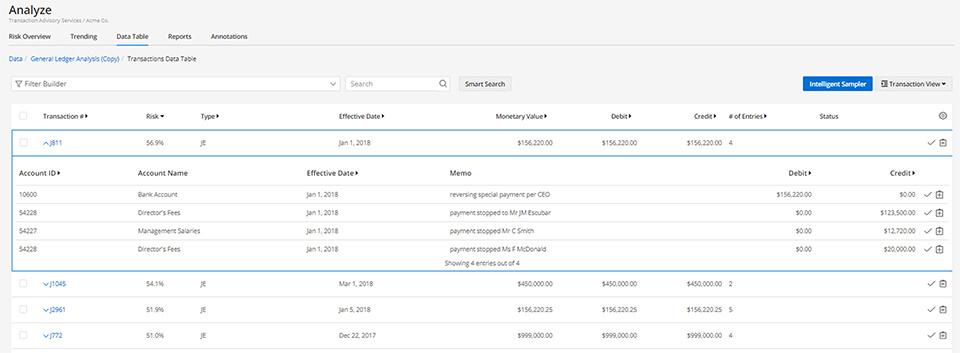

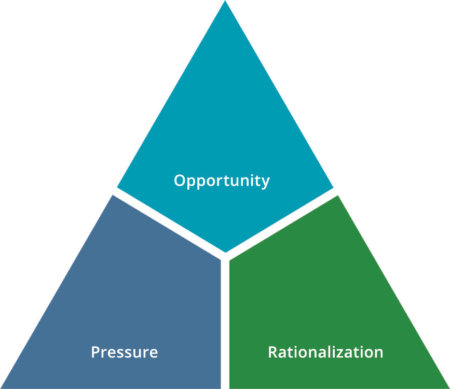

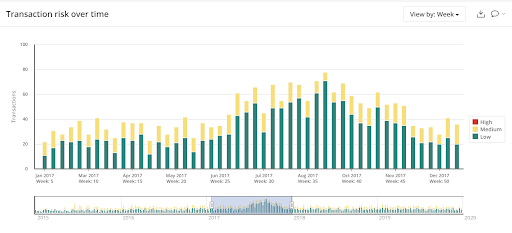

Your clients are not in the business of ensuring the right controls or worrying about anything else other than running their business. They simply don’t anticipate bad behavior, bad actors, or white-collar criminals. It is not enough to just design procedures or automate the classic CAATs-style audit tests. Instead, you can leverage the full power of advanced audit risk assessment techniques such as “Rare Flows” and “Expert score” using powerful AI auditing software. These improve your ability to detect high-risk transactions or the sidestepping of the company’s internal controls.

Some employees, including senior management learn ways to work around a specific control. For example, employees can post numerous smaller journal entries to various departmental general ledgers to circumvent approval processes. This also makes it more difficult for auditors to detect the fraud.

This is where AI can excel and really help you. Rare flows and unusual transaction analysis can help you quickly identify audit risks and conduct a more thorough journal entry testing. After saving time on the previous tasks, you will be able to dig into the data and ask the right questions.

Evolving audit risk assessments and your business

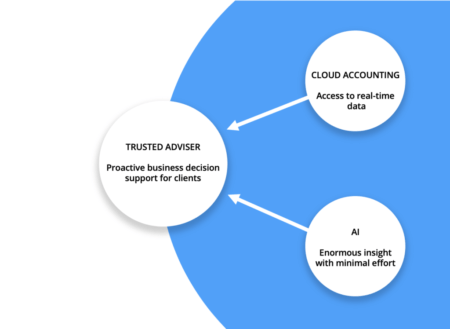

Accountants and auditors are not here just to perform repetitive tasks or follow outdated procedures. The core principle of the profession is to be business advisors to their clients.

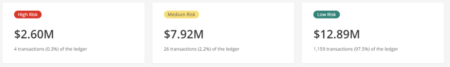

By using advanced technology for risk-based journal entry testing, auditors can streamline the auditing process and avoid spending billable hours digging for issues in only one area. Instead of limiting themselves to simply extracting data from a general ledger, they can ask for more reports and more data. This allows them to get a deeper understanding of all the anomalies in client files to perform a more thorough audit risk assessment.

With greater automation in journal entry testing, auditors will be able to get more insights from a larger dataset in minutes, and their clients will notice. That’s because after using AI accounting software in the auditing process, the audit team will be able to ask more relevant questions that lead to smarter business outcomes.

Want to learn more about the benefits of AI auditing software? Read how K·Coe Isom embraces AI accounting technology to gain new insights into their clients’ businesses.