Olympic-level finance: Five risk analytics strategies to outperform the competition

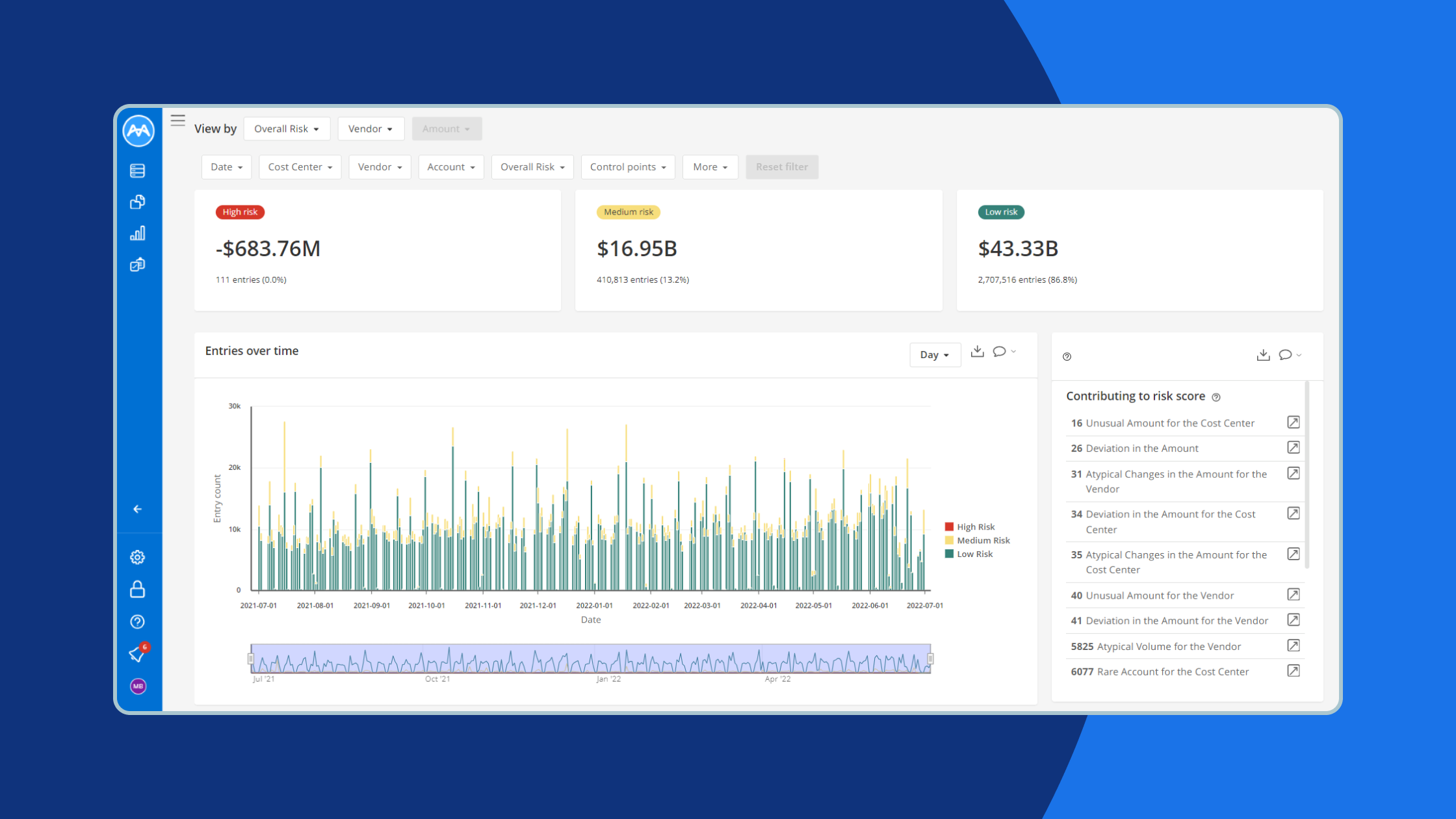

Explore Olympic-level finance strategies with MindBridge AI: Discover five key risk analytics tactics to enhance precision, strategy, and innovation in your financial operations, mirroring Olympic athletes’ quest for gold.