The explosion of remote work is one of the biggest shifts to come out of the COVID-19 pandemic. Social distancing rules and concerns of employee safety have forced many to settle into working from home. But what does that mean for the future of remote audit, and for the auditing software that makes it possible?

For accounting firms specifically, the necessary distance created by COVID-19 has meant a major increase in remote audits. While the process of embracing remote audits hasn’t exactly been easy for accounting firms, many are now turning to artificial intelligence (AI) to automate data assessment and analytics to retain the quality of their audits, while making remote work simpler and more efficient. Below, we’re exploring some of the challenges of remote auditing and how using AI in remote audits can be a game-changer.

Accountants weren’t prepared for sharp increase in remote audits

In the world of COVID and social distancing restrictions, the typical site visits that take place during audits have been put on hold. What was once a routine process of going into the field to comb through financial data, speak with key employees, check internal controls, and handle other in-person tasks has all been diverted online.

The problem is that many accountants weren’t prepared for this shift. A recent survey by IMA and Deloitte, which polled over 800 finance and accounting managers, showed that 75.7% of respondents said their company’s accounting processes are either largely manual or are still a considerable manual effort.

Because of this, the majority of auditors working remotely are facing big challenges. For one, figuring out how to securely access a company’s financial data is not always straightforward. Companies today are acutely concerned about cybersecurity risks and adhering to data and privacy protection regulations. To successfully handle remote audit engagements, accountants must choose solutions and tools that are fully hardened and meet cybersecurity best practices.

Fraud is on the rise during the COVID-19 pandemic

Even with secure access to general and sub-ledgers as well as other information, detecting risks across financial data has become harder. The fact is, fraud is on the rise as a result of this pandemic. Not only are companies under a lot of pressure to minimize loss and meet fiscal projections, but it’s extremely difficult to monitor internal controls when key employees are working from home.

For instance, an article in Accounting Today titled ‘The craziest work-from-home expenses of 2020’ shows just how outlandish some fraudsters have been with expense claims during COVID-19. Everything from a $7,600 facelift which was listed under ‘Repairs and Maintenance’ to €200 worth of tea which was credited as an ongoing company perk is being flagged. For every instance of fraud that is caught, another illegitimate expense could easily slip through the cracks.

To help counteract these new work-from-home challenges, 40% of respondents in the IMA and Deloitte report said that they’ll be implementing more automated tools in the future. Uniquely, just over 20% of those respondents are focusing on AI. That’s because whether in an office or at home, accountants can use AI auditing technology to strengthen remote audits and simplify everything from building an audit plan to identifying and assessing risks.

5 ways AI auditing technology enhances a remote audit

- Increase fraud and risk detection with AI-powered insights – With fraud on the rise, accountants must be hypervigilant when combing through all financial data. Truly AI-embedded auditing software helps auditors run multiple algorithms across all client transactions simultaneously and cross-correlate data using dozens of testing criteria. Auditors can then effectively identify all potential risks or fraud within the financial data and negate the weakening effects that work-at-home situations have had on internal controls. By taking this data-first approach, auditors can also detect anomalies such as rare monetary flows and unique account activity which can be difficult, if not near impossible to anticipate or test manually. Working remotely with AI auditing technology essentially enables auditors to get a better understanding of risks across a client’s financial data.They can then focus on delivering quality assessments and audits and offer their clients more data-driven value.

- Be better prepared to ask the right questions – With AI auditing software, accountants can become more effective at identifying real risks and anomalies versus a firm’s typical transactions. They can then direct resources to investigate those potential red flags and become better prepared when conducting interviews or gathering more information from clients. Honing in on riskier transactions and asking the right questions helps to enhance the accuracy of remote audits and ensures auditors deliver strong financial insights to their clients.

- Build a more comprehensive audit plan – An AI platform will rank transactions based on risk level. The MindBridge risk discovery platform also gives accountants an intuitive visualization dashboard that shows a holistic view of a client’s financial transactions from month to month. This makes it easier for auditors to spot risks during remote audits and dive deeper into the data that stands out based on their professional judgment. These risk-based AI rankings also help to confirm an auditor’s own risk assessments and build a more comprehensive plan for the remote audit engagement.

Learn more about how MindBridge can help you sample less, and discover more.

- Work with a secure cloud platform to access financial data – Choosing secure cloud-based AI auditing software can make all the difference in remote audits. Not only is it easy to upload and share financial data from various accounting software platforms, but leading AI auditing providers will offer solutions with built-in cybersecurity features and SOC 2 Type 2 compliance certifications. Sharing these details with customers before remote audit engagements can help ease cybersecurity concerns.

- Get hands-on support for data ingestion and analysis – Working with new technologies to facilitate remote audit engagements can be overwhelming to some firms. Having hands-on support from solution experts can help ease the transition. Both auditors and their clients will feel confident knowing they have support at the ready should they have questions or need guidance. This support also ensures they get the most value from the AI auditing software.

Thinking long-term about AI for remote audit

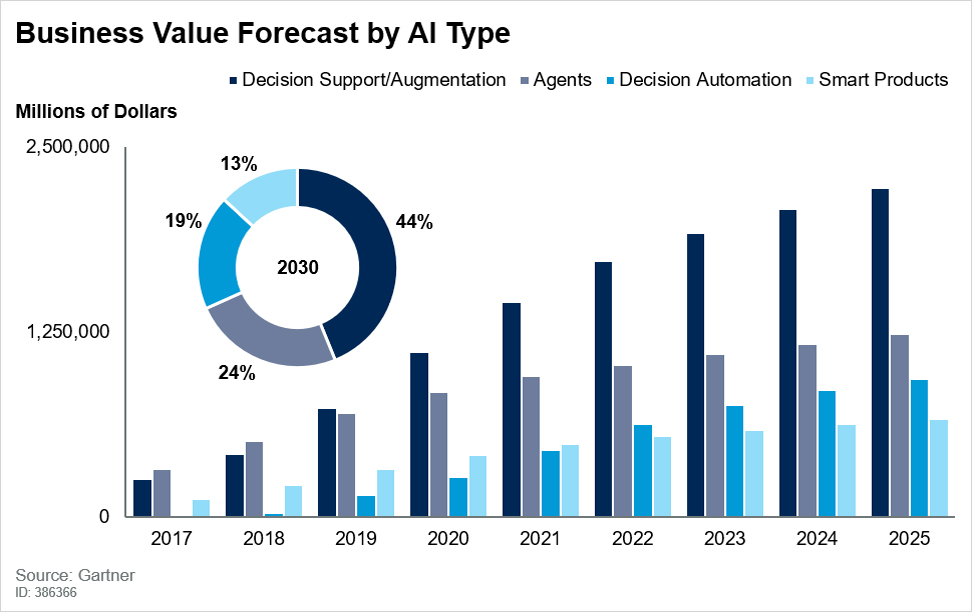

As accounting firms everywhere navigate the challenges of remote audits, groundbreaking auditing technologies are just some of the tools helping them identify financial gaps and ensure quality assessments. And though work-at-home mandates may not last forever, the benefits of AI technology can. Accounting firms that choose to leverage AI technology for remote audits today will continue to see returns on this technological investment well after this pandemic subsides.

Are you wondering how to work new technologies into your existing audit process or what other benefits they can offer? Check out our article, “Should you update your audit methodology?”

Ready to embrace AI to strengthen your remote audit?

Contact our team to schedule a demo of the MindBridge risk discovery platform.